Welcome to half two of this sequence on Bitcoin and nuclear power. Allow us to recap what we went by way of partly one earlier than we dive deeper into the matters we’ll cowl partly two.

Key Takeaways From “Why Bitcoin Is The Future Of Our Power Grid”

- Bitcoin has nice utility and is essential for people. Not everybody might use or recognize its utility in the present day, which is ok, however that doesn’t imply it holds no utility to others. At the moment, near $400 billion of the world’s wealth is saved in it, that’s loads of financial power to ignore.

- Bitcoin makes use of solely about 0.1% of world power. Present power utilization is between 100 to 200 terawatt hours (TWh) per 12 months and per the projections shared partly one, Bitcoin’s power utilization will at all times be a rounding error almost about world power consumption. It could most certainly be sub-1% for a very long time to return.

- Bitcoin, in truth, might use too little power for the worth it could retailer sooner or later. Contemplating that Bitcoin probably grows over this coming decade and will retailer $20 trillion of world’s wealth, possibly even $50 trillion or $100 trillion, that’s loads of financial power to be secured safely and guarded. We should always make investments and use extra power to guard the community than we do at present.

- Bitcoin miners are extremely cell, search for the most cost effective and lowest price power to mine and don’t compete with different industries or your private use for power.

- Power utilization is an efficient factor. You need to dwell in a spot the place there’s a good quantity of power obtainable to make use of and luxuriate in, fairly than too little. We have to use and harness extra power to develop into a Kardashev Sort-I civilization which can take a long time.

Nuclear crops have at all times fascinated folks through the years however only a few common folks to this point truly perceive the economics behind establishing a nuclear energy plant at scale. At the moment we deconstruct this very subject and in a enjoyable and revolutionary approach.

Because the trade saying goes, “There are solely two issues that matter in building of a nuclear energy plant — capital price and the prices of capital”

A Story That Begins In 2009

All good tales want to start out from the very starting. Why ought to we do it any in a different way? So right here we go.

The 12 months is 2009. There are two nuclear reactor expertise firms available in the market competing to convey their expertise on-line, deploy reactors and promote electrical energy. We’ll name these firms Alpha Labs and Beta Labs.

Each firms are at present of their R&D phases and going by way of their conceptual design for the reactor deployment. The following six or so years could be grueling. Each of those firms will undergo in depth R&D, engineering resolution making processes, provider and vendor choices, element testing, {hardware} testing, conceptual design opinions and iterations and an intensive licensing assessment by the Nuclear Regulatory Fee (NRC) earlier than they get a building allow for constructing a nuclear reactor web site. This era will likely be crammed with challenges, each technological and in any other case. Like engaged on any deep expertise, there are at all times issues that want detailed design and engineering to be labored by way of and iterated upon earlier than you’re able to convey that expertise to actuality. The nuclear sector is not any totally different.

Nonetheless, one other factor occurred round 2009: the invention or discovery of Bitcoin. Within the preliminary years nobody took any discover, no less than not within the nuclear trade, since they have been fairly occupied of their expertise work and Bitcoin was solely heard about or actually discovered within the weeds of the web. And who was actually busy trying to find that in these days? However this modified. In 2012, one engineer working at Alpha Labs found Bitcoin by probability, going by way of a Reddit weblog publish. This engineer was intrigued and began wanting into it extra. Being from an engineering background with deep expertise in power markets, he began fascinated with bitcoin as a commodity with a manufacturing price related to it like some other commodity. He found proof-of-work mining. This led him down a rabbit gap which modified the very nature of Alpha Labs’ historical past and, extra importantly, the way forward for nuclear power, energy markets, the power grid and humanity endlessly. That is the story of that one engineer.

The engineer began with mining bitcoin at his dwelling at first. He figured there was no higher approach of studying about mining than to do it himself and be within the trenches. The 12 months was now 2013 and he had been mining for a great six months and had developed deep fascinated with mining. He quickly realized the repercussions of this innovation, how mining could possibly be used to monetize power that might in any other case by no means be monetized. Bitcoin mining gives a purchaser of first resort for any power that’s low price — wasted, stranded, curtailed, surplus or underutilized. The engineer realized this. He was approach approach forward of his time, the world wouldn’t work out the profoundness of this innovation till about 2030.

The engineer, having realized this in 2013, began pitching the thought of a co-location bitcoin mining web site on the nuclear island that Alpha Labs was designing for its first web site. He acquired extreme pushback at first since nobody was conscious of Bitcoin, a lot much less of bitcoin mining. However he was persistent and didn’t hand over.

Bitcoin had additionally began to get into the mainstream information due to a worth surge, then a subsequent crash as a result of Mt. Gox debacle, and extra folks have been no less than changing into conscious of it. He began giving talks and shows to the chief crew and orange pilled a couple of of them. After six months of thorough design and engineering work in early 2014, Alpha Labs introduced its plan to co-locate a bitcoin mining heart on its nuclear island web site, which was supposed to start building in 2016.

The engineer obtained switched to a newly-created bitcoin mining division inside the corporate and began main that group. Over the subsequent 12 months, the crew labored by way of the main points of the construct out and built-in the mining heart co-location design into its nuclear island design. Alpha Labs went with a highly-mobile building design for its mining heart, in order that in case it needed to transfer or shift the mining heart elsewhere it could be comparatively straightforward to do, plus this restricted its threat of proudly owning an asset which can’t be moved if the circumstances demanded it. It realized the footprint that the mining heart took as a part of the nuclear island itself was not substantial and didn’t have a big impact (enhance) to the dimensions of land it could must get to construct the location.

Alpha Labs acquired the allow approval for building of Alpha-1, its flagship nuclear plant with the bitcoin mining co-location within the second half of 2016. It was now prepared for building.

All this was taking place whereas Beta Labs was itself busy creating its personal expertise for the nuclear reactor and making superb progress. It had gone by way of the design course of, accomplished its complete {hardware} and element testing by 2014 and had itself been protecting engagements with the NRC across the licensing piece as early as 2012. Beta Labs went with a conventional nuclear plant with no bitcoin mining co-location, because it was not offered on the thought of this innovation by anybody specific, despite the fact that it had heard in regards to the announcement of Alpha Labs within the early a part of 2014.

