A current editorial assault on Bitcoin mining by The New York Occasions raises questions on its journalistic integrity and editorial course of.

That is an opinion editorial by Level39, a researcher centered on Bitcoin, expertise, historical past, ethics and vitality.

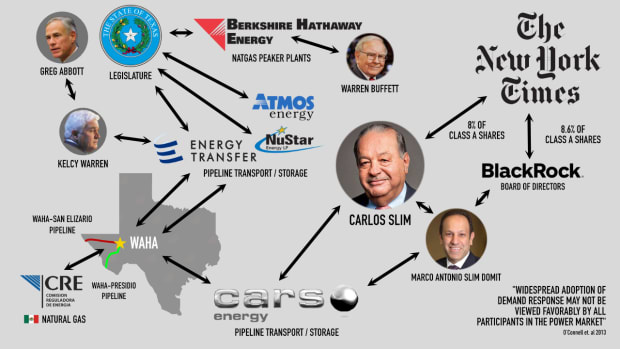

Does one of many largest particular person shareholders of The New York Occasions profit from the publication’s current hit piece on Bitcoin mining?

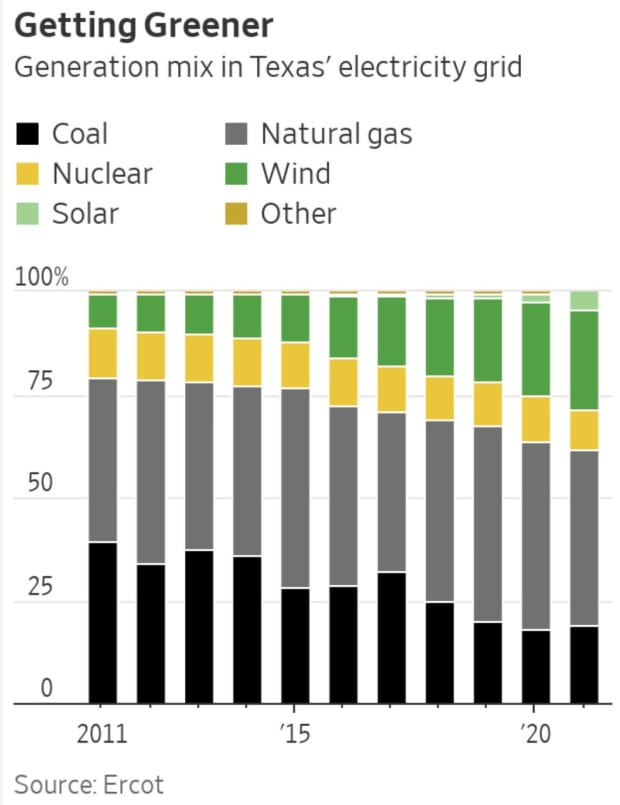

The article, “The Actual-World Prices Of The Digital Race For Bitcoin,” attacked the position of Bitcoin miners who take part in sanctioned demand-response applications throughout the Electrical energy Reliability Council Of Texas (ERCOT), the state’s vitality grid. These applications present ancillary and demand-response providers that allow variable renewable energy to be worthwhile and available when client demand rises. Additionally they permit for grids to stay dependable throughout excessive climate occasions, similar to Winter Storm Uri in February 2021.

In its haste to assault Bitcoin mining, The New York Occasions seems to have reversed greater than a decade of assist for pro-renewable, demand-response applications and has doubtlessly handed the Texas legislature fodder to restrict competitors on the Texas grid, in favor of insurance policies that promote pure fuel peaker crops and pipelines.

Who Is Carlos Slim?

