The article under is an excerpt from a current version of Bitcoin Journal PRO, Bitcoin Journal’s premium markets publication. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

The Bitcoin Halving

One of the crucial vital and revolutionary options of bitcoin is the hard-capped provide of 21 million.

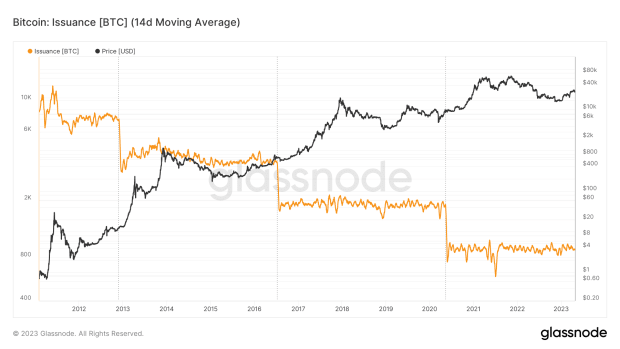

The whole provide will not be particularly outlined within the code, however is as an alternative derived from the code’s issuance schedule, which is lowered by half each 210,000 blocks or roughly each 4 years. This discount occasion known as the bitcoin halving (or “halvening” in some circles).

When Bitcoin miners efficiently discover a block of transactions that hyperlinks a set of recent transactions to the earlier block of already confirmed transactions, they’re rewarded in newly created bitcoin. The bitcoin that’s freshly created and awarded to the profitable miner with every block known as the block subsidy. This subsidy mixed with transaction charges despatched by customers who pay to get their transaction confirmed known as the block reward. The block subsidy and reward incentivizes the usage of computing energy to maintain the Bitcoin code operating.

When bitcoin was first launched to the general public, the block subsidy was 50 bitcoin. After the primary halving in 2012, this quantity was lowered to 25 bitcoin, then 12.5 bitcoin in 2016. Most lately, the bitcoin halving occurred on Could 11, 2020, with miners at the moment receiving 6.25 bitcoin per new block.

The following halving is developing in about one yr. The precise date will depend upon the quantity of hash energy that joins or leaves the community, as this impacts the pace at which blocks are discovered. Estimates for the subsequent halving vary from late April to early Could 2024. After the subsequent halving, the block subsidy might be lowered to three.125 bitcoin.

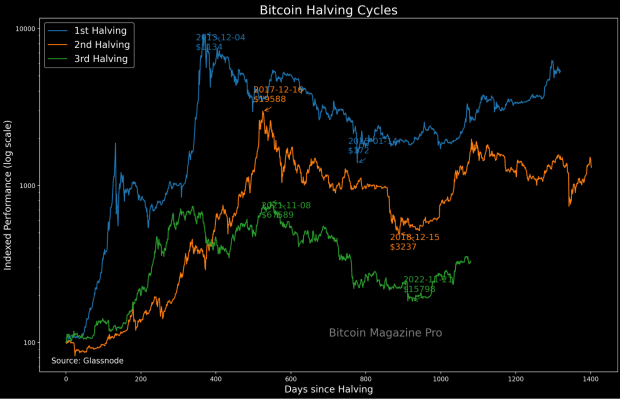

Up to now, the bitcoin value rose significantly after the halving, albeit many months after the subsidy was lowered. Each halving cycle, there’s a debate about whether or not or not the halving is priced in. This query considers the truth that the halving is a widely known occasion and makes an attempt to deal with if the market would issue this into bitcoin’s change fee.

Lengthy-Time period Holder Dynamics

Our main thesis is that the halving results in a demand-driven occasion in bitcoin, as market members change into conscious about bitcoin’s absolute digital shortage. This results in a fast section of change fee appreciation. This speculation is considerably divergent from the principle narrative, which is {that a} supply-driven occasion instigates the exponential enhance in value as a result of miners earn fewer bitcoin for a similar quantity of vitality expended and put much less promoting strain in the marketplace.

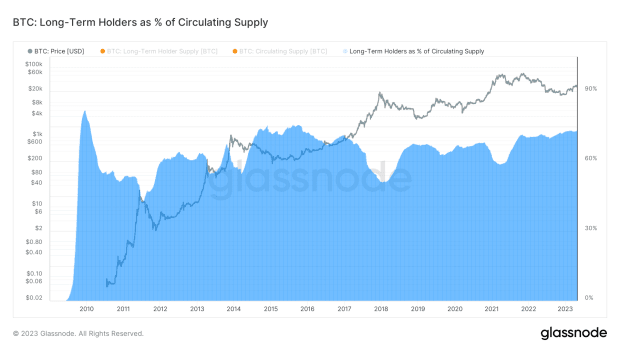

Once we look carefully on the knowledge, we are able to see that the availability shock is commonly already in place — the HODL military has already staked their floor, if you’ll. On the margin, the discount of provide hitting the market does make a cloth distinction within the each day market clearing fee, however the enhance in value is because of a demand-driven phenomenon that hits a completely illiquid provide on the promote aspect with holders who’re solid within the depths of the bear market unwilling to half with their bitcoin till value appreciates by roughly an order of magnitude.

