The Federal Reserve steadiness sheet elevated by $300 billion in a single week, resulting in debate about whether or not these actions qualify as quantitative easing.

The article under is an excerpt from a latest version of Bitcoin Journal PRO, Bitcoin Journal’s premium markets e-newsletter. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

The Lender Of Final Resort

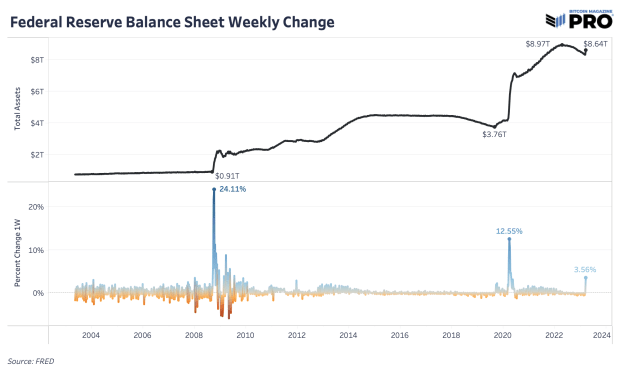

Simply days after the fallout from Silicon Valley Financial institution and the institution of the Financial institution Time period Funding Program (BTFP), there’s been a big rise within the Federal Reserve’s steadiness sheet after a full yr of decline through quantitative tightening (QT). The PTSD from in depth quantitative easing (QE) is inflicting many individuals to sound the alarms, however the modifications within the Fed’s steadiness sheet are much more nuanced than a brand new regime shift in financial coverage. In absolute phrases, it’s the biggest enhance within the steadiness sheet we’ve seen since March 2020 and in relative phrases, it’s an outlier that’s catching everybody’s consideration.

The important thing takeaway is that that is a lot completely different than the QE spree of asset shopping for and the stimulative straightforward cash with near-zero rates of interest that we’ve skilled during the last decade. That is about choose banks needing liquidity in instances of financial misery and people banks getting short-term loans with the aim of masking deposits and paying the loans again in fast style. It’s not the outright buy of securities to indefinitely maintain on the steadiness sheet from the Fed, however somewhat steadiness sheet property that must be short-lived whereas persevering with QT coverage.

Nonetheless, it’s a steadiness sheet enlargement and a liquidity enhance within the short-term — probably only a “momentary” measure (nonetheless to be decided). On the very least, these liquidity injections assist establishments not develop into pressured sellers of securities once they in any other case can be. Whether or not that’s QE, pseudo QE, or not QE is moreover the purpose. The system is exhibiting fragility as soon as once more and the federal government has to step in to maintain it from going through a systemic danger. Within the short-term, property that thrive on liquidity enhance, like bitcoin and the Nasdaq which have ripped greater at the very same time.

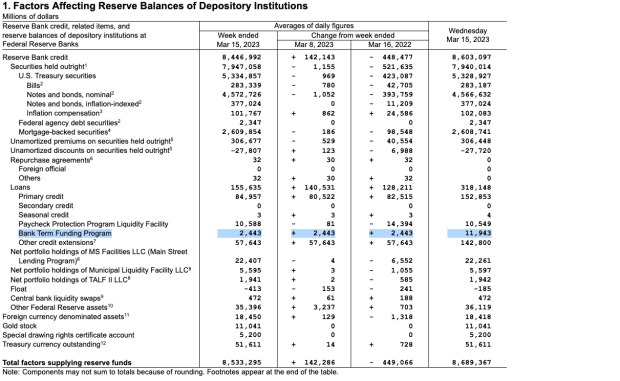

This particular enhance of the Fed’s steadiness sheet is because of an increase in short-term loans throughout the Fed’s low cost window, loans to FDIC bridge banks for Silicon Valley Financial institution and Signature Financial institution and the Financial institution Time period Funding Program. Low cost window loans have been $152.8 billion, FDIC bridge financial institution loans have been $142.8 billion and BTFP loans have been $11.9 billion for a complete of over $300 billion.

