Bitcoin (BTC) is struggling under the $90,000 degree, hovering barely above $85,000, a key assist zone that bulls should maintain to keep away from additional draw back. Regardless of optimistic information relating to the US Strategic Bitcoin Reserve, confirmed by US President Donald Trump’s Government Order on Thursday, the market has remained below heavy promoting strain, resulting in elevated volatility and a short-term bearish outlook.

Bears have taken management of value motion, pushing BTC right into a consolidation section as merchants stay unsure about its subsequent transfer. Whereas the announcement of a government-backed Bitcoin reserve was anticipated to gas bullish sentiment, the market has but to replicate any robust shopping for momentum.

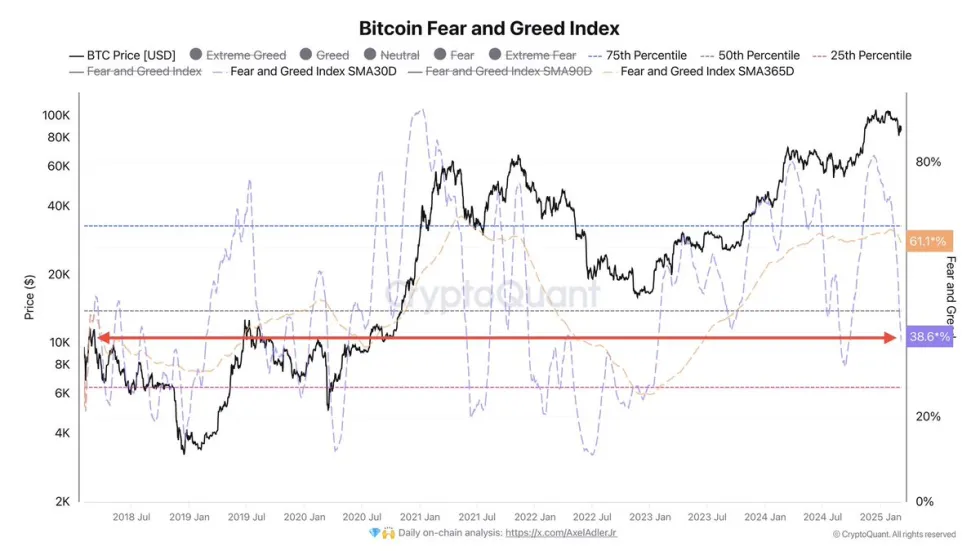

Nonetheless, on-chain information from CryptoQuant reveals that the common month-to-month Worry and Greed Index has dropped to a suitable degree, indicating that the worst of the promoting strain could also be fading. If BTC holds above $85K and reclaims $90K, a shift in market sentiment may comply with. Nonetheless, if bears proceed to dominate, one other leg down may push BTC into decrease demand zones.

With Bitcoin at a important degree, the approaching days can be essential in figuring out whether or not bulls can regain management or if promoting strain will intensify additional.

Bitcoin Faces Promoting Strain Amid World Uncertainty

Bitcoin’s value motion continues to deceive traders, notably those that anticipated 2025 to be an especially bullish 12 months for each Bitcoin and the broader crypto market. Regardless of excessive expectations, BTC has been trending downward since late January, with promoting strain dominating value actions. Even optimistic developments, reminiscent of Trump’s announcement of the US Strategic Bitcoin Reserve, have didn’t set off a sustained rally, leaving traders annoyed.

Market uncertainty stays excessive, largely pushed by fears surrounding world commerce wars. Ongoing tensions between main economies, notably involving US tariff insurance policies, have weighed on each conventional monetary markets and crypto, making traders hesitant to tackle extra danger. This uncertainty has dampened bullish sentiment, preserving Bitcoin under the $90K mark regardless of makes an attempt at restoration.

Prime analyst Axel Adler shared insights on X, suggesting that the current value swings might not be as important as they appear. He famous that the common month-to-month Worry and Greed Index has dropped to a suitable degree, implying that the market’s response to current volatility is stabilizing. He added, “That is native noise. I imagine the following buying and selling week ought to present us what all of the US authorities’s initiatives imply for the market.”

If Adler’s evaluation holds true, the approaching weeks may deliver readability to Bitcoin’s mid-term development. Buyers are carefully watching whether or not BTC can reclaim $90K, signaling renewed shopping for curiosity, or if continued promoting strain will ship costs decrease. For now, the crypto market stays in a state of uncertainty, with merchants ready for affirmation of the following main transfer.

Bulls Should Reclaim $90K Quickly

Bitcoin is presently buying and selling round $86,000, struggling to determine a transparent route for the approaching week. Regardless of a number of makes an attempt to interrupt greater, BTC stays in a good vary, with neither bulls nor bears exhibiting decisive management over value motion.

For bulls to regain momentum, Bitcoin should reclaim the $90,000 degree. A powerful push above this resistance and a sustained maintain would verify a restoration rally, probably setting the stage for BTC to focus on greater value ranges. Breaking out of this consolidation section would doubtless increase market sentiment and appeal to renewed shopping for curiosity.

Nonetheless, if BTC fails to reclaim $90K, the market may flip bearish as soon as once more. Continued weak point at this degree would doubtless ship BTC into decrease demand zones, with $85,000 appearing because the final key assist earlier than a possible transfer towards $80,000 or decrease.

With uncertainty dominating the market, merchants are carefully monitoring Bitcoin’s value motion. The following few days can be essential in figuring out whether or not BTC can break above resistance or if bears will take management and push costs decrease.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our crew of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.