It had held some preliminary discussions to grasp Alpha Labs’ resolution making however determined towards pursuing the same technique, partly as a result of truth that there have been no sources out within the public markets to information it across the use case for bitcoin mining colocation with its reactor construct out. Beta Labs itself acquired its allow approval for building within the second half of 2016 and was prepared for its personal construct out.

Each Alpha Labs and Beta Labs have been pursuing a nuclear plant building of 1 gigawatt electrical (GWe) (or 2.5 gigawatt thermal (GWth), with 40% effectivity) capability from the very early days. In 2014, Alpha Labs shifted observe and introduced a 2 GWe (or 5 GWth, 40% effectivity) reactor deployment and building plan, with 1GWe for use for promoting electrical energy to the grid whereas the steadiness of 1GWe was for use solely for mining bitcoin onsite.

So, to recap, right here is the development plan for each firms:

Alpha Labs: 2 GWe cap., 1 GWe promote to grid wholesale, 1 GWe to mine bitcoin onsite

Beta Labs: 1 GWe cap., 1 GWe to promote to grid wholesale

Economics Of Nuclear Energy Crops

We’re within the second half of 2016 now. Each Alpha and Beta Labs have introduced their nuclear energy crops (NPPs) constructions and are actively trying to increase capital.

NPP financing can take many alternative, unique types and preparations. The construction of financing for NPPs is just not a part of the scope for this text. Right here we might assume that each Alpha Labs and Beta Labs get funding on equal phrases for his or her building crops, in order to do an “apples-to-apples” projection of their capital prices, income and income/losses.

Assumptions

- Allow us to assume that NPP building for each firms will take six years to finish. So, from 2016 to 2022. That is according to building occasions of most NPPs to this point.

- Allow us to assume that the capital prices for NPP building for each firms are $5,000 per kilowatt (kW). This ballpark estimate is according to the development prices of NPPs to this point.

Based mostly on this quantity, listed here are the capital necessities for each firms:

Alpha Labs: $5,000 * 2 Gw/Kw = $10 billion

Beta Labs: $5,000 * 1 Gw/Kw = $5 billion

Now, take into account that Alpha Labs would additionally require capital to purchase miners and deploy them onsite at its co-located mining heart. However this may solely be required when it is able to produce electrical energy, which might not occur till 2022. So, it decides to get a better restrict of capital line which they’ll draw upon when wanted six years down the road. At this level in 2016, bitcoin ASICs have been going mainstream, new and extra environment friendly machines have been anticipated to return to market over the approaching years, which Alpha Labs was protecting a observe of. It was nonetheless fairly a couple of years away from inserting orders for miners, that will eat 1 GWe of nuclear technology, so the one factor to do proper then was to trace the mining trade and see it evolve.

Listed below are the funding phrases acquired by each firms:

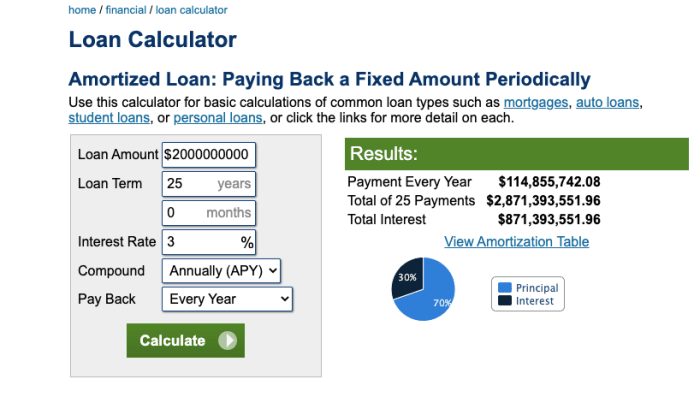

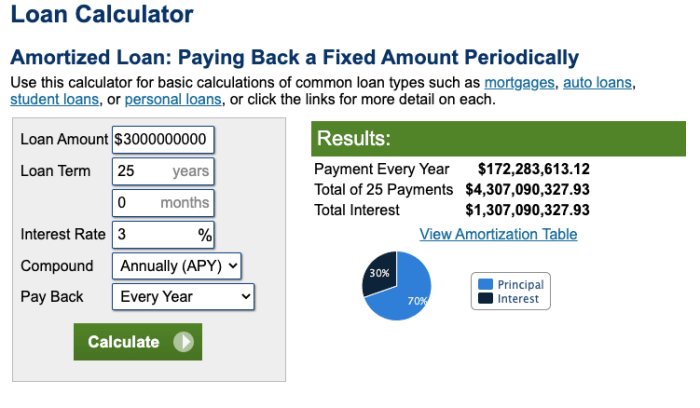

Alpha Labs: $10 billion at 3% curiosity, with a debt service interval of 25 years. The capital line could be prolonged as much as $15 billion on the identical phrases if wanted sooner or later. Alpha Labs would draw $2 billion in annually for the primary 5 years of NPP building.

Beta Labs: $5 billion at 3% curiosity, with a debt service interval of 25 years. Beta Labs would draw $1 billion in annually for the primary 5 years of NPP building.

Now, primarily based on the phrases, Beta Labs would want to pay about $57 million yearly for the subsequent 25 years for each $1 billion it drew from its capital line in the course of the first 5 years of building.

And, on comparable strains, Alpha Labs would want to pay about $114 million yearly for the subsequent 25 years for each $2 billion it drew from its capital line in the course of the first 5 years of building.

