Previously few days, the general cryptocurrency market has skilled a notable worth decline. Amid this, Ethereum (ETH), the world’s second-largest cryptocurrency by market cap, has reached a vital stage close to $1,800 for the primary time since 2023. Nevertheless, traders and long-term holders view this stage as a perfect shopping for alternative.

Key Stage for Ethereum (ETH)

At the moment, March 13, 2025, a outstanding crypto knowledgeable shared a publish on X (previously Twitter), stating that the important thing stage for Ethereum is $1,887, the place whales and traders have gathered 1.63 million ETH tokens. This publish is gaining large consideration from crypto fanatics and elevating issues about whether or not it’s a bullish signal for traders or a perfect shopping for alternative.

Ethereum (ETH) Technical Evaluation and Upcoming Ranges

In line with knowledgeable technical evaluation, ETH is close to a vital assist stage of $1,800. Nevertheless, if the asset fails to carry this stage, an enormous worth decline might happen within the coming days.

Based mostly on latest worth motion and historic patterns, if the asset stays above the $1,800 stage, it might soar by 20% to succeed in $2,200 within the coming days. However, if ETH falls and closes a each day candle under $1,780, it might drop by over 16% to succeed in $1,500.

As of now, ETH’s Relative Energy Index (RSI) is close to the oversold space, indicating low energy within the asset and suggesting that the worth might fall within the coming days.

Present Worth Momentum

At press time, ETH is buying and selling close to $1,840, having registered a worth drop of over 2.5% up to now 24 hours. Nevertheless, throughout the identical interval, its buying and selling quantity dropped by 30%, indicating decrease participation from merchants and traders in comparison with earlier days.

Merchants Over-Leveraged Ranges

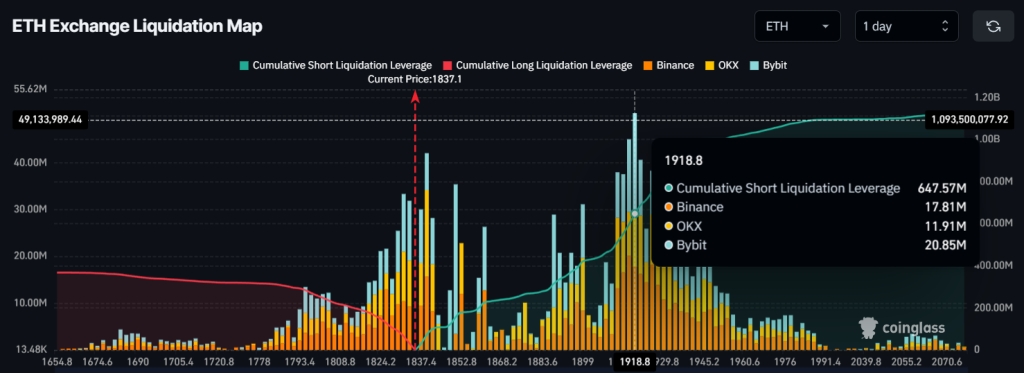

Trying on the worth drop, intraday merchants appear to have a bearish outlook, as reported by the on-chain analytics agency Coinglass.

Knowledge exhibits that merchants are over-leveraged at $1,795, at the moment holding $285 million value of lengthy positions. In the meantime, one other over-leveraged stage is at $1,920, the place merchants maintain $650 million value of quick positions.

This on-chain metric partially confirms that merchants are at the moment bearish on ETH and imagine the worth received’t rise above the $1,920 stage.