Carlos Slim Helú, a Mexican enterprise magnate who supplied the newspaper with a $250 million mortgage in 2009, presently owns roughly 8% of The New York Occasions Firm’s class A shares. He’s the eleventh-richest individual on the earth with a internet price of $86 billion, making him the richest individual in Latin America. Slim’s fortune largely derives from telecommunications networks, similar to América Móvil — Latin America’s largest cell phone firm that dominates Mexico’s telecommunications trade. The corporate has saved the nation’s cellphone charges among the many highest on the earth and is considered a key issue restraining Mexico’s financial growth.

Slim has investments within the Texas vitality market, by way of oil and fuel firms. His company conglomerate, Carso Grupo, owns Carso Vitality, which transports and sells Texas pure fuel to Mexico’s state-run energy firms by way of pipelines. By attacking Bitcoin mining, The New York Occasions not directly helps midstream firms similar to Carso Vitality, which enhance its earnings from transporting and promoting pure fuel to Mexico.

Carlos Slim’s second eldest son, Marco Antonio Slim Domit, manages the monetary aspect of their household’s enterprise empire and is a member of the board of administrators of Grupo Carso and an impartial director at BlackRock, along with being a member of its board of administrators. BlackRock is the second-largest investor of the New York Occasions Firm, holding 8.67% of sophistication A shares.

Slim’s Connection To Texas Oil And Fuel

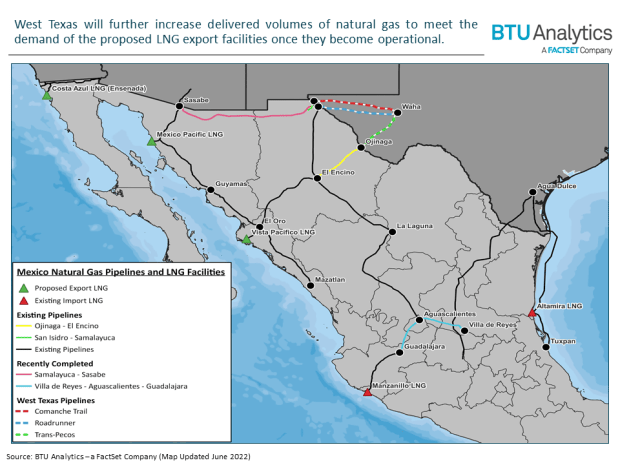

The Wahalajara system is a brand new community of pipelines that transports pure fuel from the Permian Basin to inhabitants facilities in Guadalajara and western-central Mexico. The community originates from the Waha hub in western Texas, a important provide hub for Permian Basin pure fuel producers.

A three way partnership between Carso Vitality and Vitality Switch Companions operates two important pipelines to Mexico that originate from the Waha hub — the Waha-Presidio “Trans-Picos” pipeline and Waha-San Elizario “Comanche Path” pipeline, getting into service in 2017. Carso Vitality has a 51% stake within the three way partnership. Carso Vitality has a 100% stake within the Sásabe-Samalayuc pipeline, in Mexico, which is fed from Waha through San Elizario and entered service in 2021. With the assistance of further Carso Vitality pipelines and different sources of pure fuel, the Secretaría de Energía (SENER), Mexico’s ministry of vitality, expects so as to add 30,000 megawatts of combined-cycle, gas-fired energy technology capability to the nation’s electrical grid over the following decade.

Pure Fuel Costs At The Waha Hub

Roughly 70% of Mexico’s pure fuel imports are equipped by U.S. pipelines. Subsequently, it is not uncommon for pure fuel contracts in Mexico to be linked to areas within the U.S. the place pricing is set, such because the Waha hub, Henry hub and Houston Ship Channel.

The Waha hub is likely one of the most vital pricing level for pure fuel in Mexico, partly as a result of every of the Wahalajara pipelines collectively operated by Carso Vitality and Vitality Switch are designed to move and promote over 1 billion of cubic toes of pure fuel per day to Mexico’s state-owned Comisión Federal de Electricidad (CFE) energy crops.

