Amid the continued tariff warfare, Bitcoin (BTC), the world’s largest cryptocurrency by market cap, is poised for an enormous worth crash attributable to its bearish worth motion. In current days, BTC seems to be consolidating inside a good vary. Nonetheless, upon nearer examination, it appears to have shaped a bearish head and shoulders sample on the four-hour time-frame.

Present Worth Momentum

It looks as if the market isn’t reacting to any optimistic information. Earlier, following Treasury Secretary Scott Bessent’s daring assertion, BTC together with main belongings started to rebound, however the upside momentum later light and all positive factors had been misplaced. Presently, BTC is buying and selling close to the $82,500 degree and has recorded a worth decline of over 1.10% up to now 24 hours. Throughout the identical interval, its buying and selling quantity dropped by 50%, indicating decrease participation from merchants and traders attributable to notable market volatility.

Bitcoin (BTC) Technical Evaluation and Upcoming Ranges

In accordance with skilled technical evaluation, with the current worth decline, BTC is heading towards the neckline of the bearish head and shoulders sample.

Primarily based on current worth motion and historic patterns, if this momentum continues and BTC breaches the neckline on the $81,500 degree, there’s a robust risk it may decline by 4% to succeed in the $78,200 degree within the close to future.

As of now, the asset is buying and selling under the 200 Exponential Shifting Common (EMA) on each the day by day and four-hour time frames, indicating a robust downtrend and weak momentum.

Merchants sometimes watch for a worth bounce to brief the asset, which explains the current worth spike and subsequent drop inside lower than 24 hours.

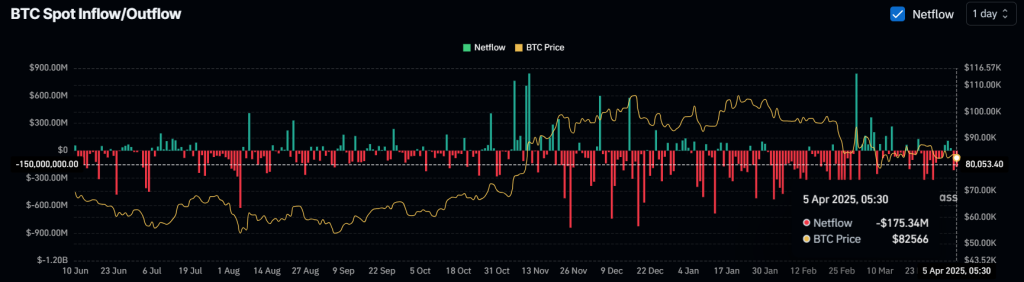

$175 Million Value of BTC Outflow

Regardless of the bearish outlook, traders and long-term holders appear to be accumulating the asset, as reported by the on-chain analytics agency Coinglass.

Knowledge from spot influx/outflow reveals that exchanges have witnessed an outflow of roughly $175 million price of BTC over the previous 24 hours. Such outflow throughout a bearish market sentiment suggests potential accumulation.

Whereas this may create shopping for stress and set off an upside rally, it sometimes happens throughout a bull run.