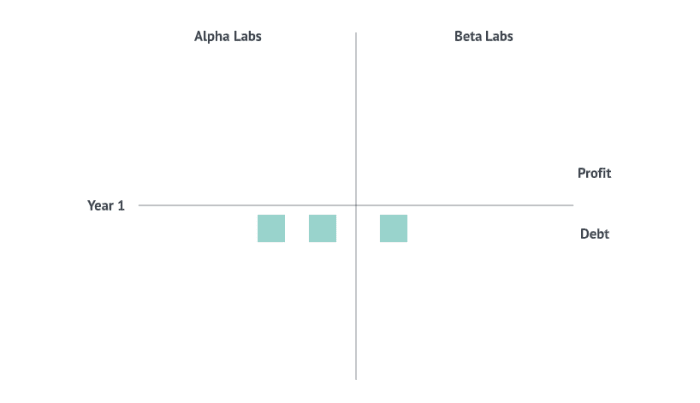

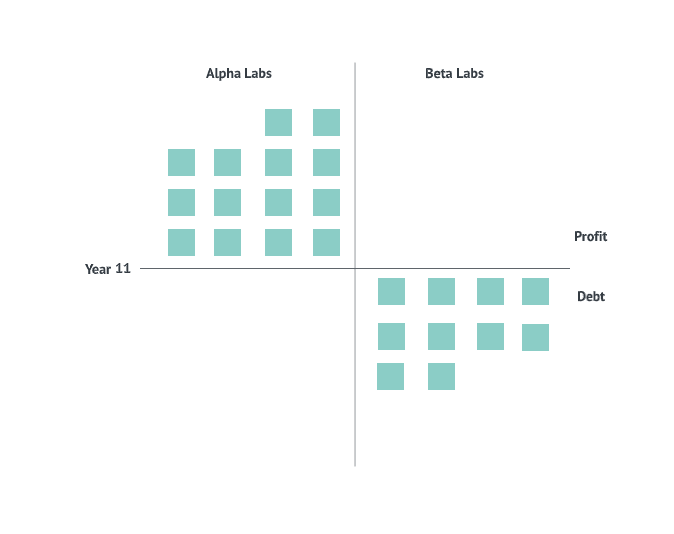

Now, we’ll use blocks of capital to signify the economics of each Alpha Labs and Beta Labs over the subsequent a few years in order to check what their money owed and income would appear to be.

Allow us to assume about $57 million is one block. We’ll signify this as a inexperienced block on the graph going ahead.

So, it’s mid-2016 and each NPP constructions are about to start.

12 months One: 2016

Beta Labs: Takes out its first $1 billion in capital to start building. Based mostly on this, it could must pay one block of debt, which is added to its steadiness sheet beneath.

Complete capital drawn: $1 billion

Complete debt: One block

Alpha Labs: Takes out its first $2 billion in capital to start building. Based mostly on this, it could must pay two blocks of debt, which is added to its steadiness sheet beneath.

Complete capital drawn: $2 billion

Complete debt: Two blocks

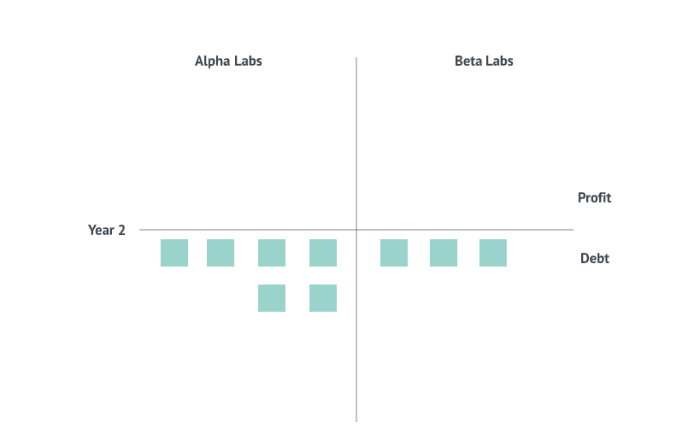

12 months Two: 2017

Beta Labs: Takes out one other $1 billion in capital. Based mostly on this, it could must pay two extra blocks of debt in 12 months two, which is added to its steadiness sheet beneath.

Complete capital drawn: $2 billion

Complete debt: Three blocks

Alpha Labs: Takes out one other $2 billion in capital. Based mostly on this, it could must pay 4 extra blocks of debt in 12 months two which is added to its steadiness sheet beneath.

Complete capital drawn: $ 4 billion

Complete debt: Six blocks

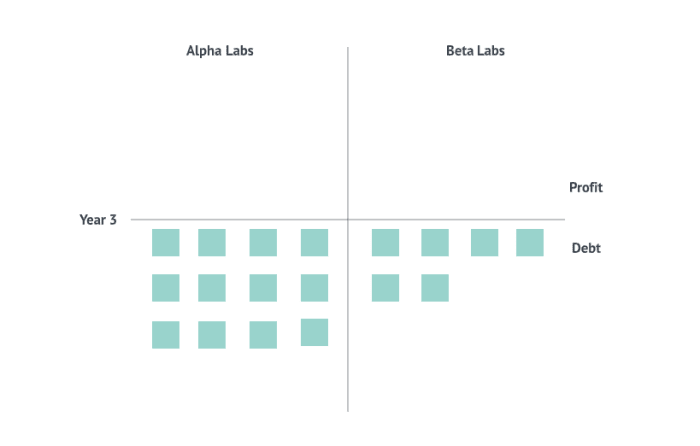

12 months Three: 2018

Beta Labs: Takes out one other $1 billion in capital. Based mostly on this, it could must pay three extra blocks of debt in 12 months three, which is added to its steadiness sheet beneath.

Complete capital drawn: $3 billion

Complete debt: Six blocks

Alpha Labs: Takes out one other $2 billion in capital. Based mostly on this, it could must pay six extra blocks of debt in 12 months three which is added to its steadiness sheet beneath.

Complete capital drawn: $6 billion

Complete debt: 12 blocks

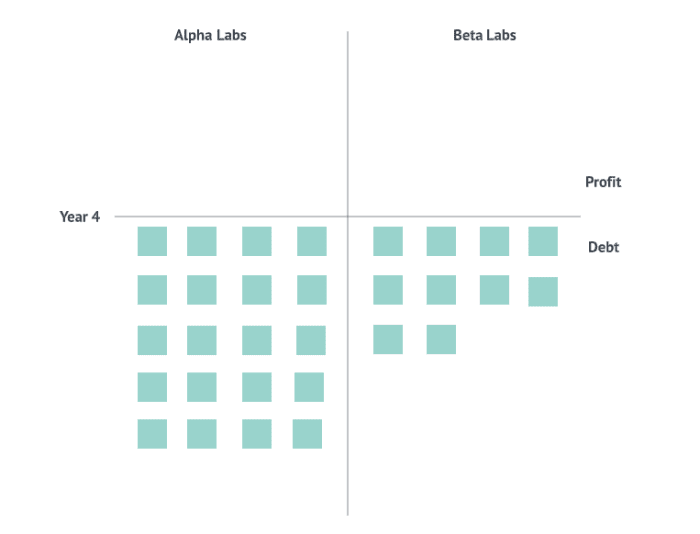

12 months 4: 2019

Beta Labs: Takes out one other $1 billion in capital. Based mostly on this they would want to pay 4 extra blocks of debt in 12 months 4, which is added to its steadiness sheet beneath.

