Este artículo también está disponible en español.

Ethereum (ETH), the second-largest cryptocurrency by market cap, is flashing a number of bullish indicators that counsel a possible upside transfer. Nonetheless, rising trade reserves are tempering this optimism.

Has Ethereum Shaped A Native Backside?

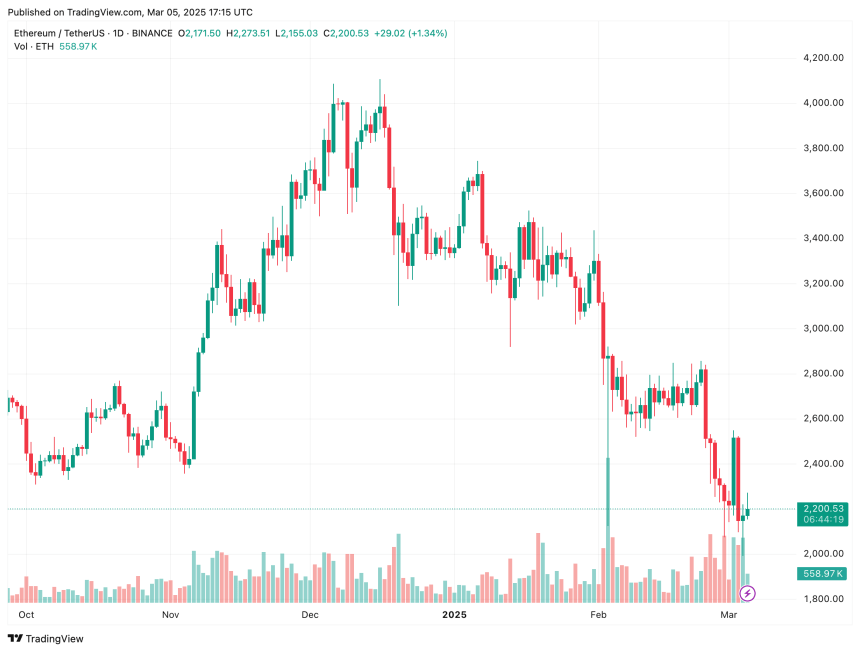

Ethereum has dropped almost 20% over the previous two weeks, falling from roughly $2,805 on February 23 to simply above $2,200 on the time of writing. This decline has worn out $80 billion from ETH’s market cap.

Associated Studying

Regardless of this sharp pullback, crypto analysts are pointing to a number of bullish indicators that would sign an impending worth reversal. Crypto analyst Merlijn The Dealer, for example, has highlighted that ETH is following the Wyckoff Reaccumulation Sample.

For these unfamiliar, the Wyckoff Reaccumulation Sample is a technical evaluation methodology developed by Richard Wyckoff. Within the context of ETH’s present worth motion, this sample means that the asset could also be getting into an accumulation section earlier than a possible upward motion.

The analyst additional famous that the “spring section” has simply been triggered – indicating a potential bear entice the place a quick dip under help ranges misleads sellers, doubtlessly setting the stage for a rally. A bounce from this degree might see ETH climb to $4,000.

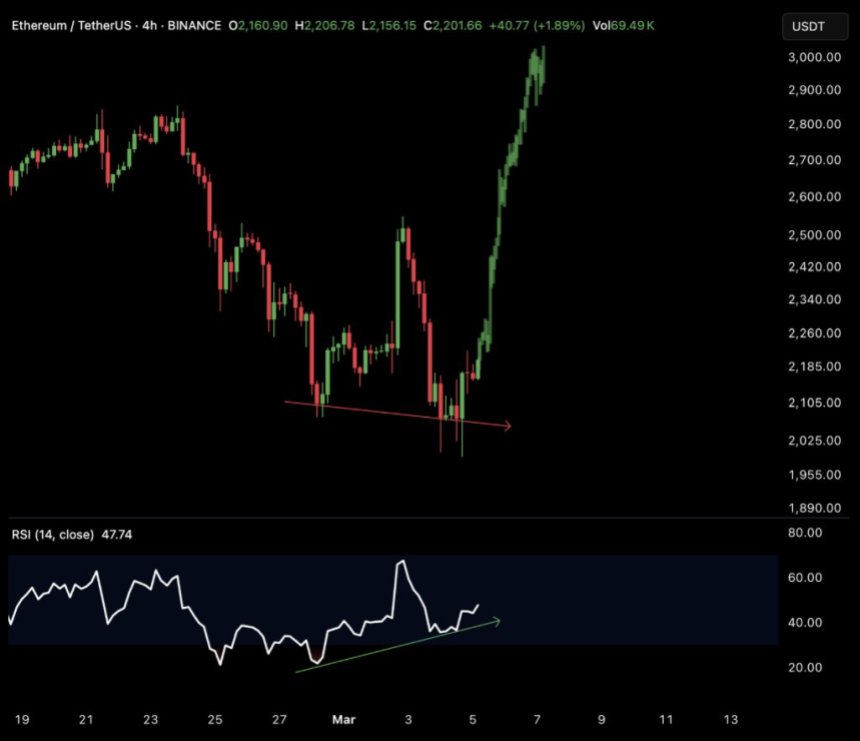

In a separate X publish, Merlijn The Dealer additionally pointed to a bullish divergence in Ethereum’s 4-hour chart. In response to the analyst, ETH’s subsequent quick goal is $2,700 earlier than shifting larger. Fellow crypto analyst CryptoGoos echoed these sentiments.