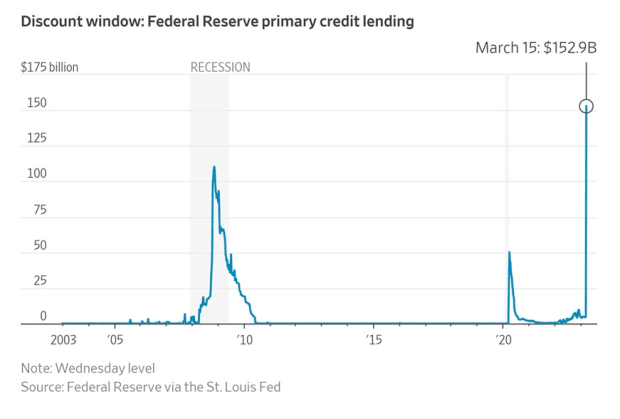

The extra alarming enhance is within the low cost window lending as that could be a final resort, excessive price liquidity possibility for banks to cowl deposits. It was the biggest low cost window borrowing on report. Banks utilizing the window are stored nameless as there’s a legit stigma challenge from discovering out who’s in want of short-term liquidity.

This brings again latest recollections of the 2019 emergency liquidity injection and intervention by the Fed into the repo market to stabilize money demand and short-term lending actions. The repo market is a key in a single day financing methodology between banks and different establishments.

Obtain the FREE “Banking Disaster Survival Information” At this time!

Get your copy of the complete report right here.

The Upcoming FOMC Assembly

The market continues to be anticipating a 25 bps charge hike on the FOMC assembly subsequent week. All-in-all, the market turmoil to this point hasn’t confirmed to “break sufficient issues” but, which might require an emergency pivot from central bankers.

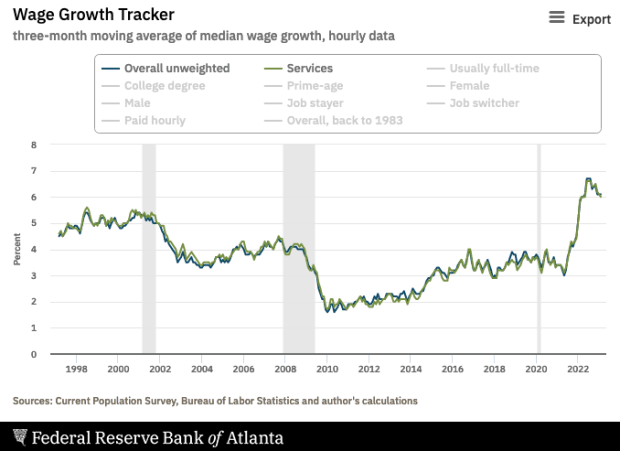

On its path to bringing inflation again to the two% goal, month-over-month Core CPI was nonetheless growing in February whereas preliminary jobless claims and unemployment haven’t budged a lot. Wage progress, particularly within the companies sector, nonetheless stays pretty sturdy on the 3-month annualized charge of 6% progress final month. Though barely coming down, extra unemployment is the place we should see extra weak spot within the labor market to be able to take wage progress a lot decrease.

We’re probably removed from the tip of the chaos and volatility this yr,as every month has introduced new ranges of uncertainty available in the market. This was the primary signal of the system needing Federal Reserve intervention and swift motion. It probably gained’t be the final in 2023.

That concludes the excerpt from a latest version of Bitcoin Journal PRO. Subscribe now to obtain PRO articles instantly in your inbox.

Related Previous Articles:

- Banking Disaster Survival Information

- PRO Market Keys Of The Week: Market Says Tightening Is Over

- Largest Financial institution Failure Since 2008 Sparks Market-Large Worry

- Banking Troubles Brewing In Crypto-Land

- A Story of Tail Dangers: The Fiat Prisoner’s Dilemma

- The Financial institution Of Japan Blinks And Markets Tremble

- The The whole lot Bubble: Markets At A Crossroads

- Silvergate Financial institution Faces Run On Deposits As Inventory Worth Tumbles

- Counterparty Danger Occurs Quick

- Not Your Common Recession: Unwinding The Largest Monetary Bubble In Historical past