Amid market uncertainty, Dogecoin (DOGE), a preferred and the world’s largest crypto meme coin, seems to be struggling to realize momentum. Amid this, a distinguished crypto professional shared a submit on X (previously Twitter), indicating that the meme coin is dealing with resistance at two key ranges: $0.18 and $0.21.

In the meantime, the professional additional famous that if DOGE breaches these resistance ranges, an enormous bull rally might observe.

Present Worth Momentum

As of now, the meme coin is buying and selling close to $0.17, having recorded a 2.75% worth surge over the previous 24 hours. Nonetheless, throughout intraday buying and selling, it reached a excessive of $0.175 however confronted sturdy resistance, resulting in a worth reversal. In the meantime, throughout the identical interval, the asset’s buying and selling quantity dropped by 10%, indicating decrease participation from merchants and traders in comparison with the day before today.

Dogecoin (DOGE) Technical Evaluation and Upcoming Ranges

Based on professional technical evaluation, DOGE seems bearish as it’s retesting the breakdown of an ascending trendline. Primarily based on current worth motion, if DOGE declines and closes a four-hour candle under the $0.162 stage, there’s a sturdy risk of a major worth drop within the coming days.

At current, DOGE is buying and selling under the 200-day Exponential Transferring Common (EMA) on the every day timeframe, indicating a robust bearish development and weak worth motion, which can be contributing to decrease participation.

Merchants’ $25.60 Million Bullish Wager

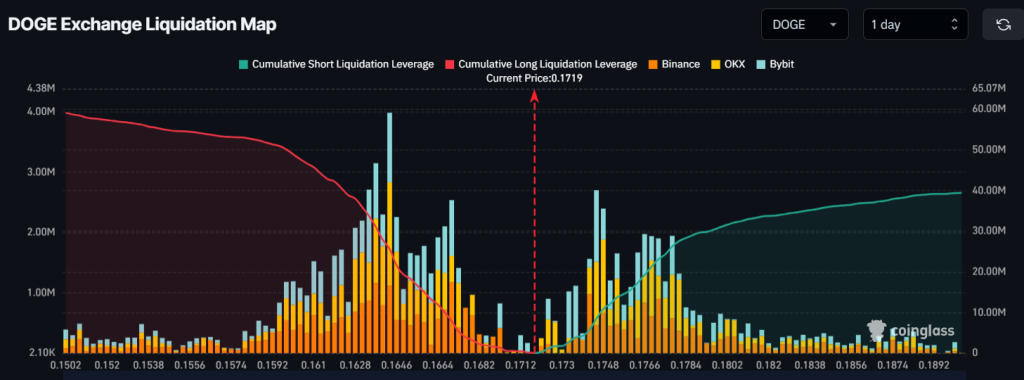

Nonetheless, merchants seem to have a bullish view, as they’re strongly betting on the lengthy facet, in line with on-chain analytics agency Coinglass.

Information from spot influx/outflow revealed that merchants are at present over-leveraged at $0.164 on the decrease facet and $0.1745 on the higher facet, holding $25.60 million in lengthy positions and $8.50 million briefly positions over the previous 24 hours.

These sturdy bets on the lengthy facet are greater than double these on the quick facet, indicating that bulls are firmly in management.