Complete capital drawn: $4 billion

Complete debt: 10 blocks

Alpha Labs: Takes out one other $2 billion in capital. Based mostly on this, it could must pay eight extra blocks of debt in 12 months 4 which is added to their steadiness sheet beneath.

Complete capital drawn: $8 billion

Complete debt: 20 blocks

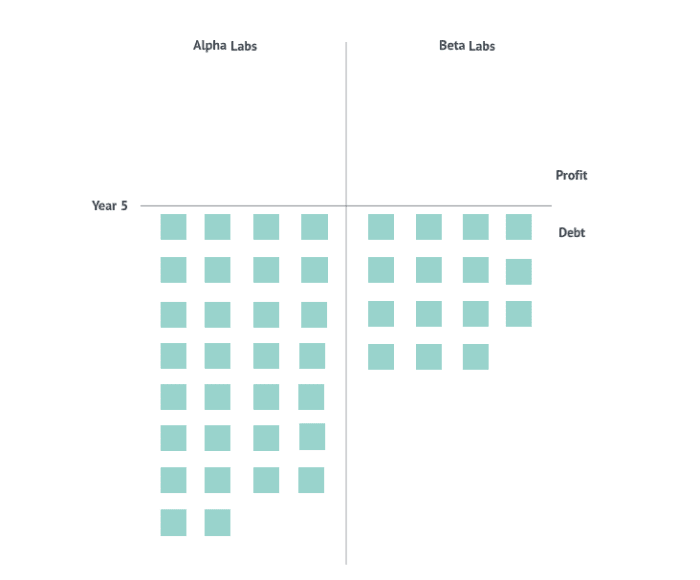

12 months 5: 2020

Beta Labs: Takes out one other $1 billion in capital. Based mostly on this, it could must pay 5 extra blocks of debt in 12 months 5 which is added to their steadiness sheet beneath.

Complete capital drawn: $5 billion

Complete debt: 15 blocks

Alpha Labs: Takes out one other $2 billion in capital. Based mostly on this, it could must pay 10 extra blocks of debt in 12 months 5 which is added to its steadiness sheet beneath.

Complete capital drawn: $10 billion

Complete debt: 30 blocks

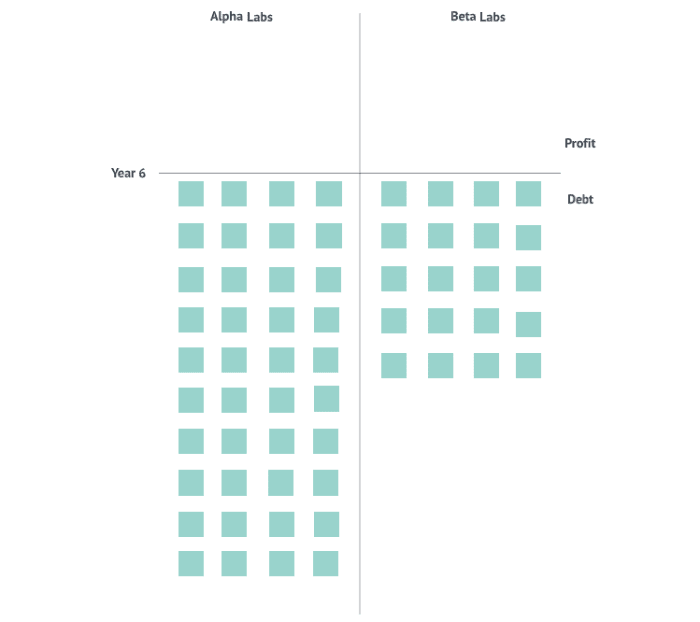

12 months Six: 2021

Beta Labs: No extra capital. So, it could must proceed paying 5 extra blocks of debt in 12 months six which is added to its steadiness sheet beneath.

Complete capital drawn: $5 billion

Complete debt: 20 blocks

Alpha Labs: No extra capital. So, it could must proceed paying 10 extra blocks of debt in 12 months six which is added to its steadiness sheet beneath.

Complete capital drawn: $10 billion

Complete debt: 40 blocks

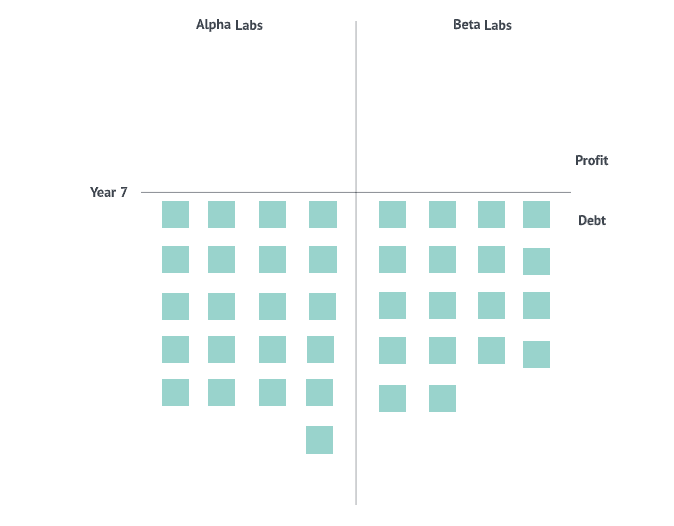

12 months Seven: 2022

That is the place issues get fascinating now. Each Alpha Labs and Beta Labs have accomplished their NPP constructions and at the moment are prepared to supply electrical energy. At this level, each firms’ steadiness sheets don’t have anything however a large compilation of debt obligations primarily based on the quantity of capital they’ve taken out for his or her respective constructions.

Assumptions

- Allow us to assume that the all in income from promoting 1 GWe electrical energy per 12 months within the wholesale energy markets is about $525 million with a clearing worth of 6 cents per kWh. This implies, primarily based on our block mannequin, that each Alpha Labs and Beta Labs would make about 9 blocks of income annually going ahead from promoting electrical energy. We might assume that each firms will run their NPPs at full energy or capability issue of 100%.