The pure fuel worth index for the Mexican market, often called the IPGN, is calculated with the Waha benchmark worth by the Comisión Reguladora de Energía (CRE), a authorities vitality regulatory fee. Carso Vitality’s transport revenue typically advantages from greater costs on the Waha hub. The CRE makes use of the Waha benchmark to calculate a every day reference worth for pure fuel utilized by CFE, which helps decide the value of pure fuel bought to the CFE by Carso Vitality, together with the midstream prices of transportation and different charges related to importing pure fuel. The CFE is likely one of the largest clients of pure fuel in Mexico and by the tip of subsequent yr, the CFE is predicted to generate 65% of Mexico’s energy. Promoting pure fuel to the CFE can grow to be extraordinarily worthwhile throughout extreme climate occasions in Texas, attributable to heavily-inflated spikes within the Waha benchmark worth.

Extreme climate occasions apart, the Waha hub has been plagued with takeaway capability constraints, inflicting document low costs within the Waha benchmark of pure fuel which have persistently fallen beneath the Henry hub in Erath, Louisiana. The New York Mercantile Trade (NYMEX) primarily makes use of the Henry hub worth for pure fuel futures contracts. Bodily provide and demand dynamics on the Waha hub can have results that affect the Henry hub and NYMEX pure fuel futures. The Wahalajara pipelines had been anticipated to assist slender the steep Waha hub low cost to the Henry hub, nevertheless, the Waha benchmark nonetheless went detrimental 20 occasions within the final three years attributable to different elements that stay a problem.

Unfavourable pricing on the Waha hub can happen when there’s an oversupply of pure fuel and never sufficient pipeline capability to move the fuel. When this occurs, producers could also be pressured to pay consumers to take their pure fuel as a way to keep away from having to completely shut down manufacturing. This will result in detrimental pricing, which might current quite a lot of challenges for Waha pipelines.

“Waha is within the Permian basin, and is characterised as a market that’s perpetually lengthy provide, and must commerce at a reduction to its marginal demand market. That demand market is sort of all the time outdoors of the Permian basin. Subsequently, foundation is set by the quantity of extra fuel that must be moved to a different location. The relative abundance or shortage of this egress capability influences Waha foundation vastly…

“Each day, wind technology straight competes with pure fuel. As new wind (and photo voltaic) farms are constructed, renewable vitality sources are taking a bigger share of complete technology. If renewables technology grows sooner than load (demand for energy), then fuel demand typically suffers.”

–“Waha Foundation: Forces Affecting Worth,” AEGIS Reference

Bitcoin Mining Competes With Pure Fuel Pipelines

Low costs cut back the motivation for producers to promote pure fuel within the Waha market, which in flip can result in decrease throughput volumes for the Wahalajara pipelines. Shale oil wells within the Permian Basin have grow to be extraordinarily gassy — producing extra related pure fuel as they age and oil manufacturing falls. This leads to elevated exploration for shale oil, which ends up in extra gassy wells and an oversupply of pure fuel. As costs keep low, or go detrimental, it turns into extra worthwhile to waste pure fuel by both venting it or flaring it.

Venting methane is dangerous for the surroundings as it’s a potent greenhouse fuel that traps 80 occasions extra warmth than carbon dioxide (CO2) over a 20-year interval. Flaring is best than venting, however is simply 92% environment friendly, that means that 8% of all flared methane nonetheless escapes into the ambiance.

Bitcoin mining is sort of 100% environment friendly at mitigating methane emissions, so it is extra ecologically sound and worthwhile to mine Bitcoin with methane from stranded Permian Basin wells than it’s to waste it. Bitcoin miners may even be used to scale back fugitive emissions from deserted oil wells as soon as the wells are now not productive. In the end, this all means there’s much less incentive to construct costly infrastructure to move Permian pure fuel to the Waha hub the place it could promote for virtually nothing.

This can be a main downside for operators of the Wahalajara pipeline system. Midstream firms similar to Carso Vitality and Vitality Transport develop earnings by rising the amount and worth of transported pure fuel. The oil and fuel trade has concluded that prices must rise as a result of the present value construction is unsustainable as losses for pure fuel explorers proceed to mount.

