After a formidable value reversal, the crypto market as soon as once more appears to be going through a dip throughout numerous cryptocurrencies. Amid this, XRP, the native token of Ripple Labs, is gaining important consideration from crypto fans regardless of the continual value decline, as reported by the on-chain analytics agency Coinglass.

Binance Merchants’ Rising Bets on Lengthy Positions

The on-chain metric Binance XRPUSDT Lengthy/Brief ratio at the moment stands at 2.80, indicating robust bullish sentiment amongst merchants. Nevertheless, this metric additionally reveals that for each 2.80 lengthy positions, there’s a single brief place.

Moreover, the information additional reveals that, at press time, 73.6% of high XRP merchants on Binance maintain lengthy positions, whereas 26.4% maintain brief positions.

Present Worth Momentum

Nevertheless, all this curiosity from Binance merchants comes whereas XRP is struggling to achieve momentum. The asset is at the moment buying and selling close to $2.50 and has skilled a value drop of over 6.50% up to now 24 hours.

Attributable to this market uncertainty, merchants’ and buyers’ participation has dropped, leading to a 65% decline in its buying and selling quantity.

XRP Worth Motion and Key Ranges

With this notable value decline, XRP appears to be failing to carry its essential help degree of $2.60, which it achieved through the important value reversal.

Based mostly on the current value motion and historic momentum, if XRP doesn’t rebound and closes a every day candle beneath the $2.50 degree, there’s a robust risk it may fall by 25% to succeed in the following help on the $1.95 degree.

In the meantime, XRP’s Relative Energy Index (RSI) is at 38, indicating it may face a value decline because of its weak energy. Moreover, the asset’s 200 Exponential Shifting Common (EMA) continues to be beneath the value, indicating an uptrend.

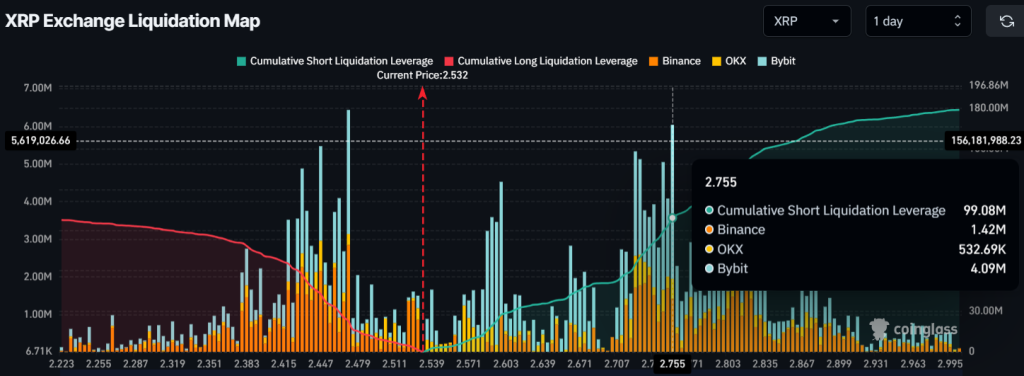

Main Liquidation Areas

With the bearish value momentum, merchants holding lengthy positions appear to be liquidating. As of now, the key liquidation areas are close to $2.47 on the decrease aspect and $2.75 on the higher aspect, with merchants over-leveraged at these factors.

If the present market sentiment stays unchanged and the value falls to the $2.47 degree, almost $22.68 million price of lengthy positions will probably be liquidated. Conversely, if the sentiment shifts and the value rises to the $2.75 degree, roughly $99 million price of brief positions will probably be liquidated.

When combining these on-chain metrics with the technical evaluation, it seems that bulls are exhausted, and short-sellers are at the moment dominating the asset, which may result in additional value decline.