- Allow us to assume that the working price of working the NPP per 12 months is about $100 million per GWe. This contains the yearly gasoline price and variable operations and upkeep. This implies, primarily based on our block mannequin, that each Beta Labs would spend about blocks in overlaying working bills yearly going ahead whereas Alpha Labs would spend about 4 blocks in overlaying working bills yearly going ahead.

Assumptions And Estimates For Bitcoin Mining

- Mining numbers and profitability evaluation was finished on June 18, 2022 for this text, when the bitcoin worth was about $20,000, community issue was 30 T and the community hash fee (30 days) was 215 exahashes per second (EH/s). The mining income projections have in mind the halving in 2024 and take an assumption that each bitcoin worth and issue would enhance 50% on common yearly for the subsequent 5 years.

- Allow us to assume that Alpha Labs is ready to safe latest-generation ASIC miners at the price of about $10,000 every for his or her 1GWe mining colocation heart. Based mostly on the typical energy draw from a single miner, Alpha Labs would want round 300,000 miners. The full capital price for this aspect of the operation could be about $3 billion which it could draw from its current capital line on the identical phrases as earlier than. Because of this they would want to pay an extra debt of about $172 million (or the equal of three blocks) yearly going ahead for this new capital draw.

- Allow us to assume that the mining {hardware} would have a lifetime of 5 years.

- Allow us to assume that Alpha Labs retains no bitcoin on its steadiness sheet from this train and subsequently converts all mining income into USD.

- Allow us to run some mining profitability numbers utilizing Braiins OS to get a projection of how a lot income Alpha Labs would make over the subsequent 5 years of mining with this mining gear:

- Listed below are the mining income outcomes that Alpha Labs would make annually:

- 12 months seven: $1.5 billion or about 27 blocks

- 12 months eight: $1.6 billion or about 29 blocks

- 12 months 9: $970 mil or about 17 blocks

- 12 months 10: $1.1 billion or about 19 blocks

- 12 months 11: $1.25 billion or about 22 blocks

Now, allow us to proceed with our block evaluation of each firms’ steadiness sheet.

Beta Labs: 20 blocks in debt already, 5 extra blocks in debt for 12 months seven, two blocks in working bills, 9 blocks in 1GWe to grid income

Yearly revenue and loss = 9 blocks – (5 blocks + 2 blocks) = 2 blocks

Complete debt = 20 blocks – 2 blocks = 18 blocks

Alpha Labs: 40 blocks in debt already, 10 extra blocks in current debt for 12 months seven, three extra blocks in miner debt taken for 12 months seven, 4 blocks in working bills, 9 blocks in 1 GWe to grid income, 27 blocks in 1 GWe mining income

Yearly revenue and loss = (9 blocks + 27 blocks) – (10 blocks + 3 blocks + 4 blocks) = 19 blocks

Complete debt = 40 blocks – 19 blocks = 21 blocks

As now you can see, Alpha Labs is transferring up from the trenches of debt assortment a lot faster than Beta Labs, which might take a very long time to show worthwhile.

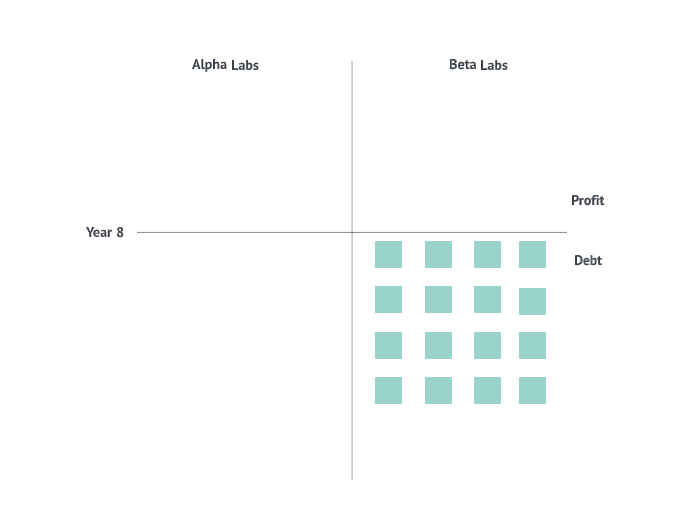

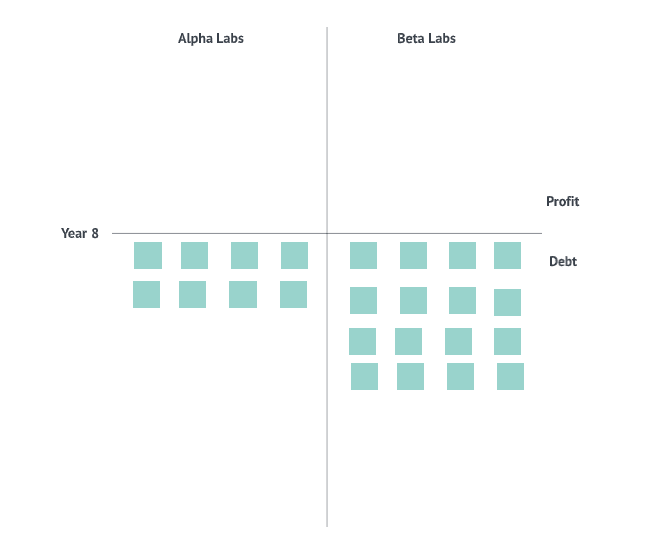

12 months Eight: 2023

Beta Labs: 18 blocks in debt already, 5 extra blocks in debt for 12 months eight, two blocks in working bills, 9 blocks in 1 GWe to grid income

Yearly income and losses = 9 blocks – (5 blocks + 2 blocks) = 2 blocks

Complete debt = 18 blocks – 2 blocks = 16 blocks

Alpha Labs: 21 blocks in debt already, 10 extra blocks in current debt for 12 months eight, three extra blocks in miner debt taken for 12 months eight, 4 blocks in working bills, 9 blocks in 1 GWe to grid income, 29 blocks in 1 GWe mining income

Yearly income and losses = (9 blocks + 29 blocks) – (10 blocks + 3 blocks + 4 blocks) = 21 blocks

Complete debt = 21 blocks – 21 blocks = 0 blocks

Alpha Labs has damaged even in 12 months eight in simply its second 12 months of NPP operation whereas Beta Labs nonetheless has 16 blocks in debt remaining on their steadiness sheet. The distinction on the steadiness sheets between the businesses has all of a sudden develop into astonishingly extensive. Alpha Labs has been in a position to wipe off 40 blocks of debt over simply two years of operation.