Bitcoin Mining Competes With Pure Fuel Peaker Crops

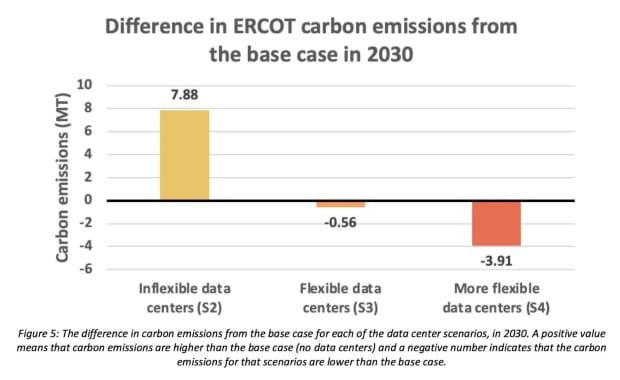

To make issues tougher for the oil and fuel trade, analysis signifies that utilizing massive, versatile hundreds, similar to these favored by Bitcoin mining operations, can have a internet decarbonizing impact on grids over the long run. That is believed to occur when hundreds steadiness fluctuations in variable renewable technology, which in flip facilitates greater penetrations of renewable assets when these energy sources can be found.

Brad Jones, the previous interim CEO of ERCOT, has publicly affirmed that Bitcoin mining has already performed a significant position in bringing renewables into the Texas grid, by supporting the financials of photo voltaic and wind services, and offering a balancing impact between shoppers and extra technology that will in any other case be negatively priced or curtailed.

“For a few years, ERCOT had been on the lookout for a great deal of scale that might reply in a requirement responsive manner that may assist us steadiness our grid… It is right here now. And it is a terrific factor for serving to us to handle the grid. Serving to us to handle our assets. Bitcoin has the character of actually turning down when costs start to rise, in a manner that we can provide that energy again to different shoppers. And on the identical time, as we convey an increasing number of renewables into the state, it turns into a driver of extra renewables. As a result of proper now if we herald all of the renewables which are signed as much as need to come to our state, there shall be a major despair of pricing in the course of the day. By having Bitcoin there to help, to stabilize these costs all through the day, it’ll drive extra renewables into our system. And that is good for Texas.”

–Brad Jones, former Interim CEO of ERCOT

Furthermore, analysis means that demand-response applications are rivals to conventional, flexible-generation crops and, by proxy, the pure fuel firms that present gas to these crops.

“Widespread adoption of demand response is probably not seen favourably by all members within the energy market. Particularly, if the capability worth, or the supply in occasions of want, of demand response is critical, house owners of peaking crops will probably see their capability elements lower as demand response takes over some or all the accountability for regulation, load following and ramping… This can have a major influence on the potential for generator house owners to get well their funding, probably resulting in the decommissioning of in any other case operational crops. Such a situation would clearly be vastly opposed by operators of versatile mills, although it could current an environment friendly resolution for the system as an entire.”

–“Advantages And Challenges Of Electrical Demand Response: A Crucial Evaluate”

If versatile demand response can result in the decommissioning of versatile technology, there would clearly be fewer potential consumers of pure fuel in periods of peak demand. As variable renewables proceed to extend market share inside ERCOT, Carso Vitality and Vitality Switch would have good purpose to view demand-response applications that Bitcoin mining operations take part in as rivals to peaker crops that reliably purchase and eat pure fuel.

After all, pure fuel peaker crops are needed when photo voltaic and wind aren’t out there, enabling miners to proceed mining throughout these hours. On the floor, this would seem to make Bitcoin miners and pure fuel firms shut allies. Nonetheless, if oil and fuel executives concur with Jones and the analysis above, there could be a motive for oil and fuel firms to negatively colour the general public’s notion of Bitcoin’s participation in ERCOT demand-response applications. Pure fuel could also be sustaining its market share inside ERCOT as renewables develop, however the trade would moderately enhance its market share and eradicate competitors to safe its long-term future.

