The Arbitrum (ARB) worth has retraced in keeping with the market-wide correction over the previous few days, falling near a important assist degree. Within the present surroundings, altcoins typically proceed to indicate weak spot throughout the board. Nevertheless, one altcoin that’s exhibiting relative power, backed by on-chain exercise, is ARB.

Arbitrum is an optimistic L2 rollup with the principle function of serving to Ethereum scale by enabling L2 transactions with a lot sooner affirmation time. The mission has established itself as one of many high names in decentralized finance (DeFi) in latest months. Remarkably, it additionally homes the preferred perpetual DEX with GMX.

ARB Value Reveals Relative Energy

A take a look at the ARB/BTC chart (2-hour chart) reveals that the altcoin has shaped an uptrend in latest days. The ascending triangle has its resistance line at 0.00004737. If ARB writes additional greater lows in opposition to BTC regardless of the widely pressured altcoins market, it may in the end break via the resistance and rally in direction of 0.00004850.

The 4-hour chart ARB/USDT reveals that Arbitrum is at the moment holding simply above probably the most essential assist degree at $1.29. If the value degree is breached to the draw back, the $1.20 to $1.24 vary could be key.

To the upside, the important thing resistance is at $1.42. Nevertheless, on the best way up the 200-day EMA, at the moment sitting at $1.35, may additionally present some minor headwinds. Fueled by a Bitcoin rally, nevertheless, the resistance at $1.42 appears inside attain with out additional ado. Ought to BTC break above $30,000, ARB bulls may even goal a transfer as much as $1.56.

Arbitrum On-Chain Exercise Stays Extremely Sturdy

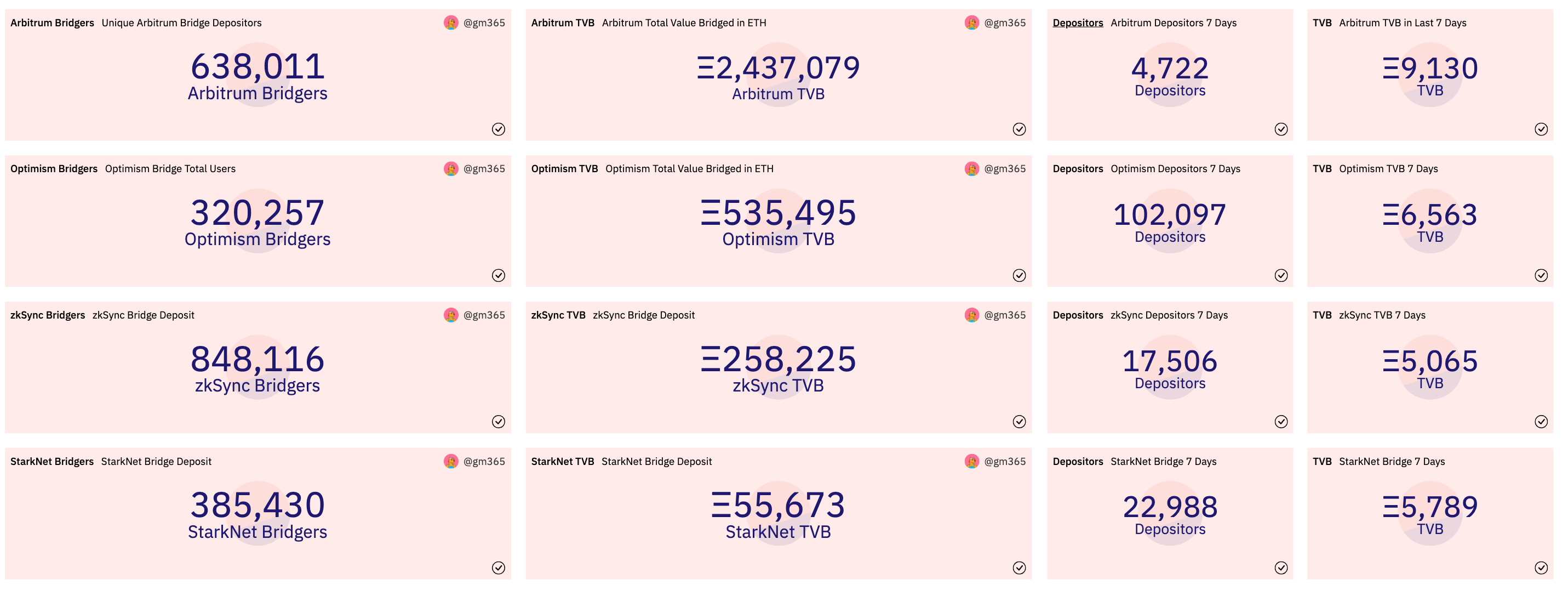

Arbitrum’s present technical power on the charts coincides with its on-chain exercise. Most metrics for Arbitrum are at an all-time excessive. Most significantly, the expansion of the Arbitrum ecosystem has remained strong after the airdrop, displaying elevated exercise, as researched by analyst Francesco, who states:

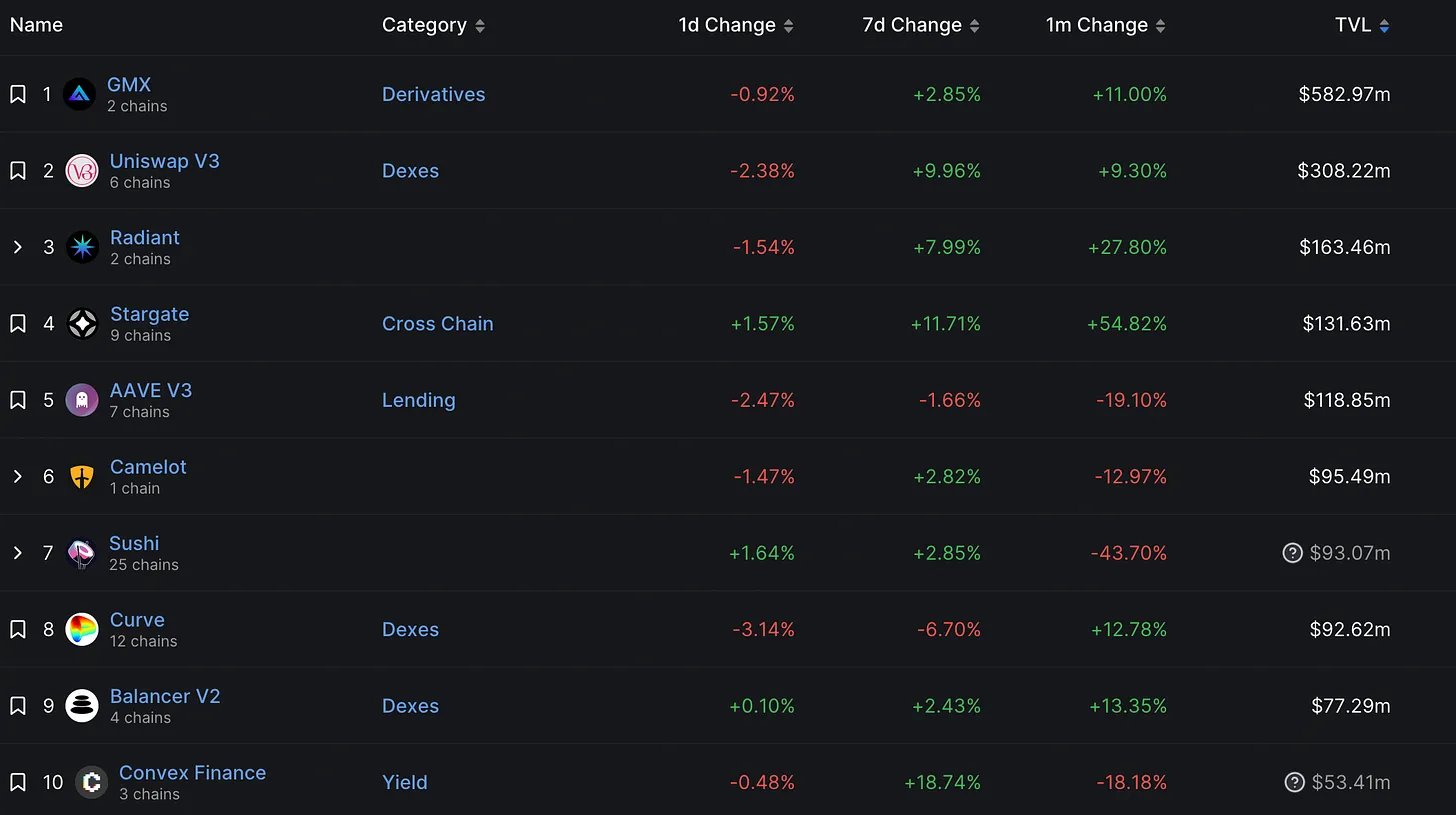

Opposite to what was anticipated after the airdrop, TVL is rising: GMX nonetheless stays the very best perpetual DEX, and Arbitrum nonetheless stays the house of DeFi as a consequence of its composability, low cost charges, and quick affirmation instances.

Arbitrum leads on nearly each metric, particularly TVL. The truth that extra customers have switched to zkSync is probably as a consequence of airdrop hunters.

Arbitrum’s TVL is at the moment over $2.2 billion, a rise of over 100% in comparison with the fourth quarter of 2022. The first purpose for that is the perpetual DEX referred to as GMX, which is Arbitrum’s main protocol with over $500 million or 26% of TVL.

Nevertheless, with Radiant, Stargate and Camelot DEX, Arbitrum primarily based initiatives additionally occupy three extra locations throughout the high 6 decentralized exchanges, underlining the expansion of your complete ecosystem. Moreover, Arbitrum ranks 4th amongst all blockchains by TVL, simply behind the layer-1’s Ethereum, Tron, and BSC.

Featured picture from Nansen, charts from TradingView.com