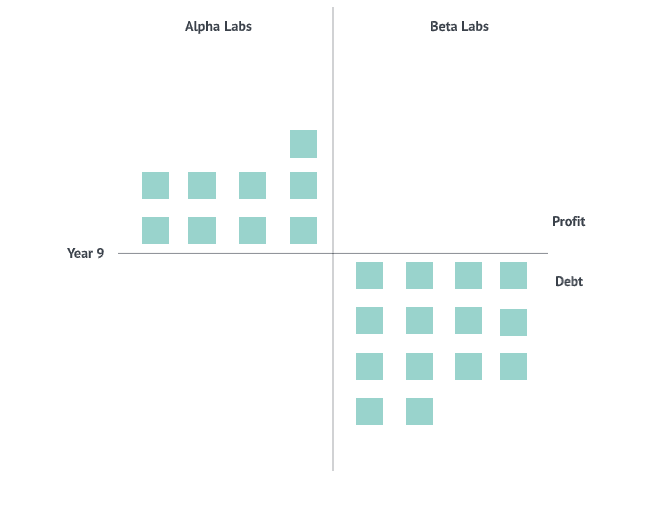

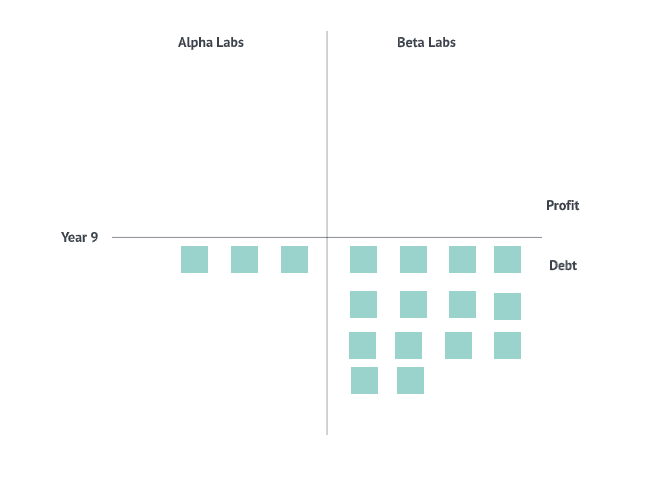

12 months 9: 2024

Beta Labs: 16 blocks in debt already, 5 extra blocks in debt for 12 months 9, two blocks in working bills, 9 blocks in 1GWe to grid income

Yearly income and losses = 9 blocks – (5 blocks + 2 blocks) = 2 blocks

Complete debt = 16 blocks – 2 blocks = 14 blocks

Alpha Labs: Zero blocks in debt already, 10 extra blocks in current debt for 12 months 9, three extra blocks in miner debt taken for 12 months 9, 4 blocks in working bills, 9 blocks in 1 GWe to grid income, 17 blocks in 1 GWe mining income

Yearly income and losses = (9 blocks + 17 blocks) – (10 blocks + 3 blocks + 4 blocks) = 9 blocks

Complete Revenue = 9 blocks – 0 blocks = 9 blocks

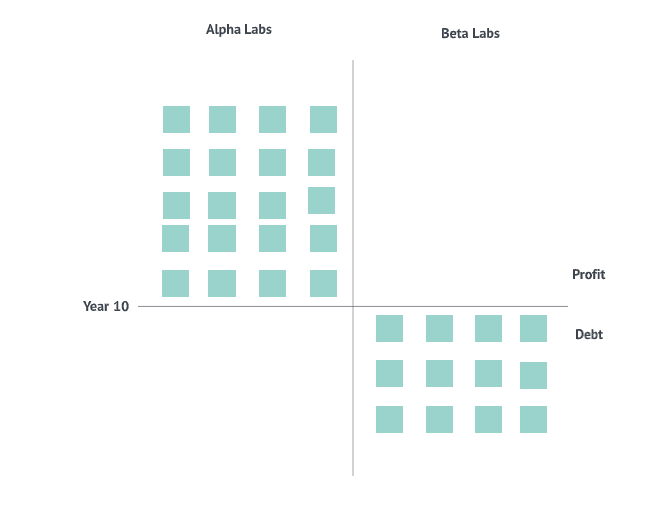

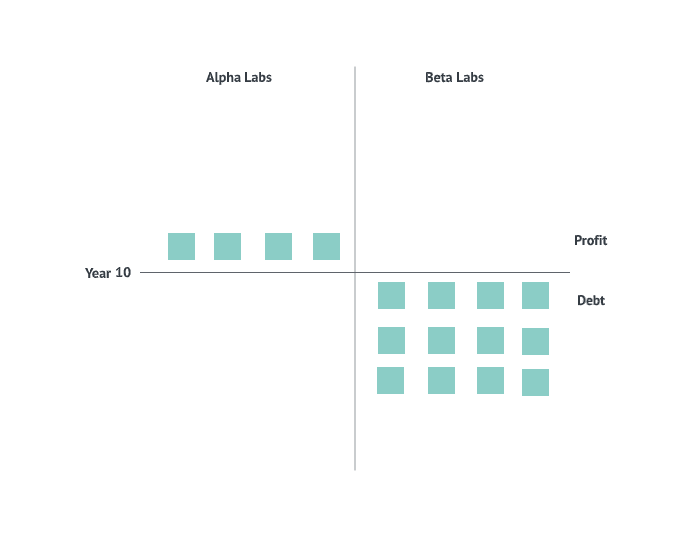

12 months 10: 2025

Beta Labs: 14 blocks in debt already, 5 extra blocks in debt for 12 months 10, two blocks in working bills, 9 blocks in 1 GWe to grid income

Yearly income and losses = 9 blocks – (5 blocks + 2 blocks) = 2 blocks

Complete debt = 14 blocks – 2 blocks = 12 blocks

Alpha Labs: 9 blocks in revenue already, 10 extra blocks in current debt for 12 months 10, three extra blocks in miner debt taken for 12 months 10, 4 blocks in working bills, 9 blocks in 1 GWe to grid income, 19 blocks in 1 GWe mining income

