After consolidating for every week, Ethereum (ETH), the world’s second-largest cryptocurrency by market cap, is poised for enormous upside momentum. On March 18, 2025, the general cryptocurrency market has began witnessing a value surge as soon as once more. Amid this, ETH has reached the higher boundary of its consolidation and is on the verge of a breakout.

Ethereum (ETH) Technical Evaluation and Upcoming Stage

In accordance with knowledgeable technical evaluation, ETH has been consolidating in a decent vary between $1,840 and $1,955 for the previous week. Nonetheless, right this moment, as costs surge throughout the crypto market, the asset has reached the higher boundary of this vary and is now just a few factors past the breakout.

Based mostly on latest value motion and historic momentum, if ETH breaches and closes a day by day candle above the $1,960 stage, there’s a sturdy risk it may soar by 11% to achieve $2,200 within the coming days.

Amid the latest value drop, ETH has fallen considerably and is buying and selling under the 200 Exponential Transferring Common (EMA) on the day by day timeframe, indicating that the asset is in a downtrend.

Bullish On-Chain Metrics

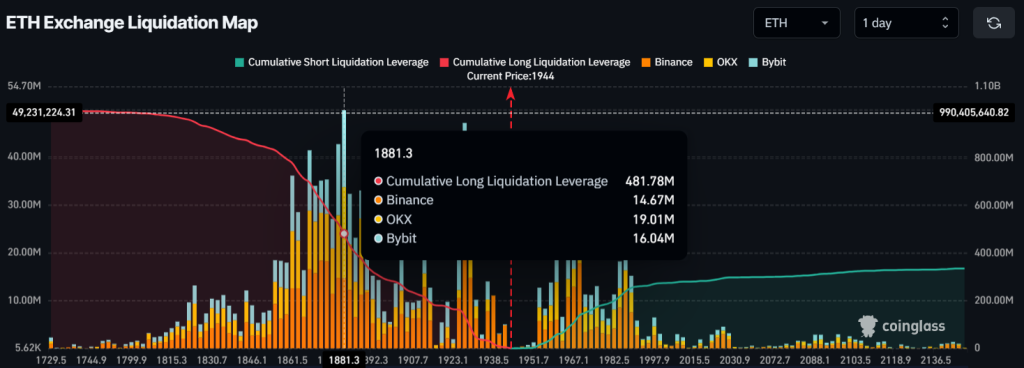

Regardless of ETH being in a downtrend, intraday merchants seem bullish as they’re strongly betting on the lengthy facet, in response to the on-chain analytics agency Coinglass.

$480 Million Value of Lengthy Positions

Information reveals that merchants are at present over-leveraged at $1,880 on the decrease facet, the place they’ve constructed $480 million price of lengthy positions. In the meantime, $1,970 is one other over-leveraged stage, with merchants having constructed $140 million price of ETH quick positions, clearly indicating a bullish outlook amongst merchants.

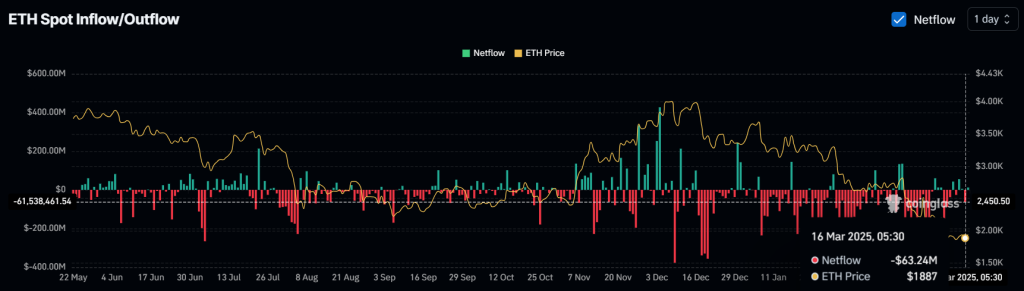

$50 Million Value of ETH Outflow

Along with merchants’ bullish outlook, traders and long-term holders additionally seem bullish in the long run, as they appear to be accumulating the asset and profiting from the latest value drop, in response to the on-chain analytics agency CoinGlass.

Information from spot influx/outflow reveals that exchanges have skilled almost $50 million price of ETH outflows previously 48 hours, indicating potential accumulation and presenting a really perfect instance of a “purchase the dip” alternative.

Present Value Momentum

ETH is at present buying and selling close to $1,950 and has registered a 5% upside momentum previously 24 hours. Nonetheless, throughout the identical time-frame, as a result of its bullish outlook, it has witnessed important participation from merchants and traders, leading to a 30% leap in buying and selling quantity.