Oil And Fuel Lobbies The Texas Legislature

Warren Buffett additionally has a motive to view Bitcoin mining’s position in demand response as competitors. Buffett owns Berkshire Hathaway Vitality, a subsidiary of Berkshire Hathaway, which is presently lobbying the Texas legislature to construct 10 new peaker crops totaling 10 gigawatts of technology capability by November 2023 — paid for by an extra cost on Texans’ energy payments. Peaker crops are sometimes pure fuel energy crops that solely run when there’s a excessive demand for vitality. New peaker crops would exchange the necessity for demand-response clients.

It’s no marvel Buffett has described Bitcoin as “rat poison squared.” Regardless of what Elizabeth Warren says, attacking Bitcoin mining’s position in demand response leads to greater electrical energy payments for Texans, to pay charges for peaker crops.

The Texas Senate lately handed Senate Invoice 6, which might funnel not less than $10 billion to construct these pure fuel peaker crops, and probably as much as $18 billion, for them to sit down idle till excessive demand and excessive climate occasions. In testimony at a committee assembly in March, Berkshire Hathaway was the lone supporter of the invoice. Vitality analysts and The Wall Road Journal have criticized the plan as being unhealthy for Texas, attributable to it being pricey and undermining competitors from photo voltaic and wind. Senate Invoice 7 provides oversight necessities to ERCOT for peaker crops and gives allowances for crops that may function at a loss when extreme climate isn’t noticed. This can be a subtle manner of claiming the trade is requiring the state to offer the oil and fuel trade with a subsidy, for which the individuals of Texas shall be on the hook.

In the meantime, the Texas Senate handed Senate Invoice 1751 unanimously out of committee and with just one “no” vote from the senate flooring, which unfairly prohibits bitcoin miners from competing to receive commonly used tax incentives. Worse, it stymies miners of their efforts to make the Texas electrical grid extra resilient in emergency conditions by arbitrarily limiting Bitcoin mining’s participation in ancillary and demand-response providers to 10%, which the trade probably already exceeds. One other invoice, Senate Invoice 2015 would set up a aim for 50% of latest producing capability put in in ERCOT by 2024, to return from dispatchable technology, which is primarily pure fuel.

It’s well-known that the oil and fuel trade showers Texas Governor Greg Abbott and different politicians with cash. After Winter Storm Uri, Vitality Switch’s CEO donated $1 million to Governor Abbott after the corporate pocketed billions of {dollars} from the lethal storm.

Atmos Pipeline-Texas and NuStar Vitality are operators of a few of the largest pipelines and pure fuel storage networks in Texas and intention to extend takeaway capability from the Permian Basin the place the Waha hub is situated. In 2022, each Atmos and NuStar donated, in complete, $40,500 to the campaigns of Lois Kolkhorst, Donna Campbell, Robert Nichols and Jose Menendez — the 4 co-sponsors of the anti-Bitcoin-mining Senate Invoice 1751. These 4 state senators acquired $163,500 from the oil and fuel trade as an entire.

If Bitcoin actually had been to advertise the usage of fossil fuels over the long term, why are Texas senators — who considerably profit from the oil and fuel trade — introducing laws that unfairly targets Bitcoin miners?

Bitcoin Mining Relocates To Texas And Balances Its Grid

Previous to China’s ban on Bitcoin mining enacted in June 2021, extreme climate occasions in Texas resulted in windfall earnings for pure fuel firms. For instance, Vitality Switch raked in $2.4 billion in the course of the February 2021 blackout of Winter Storm Uri, through the use of pure fuel as a peaking asset — storing it when the value is low, and promoting when demand skyrocketed.

