The under is an excerpt from a current version of Bitcoin Journal Professional, Bitcoin Journal’s premium markets publication. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

In Case You Missed It: Bitcoin Journal Professional Particular Version Contagion Report

Early on July 6, 2022, it was introduced that Voyager has filed for Chapter 11 chapter.

Voyager Digital Commences Monetary Restructuring Course of to Maximize Worth for All Stakeholders

This was following the announcement from the agency on June 22 that that they had massive publicity to Three Arrows Capital (3AC) within the type of unsecured loans.

“Voyager concurrently introduced that its working subsidiary, Voyager Digital, LLC, might problem a discover of default to Three Arrows Capital (“3AC”) for failure to repay its mortgage. Voyager’s publicity to 3AC consists of 15,250 BTC and $350 million USDC. The Firm made an preliminary request for a compensation of $25 million USDC by June 24, 2022, and subsequently requested compensation of the complete steadiness of USDC and BTC by June 27, 2022. Neither of those quantities has been repaid, and failure by 3AC to repay both requested quantity by these specified dates will represent an occasion of default.” – Voyager Press Launch

In our June 16 launch, following the introduced insolvency of 3AC, we speculated on the probability of Voyager publicity to 3AC in our problem, Fears Of Additional Contagion.

“With the current developments, rumors have been flying, with hypothesis that a number of crypto lending/borrowing desks have been hit from insolvency.

“Whereas it’s unsure which corporations might have skilled any steadiness sheet impairment, there’s a massive risk of losses throughout corporations within the business, and it is doubtless that we haven’t seen the mud settle.

“Shares of crypto custody/borrowing agency Make investments Voyager ($VOYG) have fallen 33% over the previous two days. The agency’s newest quarterly launch confirmed that the corporate had lent $320 million to a Singapore-based entity (house of 3AC earlier than relocation). No matter whether or not the mortgage was to 3AC, the collapse in share worth is actually not a vote of confidence by the marketplace for a U.S.-based public crypto lending platform.” – Fears Of Additional Contagion

Now, with the announcement of Voyager’s chapter proceedings, some attention-grabbing findings may be seen within the chapter filings.

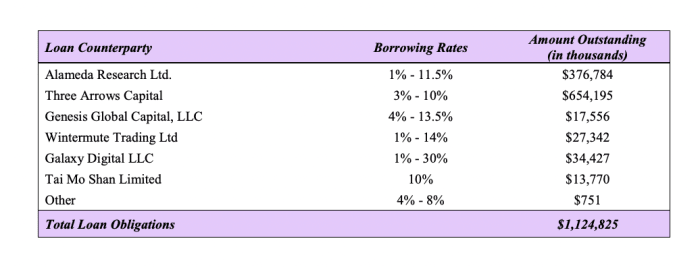

Within the firm’s submitting, it was reported that Alameda Analysis has borrowed $376 million from Voyager, for unknown causes.

Whereas it’s considerably curious that the agency supposedly is working to shore up the business and stem the steadiness sheet contagion is presently borrowing cash from an bancrupt agency (that Alameda holds 9.49% possession in), there are a couple of causes that come to thoughts.

- It isn’t uncommon for a proprietary buying and selling desk to borrow capital within the cryptocurrency business (particularly denominated in belongings apart from the greenback).

- Provided that Voyager’s belongings (that had been largely buyer deposits) had been partially bitcoin denominated, Alameda may probably be borrowing BTC to make use of for market making/shorting, wherein they might purpose to cowl the mortgage at a later date.

- Though the phrases of the mortgage are unspecified, given Alameda’s possession stake in Voyager, it could make sense that the agency would not name within the mortgage, which might decrease anticipated curiosity revenues.

It’s our perception that it’s going to take the market both decrease costs and/or important time to get better from the injury suffered in current months, from each a steadiness sheet impairment perspective in addition to a reputational/legitimacy perspective.