Statistically talking, long-term holders are the least more likely to promote their bitcoin and the present provide is held tightly by this cohort. The individuals who had been shopping for and holding bitcoin whereas the change fee was down roughly 80% at the moment are the dominant majority share of the free float provide.

The halving reinforces the fact of Bitcoin’s provide inelasticity to altering demand. As schooling and understanding about bitcoin’s superior financial properties additional perpetuate internationally, there might be an inflow of demand whereas its inelastic provide makes the worth rise exponentially. It isn’t till a big share of the convicted holders half with a proportion of their beforehand dormant stash that the change fee crashes from a feverish excessive.

These holding and spending patterns are very effectively quantifiable, with a completely clear and immutable ledger to doc all of it.

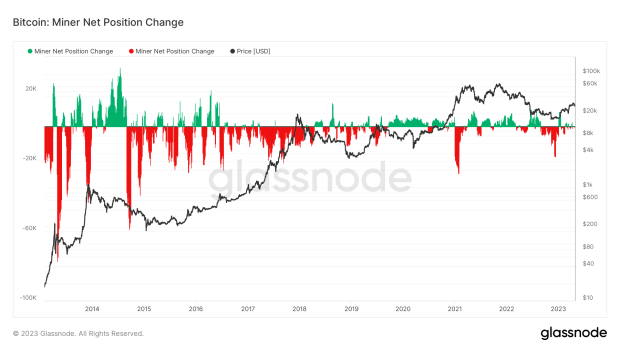

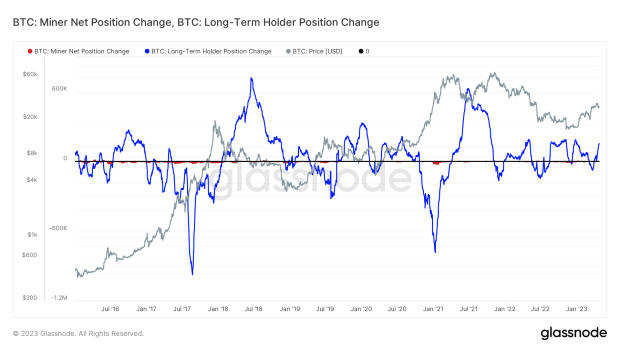

We all know that the long-term holders are those setting the ground within the bear market, however they’re additionally those setting tops in bull markets. Many individuals look to the halving’s provide shock as what drives the rise in value, with miners incomes fewer cash whereas nonetheless needing to promote some with the intention to pay their payments which have remained the identical value in greenback phrases (or the native forex phrases). We will observe miners’ web place change overlaid with the bitcoin value and see the affect of their accumulation and promoting.

There’s clearly a relationship between the bitcoin value and whether or not miners are accumulating or promoting, however correlation doesn’t equal causation and after we embody the conduct of long-term holders, we are able to see how a lot bigger the tide of holder accumulation and distribution is in comparison with miner promote strain. The chart under reveals the identical miner web place change as above, however overlays it with long-term holder web place change, each measuring the online accumulation and distribution of the 2 cohorts over a 30-day interval, displayed on the identical y-axis. Once we evaluate the 2, it’s troublesome to see the miner web place change (pink) in relation to the way more outstanding place change of long-term holders (blue). Whereas miner promote strain receives all the press, the true driver of the bitcoin cycle is the convicted holders, who set the ground with accumulation, compressing the proverbial spring for the subsequent wave of incoming demand.

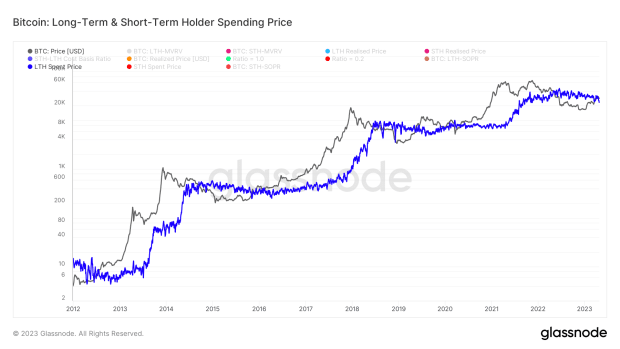

Lengthy-term holders are likely to distribute their cash as bitcoin makes its parabolic rise after which start reaccumulating after the worth corrects. We will have a look at long-term holder spending habits to see how the change in long-term holder provide is what finally helps the worth cool off after a parabolic rise.