Exporting pure fuel to Mexico throughout a extreme climate occasion in Texas will be much more worthwhile for the Wahalajara pipeline operators, because the Mexican worth is perhaps even greater — particularly If ERCOT had been extra reliant on pure fuel peakers. In the course of the 2021 Texas winter blackouts, the value of pure fuel in Mexico skyrocketed to 100 occasions regular costs. Pure fuel peaker crops struggled throughout Uri, as pure fuel was freezing in pipes.

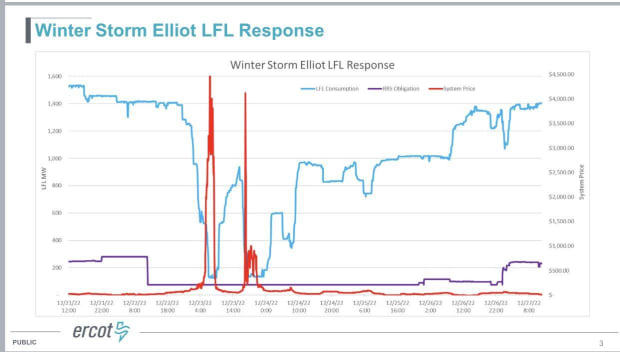

After an inflow of mining rigs from China relocated to Texas in late 2021, many grew to become sanctioned as massive versatile hundreds (LFLs) inside ERCOT. At present, LFLs are offering and making the most of ancillary providers that pure fuel peaker crops would have beforehand dominated. And they’re doing so at a lower cost level that peaker crops battle to compete with — saving Texans cash on their electrical payments by getting extra for much less. In truth, LFLs helped steadiness the grid and keep away from blackouts in the course of the summer time warmth wave of 2022 and through Winter Storm Elliot, over Christmas of 2022 — releasing up over 3,000 megawatts of spare capability on the grid. This success was forecasted by ERCOT a couple of weeks previous to Winter Storm Elliot, in a report that heralded Bitcoin miners as helpful to balancing the grid throughout excessive climate occasions.

The Grey Girl Assaults Bitcoin

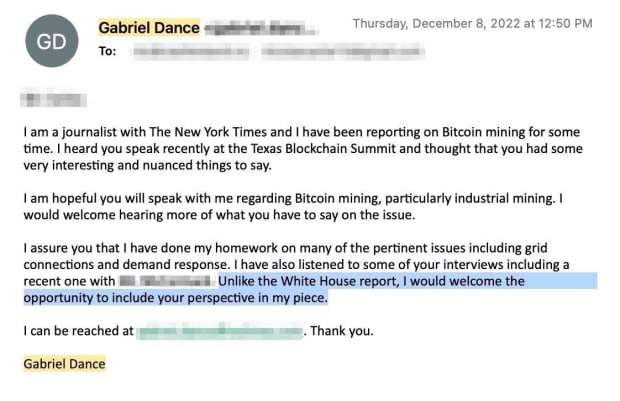

In November 2022, 5 months earlier than his anti-Bitcoin mining article was revealed, Gabriel Dance — deputy investigations editor at The New York Occasions — attended the Texas Blockchain Summit, in Austin, as a part of his investigative analysis. A number of weeks later, he started emailing members from the convention, promising to incorporate their nuanced views in his upcoming article.

Dance in the end proved this was all a ruse. When his article was lastly revealed, it grew to become evident that he selected to omit all the pro-Bitcoin mining arguments and solely included unbecoming quotes from its proponents.

The substance of Dance’s article deserves harsh criticism. It was full of disinformation and fallacious reporting concerning the position of demand response that has since been totally debunked by the Bitcoin Coverage Institute. Dance’s reporting contradicted the U.S. Division of Vitality, which views demand response favorably. It additionally conflicted with earlier endorsements of demand response from The New York Times, going again not less than to 2007.

