A really friendly-looking bitcoin (BTC) mannequin known as the “Bitcoin Rainbow” chart would have you ever imagine that bitcoin is severely undervalued — however what do the basics say?

Blockchain Middle’s Bitcoin Rainbow chart is at the moment screaming “BUY!” after BTC’s value began to come back out of the “principally a hearth sale” space the place it had consolidated for a while.

Nonetheless, the web site explains that the crew “fitted two curves” one in all which “is one of the best match for all of bitcoin highs (pink) and one that features solely the lows (blue).”

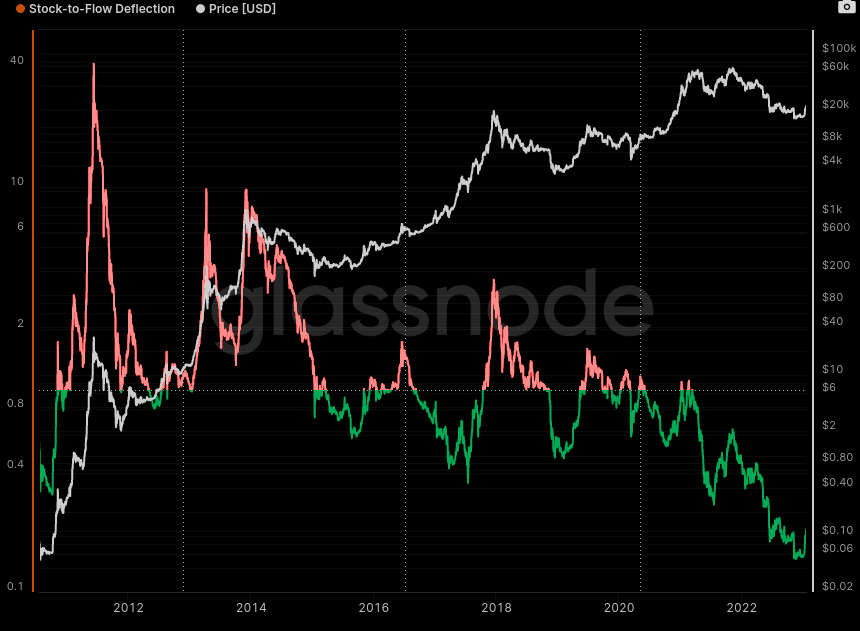

One other widespread bitcoin mannequin — the stock-to-flow mannequin (S2F) — has an arguably extra stable base, however regardless of this BTC’s value has just lately ventured removed from the worth estimated by the mannequin. In keeping with Glassnode’s S2F deflection mannequin, bitcoin is at the moment value solely about 0.2 of what it’s value in line with the mannequin.

Wanting on the exponential S2F chart, the mannequin has traditionally predicted bitcoin’s value to an astonishing diploma of precision.

In keeping with Purchase Bitcoin Worldwide’s S2F chart, the mannequin at the moment estimates bitcoin to be value $109,500. Throughout a December 2022 interview, the mannequin’s pseudonymous creator PlanB advised that bitcoin could possibly be headed larger and that the stock-to-flow mannequin has not but been invalidated.

PlanB advised that the unique model of the mannequin is the one he trusts essentially the most, no more optimistic later fashions.

“If we assume that the previous mannequin, the unique 2019 mannequin is appropriate, the $55,000 mannequin, then the subsequent halving might result in costs someplace — and I’m making a really big selection, some folks don’t prefer it — however someplace between $100,000 and a $1 million.”

PlanB.

The stock-to-flow (S2F) chart is a metric that compares the present inventory of bitcoin (the entire quantity of bitcoin at the moment in circulation) to its annual manufacturing move (the variety of new bitcoins mined annually). The ratio of inventory to move estimates the worth of bitcoin and different scarce property.

The chart is predicated on the concept that the worth of an asset is immediately proportional to its shortage.

In keeping with the stock-to-flow mannequin, the halving occasions that happen roughly each 4 years — when the speed of latest bitcoin mined is minimize in half — immediately have an effect on the value of bitcoin. The present stock-to-flow ratio means that bitcoin continues to be undervalued and is anticipated to achieve a brand new all-time excessive sooner or later.

Whereas over the previous few months, bitcoin has ventured additional than ever from its estimated value into the adverse, its value has up to now ventured a lot additional into the constructive. In truth, Glassnode’s aforementioned chart reveals that on June 8, 2011, bitcoin was value practically 41 occasions the worth estimated by the S2F mannequin.

Taking a look at different fundamentals, Glassnode information additionally reveals that bitcoin’s % of provide final energetic 5 or extra years in the past simply reached a brand new all-time excessive of 27,772% — an indication that BTC accumulation for long-term holding is ongoing.

Observe Us on Google Information