Yearly income and losses = (9 blocks + 19 blocks) – (10 blocks + 3 blocks + 4 blocks) = 11 blocks

Complete Revenue = 9 blocks + 11 blocks = 20 blocks

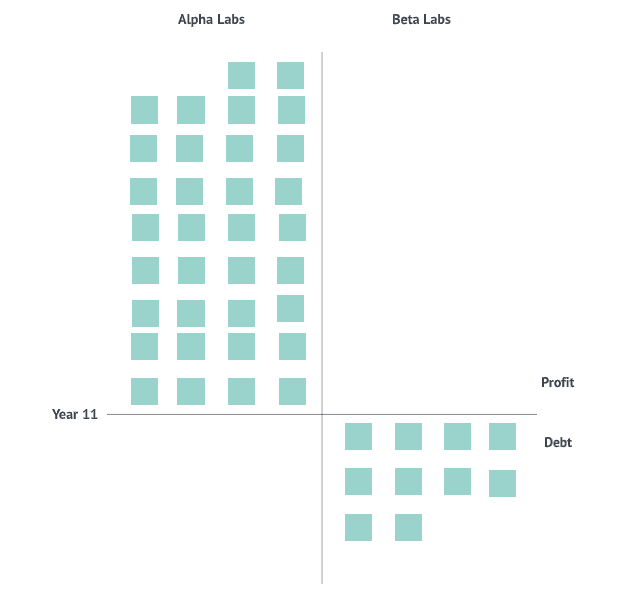

12 months 11: 2026

Beta Labs: 12 blocks in debt already, 5 extra blocks in debt for 12 months 11, two blocks in working bills, 9 blocks in 1 GWe to grid income

Yearly income and losses = 9 blocks – (5 blocks + 2 blocks) = 2 blocks

Complete debt = 12 blocks – 2 blocks = 10 blocks

Alpha Labs: 20 blocks in revenue already, 10 extra blocks in current debt for 12 months 11, three extra blocks in miner debt taken for 12 months 11, 4 blocks in working bills, 9 blocks in 1 GWe to grid income, 22 blocks in 1GWe mining income

Yearly income and losses = (9 blocks + 22 blocks) – (10 blocks + 3 blocks + 4 blocks) = 14 blocks

Complete Revenue = 20 blocks + 14 blocks = 34 blocks

As now you can see very clearly, it could take Beta Labs round 16 years to interrupt even (round 2031) whereas Alpha Labs broke even in solely its second 12 months of operation (in 2023) and 12 months eight from the beginning of NPP building in 2016.

Co-location of a bitcoin mining heart onsite was actually a game-changing resolution for Alpha Labs, because of that one visionary engineer who has now been promoted to the chief crew. Effectively deserved certainly.

As we get to see from this case research, co-location of bitcoin mining onsite on the NPP improves each the mission income and pay again interval, which makes the funding capital extra enticing. Might bitcoin mining truly assist push nuclear energy into the mainstream once more? One thing to consider.

Close to-Free Electrical energy: A Thought Experiment

Now, how about we perform a little thought experiment and see if Alpha Labs can promote its 1 GWe electrical energy to the grid at half the worth it was promoting within the case research earlier than. How would its steadiness sheet look on this case?

Till 12 months six, there could be no distinction, as NPPs are simply ending building, so we’ll decide up from 12 months seven onwards. Right here’s how each firms’ steadiness sheets appear to be on the finish of 12 months six:

12 months Seven: 2022

That is the place issues get actually fascinating once more. Each Alpha Labs and Beta Labs have accomplished their NPP constructions and at the moment are prepared to supply electrical energy.

All of our assumptions from the earlier case research stay legitimate for this thought experiment. The one distinction is that Alpha Labs is monetizing 1 GWe of its electrical energy technology by mining bitcoin the very same approach whereas its 1 GWe portion which it was beforehand promoting to the grid for about $525 million or 9 blocks of income is now making them half, so about $267 million or 5 blocks of income. This may imply promoting at a clearing worth of three cents per kWh as an alternative of 6 cents per kWh.

Beta Labs: 20 blocks in debt already, 5 extra blocks in debt for 12 months seven, two blocks in working bills, 9 blocks in 1 GWe to grid income

Yearly income and losses = 9 blocks – (5 blocks + 2 blocks) = 2 blocks

Complete debt = 20 blocks – 2 blocks = 18 blocks

Alpha Labs: 40 blocks in debt already, 10 extra blocks in current debt for 12 months seven, three extra blocks in miner debt taken for 12 months seven, 4 blocks in working bills, 5 blocks in 1 GWe to grid income, 27 blocks in 1 GWe mining income

Yearly income and losses = (27 blocks + 5 blocks) – (10 blocks + 3 blocks + 4 blocks) = 15 blocks

Complete debt = 40 blocks – 15 blocks = 25 blocks

12 months Eight: 2023

Beta Labs: 18 blocks in debt already, 5 extra blocks in debt for 12 months eight, two blocks in working bills, 9 blocks in 1 GWe to grid income

Yearly income and losses = 9 blocks – (5 blocks + 2 blocks) = 2 blocks

Complete debt = 18 blocks – 2 blocks = 16 blocks

Alpha Labs: 30 blocks in debt already, 10 extra blocks in current debt for 12 months eight, three extra blocks in miner debt taken for 12 months eight, 4 blocks in working bills, 5 blocks in 1 GWe to grid income, 29 blocks in 1 GWe mining income

Yearly income and losses = (29 blocks + 5 blocks) – (10 blocks + 3 blocks + 4 blocks) = 17 blocks

Complete debt = 25 blocks – 17 blocks = 8 blocks

12 months 9: 2024

Beta Labs: 16 blocks in debt already, 5 extra blocks in debt for 12 months 9, two blocks in working bills, 9 blocks in 1 GWe to grid income

Yearly income and losses = 9 blocks – (5 blocks + 2 blocks) = 2 blocks

Complete debt = 16 blocks – 2 blocks = 14 blocks

Alpha Labs: 18 blocks in debt already, 10 extra blocks in current debt for 12 months 9, three extra blocks in miner debt taken for 12 months 9, 4 blocks in working bills, 5 blocks in 1 GWe to grid income, 17 blocks in 1 GWe mining income