Here’s a choice of earlier endorsements from the Occasions:

“Throughout america, a number of thousand companies and residential clients are ceding management of their electrical techniques throughout moments of unusually excessive demand. And they’re getting paid to do it. The system, based mostly on an idea referred to as ‘demand response,’ is likely one of the newest ways in which Web expertise is being utilized to handle over-stretched U.S. energy provides higher.”

–“Demand Response Expertise Shaves Peak Vitality Consumption By Distant Management,” The New York Occasions, November 7, 2007

In 2009, The New York Occasions reported that demand response had been endorsed by the Obama administration’s Federal Vitality Regulatory Fee chairman, Jon Wellinghoff.

“The Obama administration, Congress and the brand new Federal Vitality Regulatory Fee chairman, Jon Wellinghoff, have all centered on decreasing peak demand. Mr. Wellinghoff has referred to as demand response the ‘killer software’ of the sensible grid.”

–“Dimming The Lights To Meet Demand,” The New York Occasions, April 17, 2009

In 2010, in its “Vitality And Surroundings” part of the paper, the Occasions continued to extol the advantages of demand response to its readers.

“This idea, referred to as demand response, has gained traction in utility circles. In essence, it entails paying customers to make small sacrifices when there’s an pressing want for further energy (the ‘peak’). The utility can then depend on chopping some demand on its system at essential occasions and, in principle, keep away from the price of constructing a brand new plant simply to fulfill these peak wants… For farmers, nevertheless, this course of is not straightforward. Staff should be dispatched to show the pumps on and off, and there’s a threat of crop injury.”

–“Why Is A Utility Paying Clients?,” The New York Occasions, January 23, 2010

Once more, later in 2010, the Occasions reiterated the Obama administration’s constructive view of demand response.

“…[Wellinghoff] sees shoppers as energetic elements of the grid … stabilizing the grid by adjusting demand by way of clever home equipment or conduct modification, often called demand response; and storing vitality for numerous grid duties. He thinks shoppers ought to receives a commission to offer these providers.”

–“Making The Shopper An Energetic Participant In The Grid,” The New York Occasions, November 29, 2010

The newspaper even quoted environmentalists who wished Texas to undertake extra demand response.

“Environmentalists argue that the strains on the grid ought to spur Texas to work on energy-saving methods. Particularly, they’re pushing a program referred to as demand response, by which companies and shoppers are paid to scale back energy at occasions of excessive demand, like late summer time afternoons. Colin Meehan, a clear vitality analyst with the Environmental Protection Fund in Texas, stated in an e-mail that Texas had ‘thus far solely taken very small steps’ on demand response.”

–“Electrical Grid In Texas Faces A number of Challenges,” The New York Occasions, December 22, 2011

The Occasions continued to reward demand response all through the Obama administration, nearly as if it was doing the administration’s job to advertise the expertise.

“However balancing the grid entails extra than simply rising capability. Maybe the state’s most promising conservation software is ‘demand response,’ … The applications, that are voluntary in Texas, can take many kinds… Demand response ‘in all probability deserves extra focus and a focus,’ stated Doyle Beneby, the president of C.P.S. Vitality, a municipally owned utility that has not taken a place within the capability market debate. ‘In Texas, it could possibly be a giant a part of the answer.’”

–“With Pressure On Electrical Grid, A Push To Prioritize Conservation,” The New York Occasions, January 23, 2014

And but, Dance’s hit piece towards Bitcoin mining single-handedly reversed the Occasions’ place on demand response. Dance wrote the next passage, which makes demand response sound like an evil scheme for versatile clients to defraud retail clients:

“Their huge vitality consumption mixed with their skill to close off nearly immediately permits some firms to economize and become profitable by deftly pulling the levers of U.S. energy markets. They’ll keep away from charges charged throughout peak demand, resell their electrical energy at a premium when costs spike and even be paid for providing to show off. Different main vitality customers, like factories and hospitals, can not cut back their energy use as routinely or dramatically with out extreme penalties.”