On-chain knowledge reveals that cash that haven’t moved for over six months at the moment have a mean spend value that stays comparatively flat in the course of the entirety of the bear market — in comparison with the volatility of the market-to-market change fee. What happens in the course of the bear market is solely a reshuffling of the deck: UTXOs are exchanging arms from the speculator to the convicted, from the overleveraged to those who’ve free money movement.

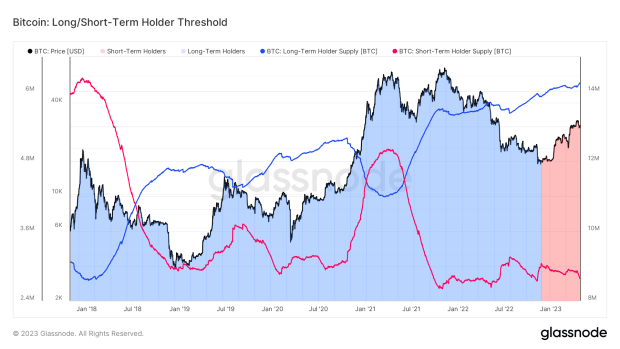

During times of market frenzy to the upside, the outflow of cash from long-term holders is far bigger than the sum of each day issuance, whereas the alternative will be true within the depths of the bear — holders are absorbing far higher quantities of cash than the sum of recent issuance.

We’ve been in a web accumulation regime for 2 years, whereas wiping out almost your entire spinoff complicated within the course of. Immediately’s long-term holders have cash that didn’t budge in the course of the Three Arrows Capital blowup or the FTX fiasco.

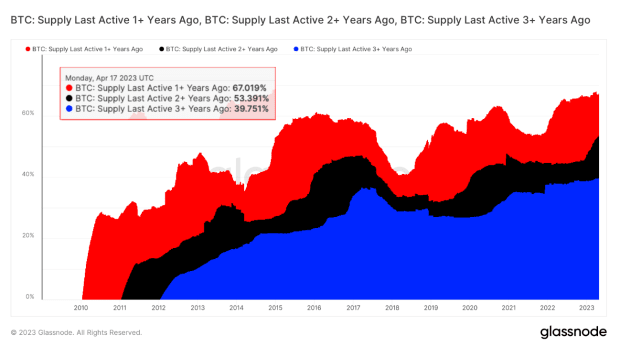

To display simply how a lot conviction long-term holders have on this asset, we are able to observe cash that haven’t moved for one, two and three years. The chart under reveals the proportion of UTXOs which have remained dormant over these timeframes. We will see that 67.02% of bitcoin hasn’t modified arms in a single yr, 53.39% in two years, and 39.75% in three years. Whereas these aren’t excellent metrics for analyzing HODLer conduct, they present that on the very least there’s a important quantity of the entire provide that’s held by individuals who have little intention of promoting these cash anytime quickly.

Except for bitcoin changing into more durable to supply on the margin, the halving occasion’s almost certainly contribution to bitcoin is the advertising and marketing round it. At this level, the predominant majority of the world is conversant in bitcoin, however few perceive the unconventional idea of absolute shortage. With every halving, the media protection is bigger and extra important.

Bitcoin stands alone with its algorithmic and stuck financial coverage in a world of arbitrary, bureaucratic fiscal coverage gone astray and a by no means ending stream of debt monetization insurance policies.

The 2024 halving, lower than 52,000 bitcoin blocks away, will once more reinforce the narrative of provide inelasticity, whereas an awesome majority of the circulating provide is held by holders who’re completely disinterested in parting with their share.

Last Word:

Regardless of the halving’s lessening impact in relative phrases after every cycle, the upcoming occasion will function a actuality verify for the market, notably for many who start to really feel that they’ve inadequate publicity to the asset. Because the programmatic financial coverage of Bitcoin continues to work precisely as designed, roughly 92% of the terminal provide is already in circulation, and the graduation of yet one more provide issuance halving occasion will solely reinforce the narrative of apolitical cash and bitcoin’s distinctive digital shortage will come into focus extra sharply.

That concludes the excerpt from a current version of Bitcoin Journal PRO. Subscribe now to obtain PRO articles immediately in your inbox.