Yearly income and losses = (17 blocks + 5 blocks) – (10 blocks + 3 blocks + 4 blocks) = 5 blocks

Complete Debt = 8 blocks – 5 blocks = 3 blocks

12 months 10: 2025

Beta Labs: 16 blocks in debt already, 5 extra blocks in debt for 12 months 9, two blocks in working bills, 9 blocks in 1 GWe to grid income

Yearly income and losses = 9 blocks – (5 blocks + 2 blocks) = 2 blocks

Complete debt = 14 blocks – 2 blocks = 12 blocks

Alpha Labs: 18 blocks in debt already, 10 extra blocks in current debt for 12 months 9, three extra blocks in miner debt taken for 12 months 9, 4 blocks in working bills, 5 blocks in 1GWe to grid income, 19 blocks in 1 GWe mining income

Yearly income and losses = (19 blocks + 5 blocks) – (10 blocks + 3 blocks + 4 blocks) = 7 blocks

Complete revenue = 7 blocks – 3 blocks = 4 blocks

Alpha Labs has damaged even in 12 months 10 on this case as an alternative of 12 months eight, or 4 years after starting operation. Nonetheless fairly superb contemplating Beta Labs wouldn’t flip revenue till 12 months 16 and Alpha Labs is promoting 1 GWe electrical energy at half worth in comparison with them.

12 months 11: 2026

Beta Labs: 16 blocks in debt already, 5 extra blocks in debt for 12 months 9, two blocks in working bills, 9 blocks in 1 GWe to grid income

Yearly income and losses = 9 blocks – (5 blocks + 2 blocks) = 2 blocks

Complete debt = 12 blocks – 2 blocks = 10 blocks

Alpha Labs: 18 blocks in debt already, 10 extra blocks in current debt for 12 months 9, three extra blocks in miner debt taken for 12 months 9, 4 blocks in working bills, 5 blocks in 1 GWe to grid income, 22 blocks in 1GWe mining income

Yearly income and losses = (22 blocks + 5 blocks) – (10 blocks + 3 blocks + 4 blocks) = 10 blocks

Complete revenue = 4 blocks + 10 blocks = 14 blocks

Co-location of a bitcoin mining heart onsite was actually a game-changing resolution for Alpha Labs and even when it offered their electrical energy at half worth in comparison with Beta Labs, it’s significantly extra worthwhile in comparison with that operation at this stage.

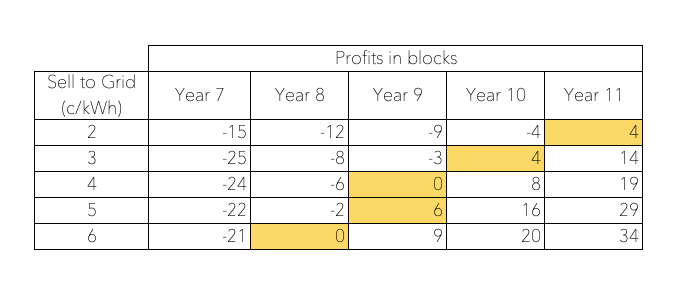

Here’s a sensitivity evaluation on the clearing worth of electrical energy offered by Alpha Labs and its steadiness sheet primarily based off of block increments:

As you may see from the desk above, in all circumstances as much as 2 cents per kWh, Alpha Labs would flip a revenue by 12 months 11 (all highlighted in yellow).

Having labored by way of the maths on each Alpha and Beta Labs’ steadiness sheets, listed here are some essential issues to level out and bear in mind:

- Elevating north of $10 billion at 3% curiosity with the phrases outlined on this article for establishing NPPs with bitcoin mining co-location (two closely misunderstood industries) is not any straightforward process in in the present day’s surroundings. NPP constructions are very delicate to the capital price and value of capital and it’s crucial to get the very best phrases to construct NPPs with mining colocation for long-term profitability.

- NPP constructions can take a very long time, round six years for full building, assuming there are not any delays brought on as a consequence of a number of attainable causes, together with public outcry and protests. In comparison with this, a pure fuel energy plant will be up and working in about two years. NPPs are pricey to assemble and extremely low cost to function whereas the pure fuel energy crops are the opposite approach round. Given how cyclical and evolving the mining trade is and the way aggressive it may develop into over time, it’s tough to mission mining revenues six years down the road with any given certainty for elevating capital and constructing capability enlargement upfront for mining onsite.

- Bitcoin mining goes to develop into extremely price aggressive over time and revenues are going to shrink to the purpose the place working massive mining facilities would solely be attainable behind the meter in some kind. Nuclear supplies the very best case base load for constructing mining facilities for twenty-four/7 dependable power and no tie in to the grid is required. Even if you’re co-locating your mining heart with photo voltaic or wind, you’ll want some tie in to the grid, since photo voltaic and wind are each intermittent sources of technology, in contrast to nuclear.

- NPP building prices and timelines would possibly each go down significantly with the arrival of modular reactors and subsequent technology reactor varieties which don’t require design and supplies of the previous, which had led to price and building occasions each ballooning beforehand.

- The NPP and bitcoin mining mannequin of electrical energy technology could possibly be adopted by nation states at scale as a matter of power and nationwide safety. These initiatives may obtain state funding and subsidies/credit to make them much more enticing for funding capital.

The intention of this text was to supply an intensive case research on what bitcoin mining co-location with a nuclear energy plant building may appear to be and the way a lot of a distinction it may truly make to the steadiness sheet of the corporate proudly owning that technology asset. As we see, you’d fairly take the technique of Alpha Labs than Beta Labs. All you want is one engineer in your organization to grasp this and pitch it to you.

References

Disclaimer: The data offered on this article relies upon our forecasts and displays prevailing market situations and our views as of this date, all of that are topic to alter. The article comprises forward-looking projections which contain dangers and uncertainties. Any statements made within the article are primarily based on the authors’ present data and assumptions. Numerous elements may trigger precise future outcomes, efficiency or occasions to vary materially from these described in these statements.

This can be a visitor publish by Puru Goyal and Tina Stoddard. Opinions expressed are fully their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.