The worth of Bitcoin has had an fascinating efficiency to date in 2025, beginning the yr with a run to a brand new all-time excessive. Nonetheless, the flagship cryptocurrency completed the yr’s first quarter with over 15% of its worth shaved off in these three months.

Whereas the BTC value seems to be steadying inside a consolidation vary, the prognosis doesn’t look all optimistic for the world’s largest cryptocurrency. This explains why a number of short-term traders are getting pissed off and, consequently, exiting the market.

Is Bitcoin About To Go Up?

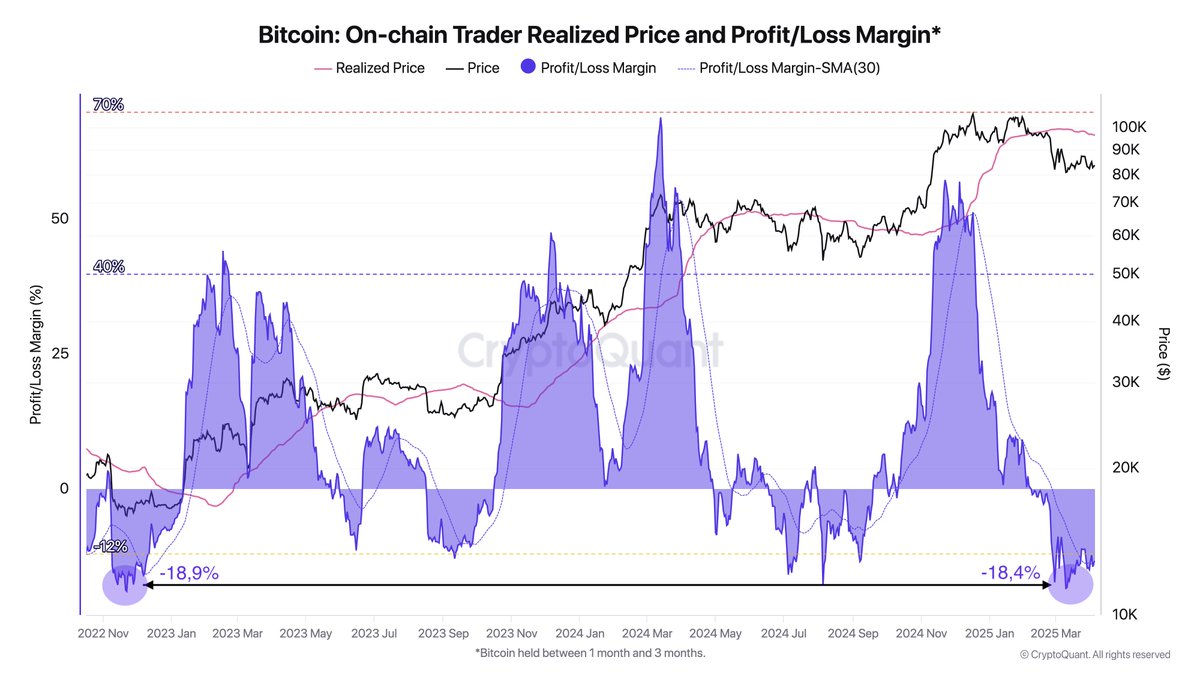

In a brand new submit on the X platform, an on-chain analyst with the pseudonym Darkfost revealed {that a} sure class of Bitcoin holders have been promoting their property at a loss. In response to the crypto pundit, the sell-offs are occurring at a charge not seen because the FTX collapse.

This on-chain statement is predicated on a major drop within the Revenue/Loss Margin, which tracks the profitability of traders by evaluating their buy value to the present value of a cryptocurrency. This metric presents perception into whether or not the market is in a state of unrealized revenue or loss.

Particularly, Darkfost’s evaluation focuses on Bitcoin traders who’ve been holding BTC for between one to 3 months (in any other case often called short-term holders). These merchants are thought-about probably the most reactive class of holders, a trait highlighted by their current exercise.

Supply: @Darkfost_Coc on X

In response to Darkfost, BTC short-term holders have been offloading their cash at a loss since early February. These realized losses have now reached ranges final seen within the FTX crash and are even increased than the losses recorded throughout the 2024 value pullback.

Traditionally, vital loss realization by the Bitcoin short-term holders has preceded substantial upward value actions, particularly when long-term holders proceed to build up. Therefore, the persistence of this pattern signifies that long-term traders will take the cash off the weak arms earlier than the subsequent bullish soar.

BTC Worth At A Look

As of this writing, the worth of BTC stands at round $83,700, reflecting no vital change up to now 24 hours. In response to information from CoinGecko, the market chief is up by 1% within the final seven days.

The worth of Bitcoin is thickening across the $84,000 degree on the each day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our staff of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.