Past technical indicators, whale exercise has added to the bullish sentiment surrounding ETH. In an X publish, crypto analyst Ted famous:

Ethereum whale purchased 17,855 ETH price $36,000,000 at a median worth of $2,054. Whole holding $2,530,000,000 Ethereum. You assume that is happening? Assume once more.

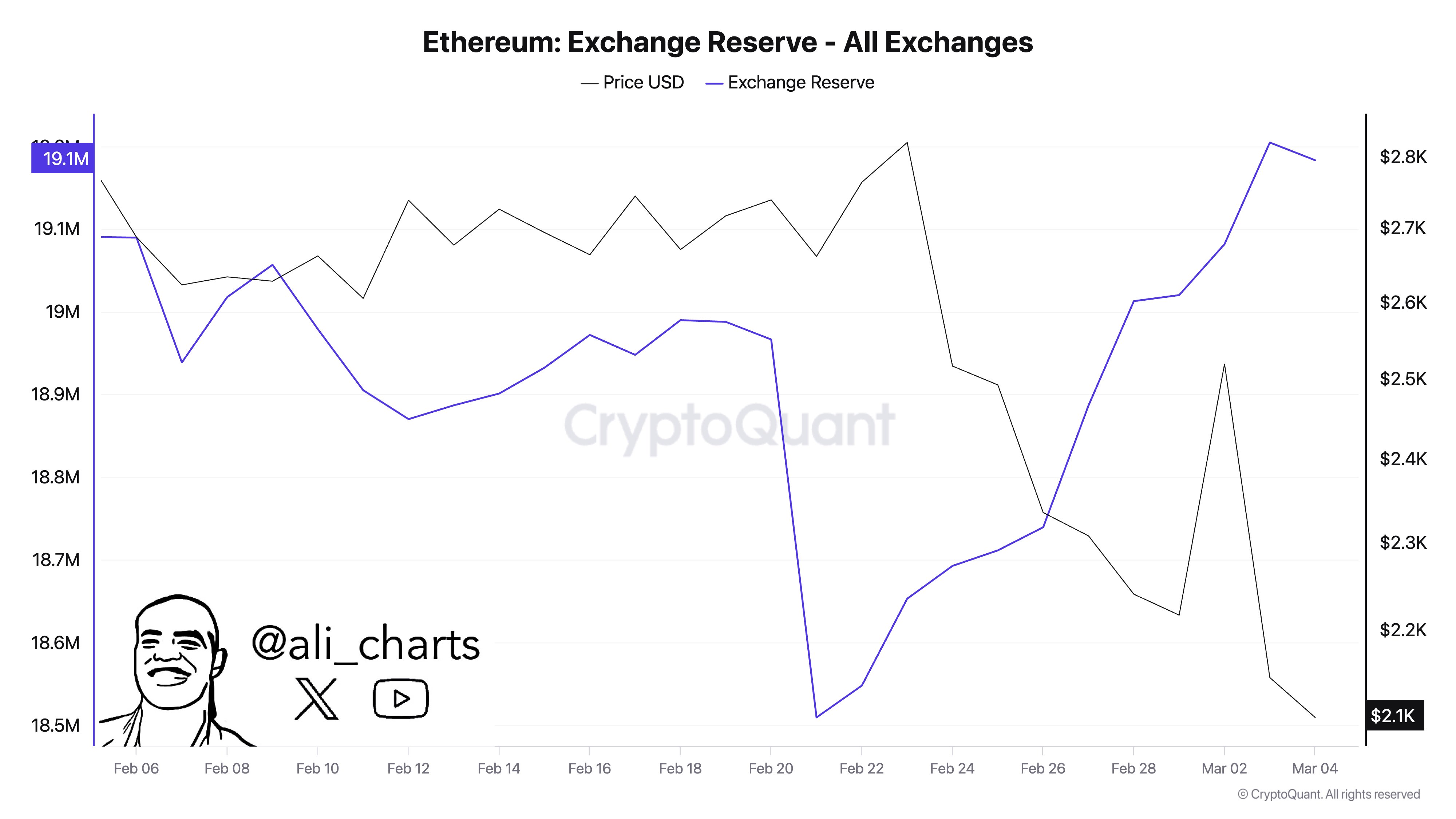

Rising Alternate Reserves Could Spoil The Get together

On the bearish facet, crypto analyst Ali Martinez pointed out that ETH reserves on exchanges have been steadily rising. Over the previous two weeks, greater than 610,000 ETH has been transferred to exchanges, which might enhance promoting stress.

Martinez’s evaluation aligns with a current report that discovered that regardless of ETH’s Relative Power Index (RSI) being at a multi-year low, there might nonetheless be additional draw back in retailer for the digital foreign money.

Associated Studying

Certainly, ETH has been marred by important bearish sentiment attributable to its comparatively weak worth efficiency over the previous two years in comparison with cryptocurrencies like Bitcoin (BTC), Solana (SOL), and XRP.

Nonetheless, excessive bearish sentiment might act as a contrarian sign, setting the stage for a shock rally. At press time, ETH trades at $2,200, up 6% previously 24 hours.

Featured picture from Unsplash, charts from X and Tradingview.com