–“The Actual-World Prices Of The Digital Race For Bitcoin,” The New York Occasions, April 9, 2023

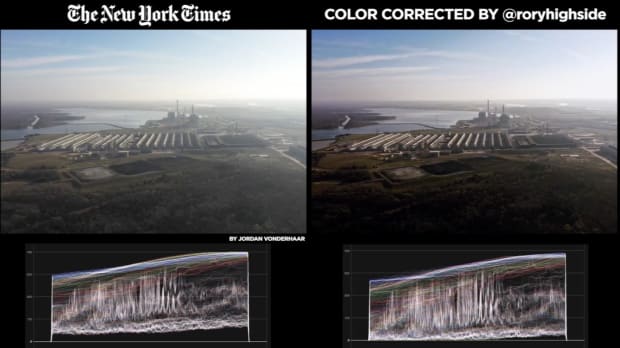

All of it begs an extended checklist of questions: Why did The New York Occasions spend months researching an article that distracts readers from critical environmental points, solely to concentrate on a expertise that’s solely answerable for an infinitesimal 0.14% of worldwide emissions? Why did it ignore a December 2022 ERCOT research that confirmed massive versatile hundreds, similar to these favored by Bitcoin mining operations, had been helpful to the Texas grid? Why did The New York Occasions ignore the truth that Bitcoin mining performed a major position in avoiding blackouts throughout Winter Storm Elliot, over Christmas and in the course of the 2022 summer time warmth wave? Why did it ignore that Bitcoin mining reliably gives a worth flooring for overbuilding renewable technology on the ERCOT grid? Why single out a sanctioned demand-response buyer that was, in response to ERCOT’s former interim CEO, largely answerable for bringing in large-scale, variable renewable tasks into Texas? Why did The New York Occasions reverse more than a decade of support for pro-renewable demand response applications that had been championed by the U.S. Division of Vitality and Obama’s Federal Vitality Regulatory Fee chairman? Why, after months of analysis, did The New York Occasions publish its anti-Bitcoin mining story exactly when the Texas legislature was voting on payments that assault Bitcoin mining demand-response applications and exchange them with pure fuel peaker crops? Why did the Occasions’ editors use allegedly-manipulated footage that made it appear as if there was smog in Rockdale, Texas?

Little or no concerning the hit piece makes any sense. Is it a coincidence that The New York Occasions attacked Texas Bitcoin mining at simply the proper time that it may gain advantage one in all its largest shareholders?

“The purpose is, Slim doesn’t must intervene in any respect. I do know from expertise that publishers do intervene within the editorial course of, as is their prerogative. And I can guarantee you that Slim’s funding shall be an element, even when unstated, in editorial decision-making henceforth on the Occasions. Maybe Mexico’s crony capitalism will stay a largely uncared for subject — however now conspiracies shall be learn into the neglect.”

–Andreas Martinez, former columnist for The New York Occasions

We might by no means know if Slim influenced the editorial course of within the newspaper’s newest hit piece attacking Bitcoin mining. Nonetheless, it might match an ongoing sample of The New York Occasions defending Slim’s enterprise pursuits along with patterns of alleged, calculated, systemic bias and distortions. Whether or not these are all coincidences, or one thing extra, could also be up for debate. Nonetheless, editors of the Occasions appear greater than prepared to sacrifice the newspaper’s remaining shreds of journalistic integrity for no matter motivates them to run such hit items.

Increasingly readers, however, are starting to mistrust mainstream media and it doesn’t assist when the biggest shareholders of media firms are positioned to reap earnings from the reporting. There’s little recourse in such issues, nevertheless, bringing consideration to potential conflicts of curiosity might not less than present some context to in any other case inexplicable editorial choices.

Due to Justin Orkney for help with this text.

This can be a visitor submit by Level39. Opinions expressed are completely their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.