Ethereum could also be below strain on the charts, however behind the scenes, bullish alerts are quickly stacking up. Regardless of a 1.82% drop at present and a 26.75% decline over the previous 12 months, a outstanding crypto analyst often known as Unipcs—additionally known as “Bonk Man“—has outlined a number of key elements that would spark a strong ETH rally.

Ethereum ETFs See Large Inflows

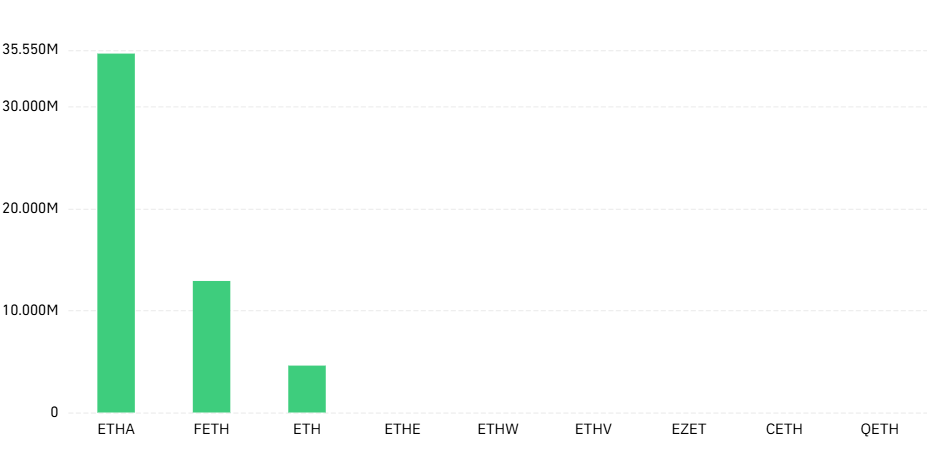

Some of the bullish developments cited by Bonk Man is the constant influx into Ethereum exchange-traded funds (ETFs).

Based on Coinglass knowledge, ETH ETFs have now posted 15 consecutive days of constructive inflows.

- BlackRock’s ETHA led with $35.2 million in a single day

- Constancy’s FETH adopted with $12.9 million

- Grayscale’s ETH added $4.6 million

On June 3 alone, ETH ETFs recorded a large $109.5 million in inflows—marking the very best single-day influx for Ethereum ETFs to this point this month.

Corporates Are Holding Ethereum

Bonk Man notes a shift amongst establishments adopting Ethereum as a treasury asset. In a headline-grabbing transfer, SharpLink Gaming closed a $425 million personal placement, led by ConsenSys Software program Inc, to implement one of many largest Ethereum treasury methods in public markets.

This alerts rising company confidence in ETH, mirroring the Bitcoin-focused strategy seen with MicroStrategy.

ETH Staking Approval in ETFs Could Be Close to

Regulatory alerts counsel that ETH staking might quickly be allowed in ETF buildings. If accredited, it might unlock vital institutional inflows and act as a main bullish catalyst for Ethereum.

Brief Squeeze Forward?

The analyst additionally identified that many funds and merchants are presently shorting ETH. Ought to the value reverse upward, it might set off a brief squeeze, amplifying beneficial properties as merchants rush to cowl positions.

In the meantime, weekly energetic Ethereum addresses have hit report highs, displaying surging consumer engagement and strengthening the case for long-term development.

- Additionally Learn :

- Arthur Hayes Predicts Bitcoin Surge If Financial institution of Japan Eases Coverage

- ,

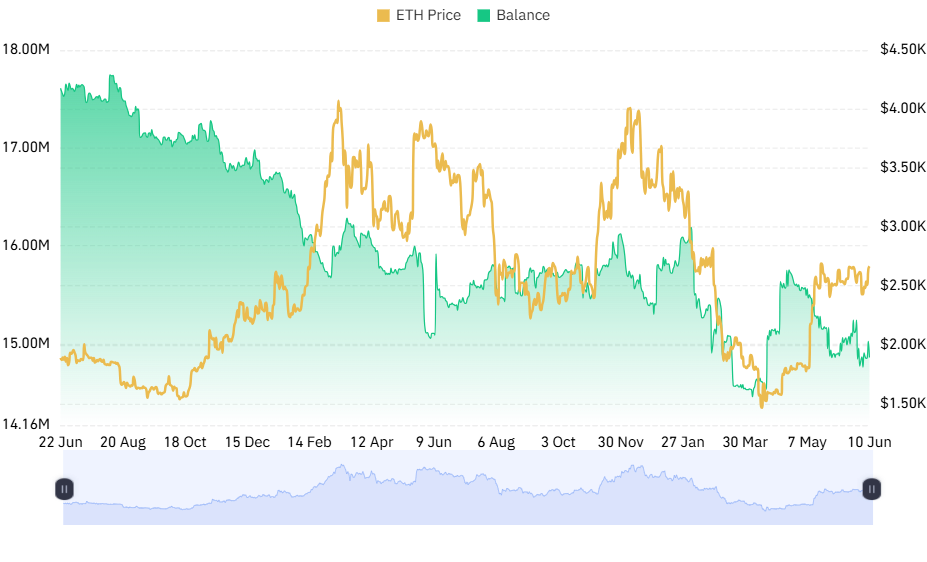

ETH Provide on Exchanges Is Shrinking

Ethereum provide on exchanges is dropping quick—an indication that merchants are shifting belongings to chilly storage or staking, lowering promote strain.

Notable 30-day ETH outflows embody:

- Bitfinex: -572,946 ETH

- Coinbase Professional: -2,149 ETH

- OKX: -13,627 ETH

- Kraken: -6,428 ETH

- Bithumb: -19,572 ETH

In whole, prime exchanges together with Binance and Coinbase noticed a mixed decline of over 261,000 ETH.

All-Time Excessive Staking and Layer 2 Growth

The Ethereum ecosystem can be increasing, with over 34.6 million ETH now staked, locking up a good portion of provide.

Furthermore, Layer 2 networks like Base are displaying explosive development, pointing to rising scalability and mainstream adoption.Backside Line: Whereas Ethereum’s worth efficiency might look disappointing within the quick time period, on-chain knowledge, ETF inflows, treasury adoption, and rising community exercise all trace at a possible breakout rally on the horizon.

By no means Miss a Beat within the Crypto World!

Keep forward with breaking information, skilled evaluation, and real-time updates on the most recent developments in Bitcoin, altcoins, DeFi, NFTs, and extra.

FAQs

Ethereum’s worth is up at present on account of continued robust inflows into ETH ETFs (e.g., BlackRock, Constancy), rising institutional confidence, a shrinking provide on exchanges, and the general constructive sentiment within the crypto market with Bitcoin approaching $110,000.

The US Client Worth Index (CPI) report, due out this Wednesday, is essential. If inflation knowledge is larger than anticipated, it might dampen crypto sentiment and ETH worth. Conversely, lower-than-expected CPI might set off beneficial properties for ETH.

As per our ETH worth prediction 2025, the ETH worth might attain a most of $5,925.