The heuristics usually described in behavioral economics supply insightful frameworks for understanding mainstream resistance to Bitcoin.

That is an opinion editorial by Wealthy Feldman, a advertising government, creator and advisory board member at Western Connecticut College.

Behavioral economics has lengthy been cited to explain our “irrational tendencies” as shoppers and traders. I’m right here to increase that dialogue particularly to Bitcoin as a result of, let’s face it, relating to crypto generally and Bitcoin particularly, the affect of feelings, biases, heuristics and social stress in shaping our preferences, beliefs and behaviors is profound… and interesting.

Getting Past FOMO

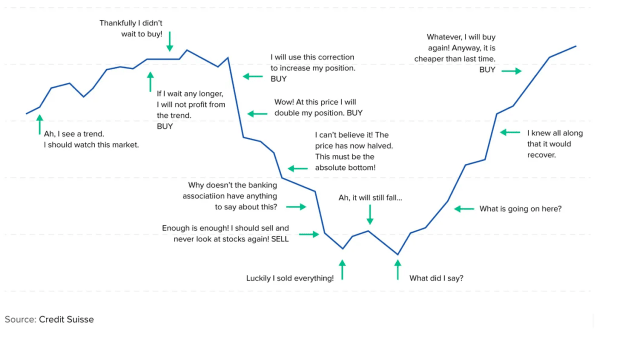

As is preached in behavioral finance, investing in something is vulnerable to frequent “traps” similar to concern of lacking out (FOMO), loss aversion, groupthink (“the bandwagon” impact) and the sunk-cost fallacy — which account for folks holding onto their investments longer than they need to.

Cognitive journeys similar to these are properly demonstrated within the chart beneath which, sarcastically, was created by Credit score Suisse. In gentle of latest occasions, maybe it ought to’ve been cautious of “overreach bias!” However let’s not kick it whereas it’s down.

Ideas of behavioral finance and Bitcoin definitely have attention-grabbing parallels. For instance: FOGI (not the “outdated” kind), or concern of getting in. Chalk that as much as a nascent buying and selling market which could be extremely complicated and (for a lot of) require a technological leap of religion.

But, anybody who thinks this can be a new phenomenon want solely look to the launch of on-line banking, invoice pay and cellular deposits to know that there’s hesitancy round each shopper foray into new applied sciences, significantly as they evolve. As such, FOGI paralyzes the “crypto curious” from making the behavioral strikes (aka, studying and discovery) required to really take part within the asset class.

Furthermore, recency bias can definitely assist clarify a lot of the gyrations of the Bitcoin ecosystem. With so many main advances, disruptions and “seizures” capturing headlines seemingly day by day, it’s no shock that this irrational tendency to assume that latest occasions will all however definitely repeat themselves can simply be related to a volatility that may appear ever current.

With entry to a 24-hour market, that is solely exacerbated, amplifying the peak-end rule by which the latest and intense constructive or adverse occasions (or “peaks”) weigh most closely in how we keep in mind how sure issues have been skilled — thus having the potential for undue affect on near-future selections.

Temporal Discounting And The YOLO Impact

However of all of the biases and heuristics that I feel assist clarify the mainstream notion of Bitcoin at present, it’s temporal discounting — which is our tendency to understand a desired end result sooner or later as much less worthwhile than one within the current — that’s most prescient. Add onto that the YOLO impact — “you solely reside as soon as” hedonism and future “blindness” — to the combo, and you’ve got a strong crypto cocktail.

Right here’s why.

It’s human nature for individuals who say, “I can’t see the place that is going” — significantly these within the “there’s no there, there” camp — to not strive to check the place it’s going. Centered on the current, they appear to border one thing that exists solely primarily based on what they’ll determine, interpret and internalize now.

These are the identical forms of of us who, when cell telephones have been first launched, requested “why do we’d like this?” They merely couldn’t foresee cellular know-how lifting creating nations, turning into central to a complete funds business, essentially altering telecommunications and so forth. This isn’t to disparage these folks; temporal discounting is commonplace. In actual fact, you possibly can chalk this phenomenon as much as the woeful fee of retirement financial savings amongst a large swath of the inhabitants.

An incapability to think about the longer term, or easy disinterest in doing so, results in a need to create shortcuts in understanding and explaining the “why?” Mixed with the “phantasm of management” heuristic — or perception that we’ve got extra management over the world than we really do — there is no such thing as a urge for food for a leap of religion or belief that, within the know-how, there’s a world of promise.

‘The Outdated New Expertise’ Narrative

One other attention-grabbing psychological perspective could be summed up this manner: Bitcoin was launched to the world in January 2009 by Satoshi Nakimoto. At that time, it was a groundbreaking, revolutionary thought. However, now, there are actually hundreds of blockchain protocols and initiatives — lots of which have leaped previous Bitcoin of their utility and promise.

Or, put one other manner, Bitcoin is outdated new know-how. A type of the provision heuristic, it captures our tendency to bias info that we conjure up shortly and simply to border an opinion.

Proponents of this viewpoint will level to Bitcoin’s rejection of the proof-of-stake consensus mechanism (and the myriad causes for that), a centralization of mining energy and smaller developer neighborhood in comparison with others.

Opponents of this viewpoint should snigger. Fourteen years is hardly “outdated.” The know-how has withstood the take a look at of time fairly admirably in comparison with others, and innovation on the blockchain continues to march ahead with cross-chain bridges, Ordinals, the Lightning Community, and so forth. In actual fact, it’s Bitcoin’s stability, permanence and safety that has stored it on the forefront of this rising ecosystem.

Briefly, while you’re first, you’re inevitably in comparison with all the pieces.

The Inflation-Hedge Affirmation Bias

For fairly a while, the narrative round bitcoin as an funding was that it was “a hedge towards inflation.” “Digital gold,” if you’ll.

Many would argue that this prevailing knowledge has been debunked — no less than for now. In actuality, what it’s, and may have all the time been seen as, is a hedge towards systematic institutional failure. In spite of everything, the very thought of Bitcoin was born out of a previous monetary disaster. As of this writing, when banks like Silicon Valley Financial institution (SVB), Credit score Suisse and Silvergate have come below excessive duress, Bitcoin is displaying its mettle.

That the inflation-hedge narrative took off in such a giant manner is an instance of affirmation bias — or our tendency to favor current beliefs. That the unique raison d’etre for Bitcoin was shoved apart (by some), could be attributed to optimism bias. Individuals merely proceed to underestimate the potential for experiencing adverse occasions.

And even when there isn’t a catastrophic systematic implosion, the mere potential of 1 opens the door to present this new retailer of worth an unlimited new footprint.

Bit Bias

In terms of Net 3, crypto, blockchains and Bitcoin, I can admit to having bit bias. That may be chalked up as a perception that the basic attributes of Bitcoin know-how — decentralization, self custody, possession and management — will morph in methods we can not totally comprehend at present.

Put one other manner, should you assume “there’s no there, there,” maybe it’s since you simply can’t think about what the “there” could possibly be.

Irrational? Let’s speak 10 years from now.

It is a visitor put up by Wealthy Feldman. Opinions expressed are completely their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.