BNB is presently displaying bearish indicators that counsel a attainable continuation of the continuing downtrend, surpassing the expectations of many traders.

Regardless of preliminary hopes for a swift restoration, the persistence of those bearish indicators compels traders to discover the implications and brace for the opportunity of a extra extended downturn, frightening additional scrutiny of the way forward for BNB and its influence on the broader cryptocurrency ecosystem.

However what precisely are these alerts telling us about the way forward for BNB?

BNB Current Downturn Coincides With Surge In Buying and selling Quantity

In keeping with a current tweet by Santiment, BNB has skilled a notable downturn of -15% since June 4. The decline in BNB’s worth coincided with a surge in its buying and selling quantity, reaching a degree not seen previously 5 weeks.

📉 #BinanceCoin has been hammered in comparison with the remainder of the markets these previous couple days. Now -15% since Sunday, social dominance has surged because the asset has turn into fairly polarizing. $BNB buying and selling quantity is at 5-week excessive ranges as effectively. https://t.co/E7sU59lkRe pic.twitter.com/FL0Er5vmQa

— Santiment (@santimentfeed) June 7, 2023

This enhance in buying and selling exercise means that market contributors are actively participating with BNB throughout its worth decline, presumably searching for shopping for alternatives or adjusting their positions in response to the market motion.

The upper buying and selling quantity signifies heightened market curiosity and the potential for elevated worth volatility as traders carefully monitor BNB’s efficiency.

BNB market cap presently at $40.5 billion. Chart: TradingView.com

This confluence of things, with BNB experiencing a big lower in worth alongside a surge in buying and selling quantity, presents a dynamic and evolving state of affairs for merchants and traders, warranting cautious consideration and evaluation of the underlying market dynamics.

Amidst the volatility of the cryptocurrency market, BNB’s worth on CoinGecko stands at $260.59, reflecting a mere 0.8% drop previously 24 hours. Nonetheless, a extra regarding pattern emerges once we take into account its seven-day decline, which quantities to a big 15.1%.

Supply: Coingecko

Open Curiosity Up, Whale Transactions Down

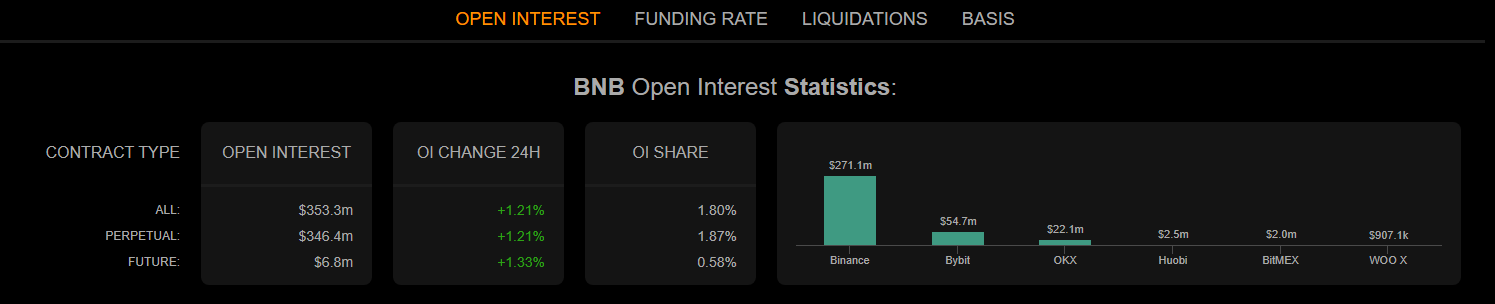

Including to the prevailing bearish sentiment surrounding BNB, its chart evaluation reveals further causes for concern. Notably, BNB’s open curiosity has gained upward momentum, indicating an inflow of latest or further capital coming into the market.

This enhance in open curiosity means that the present market pattern might persist for an extended interval, with none imminent reversal.

Supply: Coinalyze

Nonetheless, a bearish indication got here from the Market Worth Realized Worth (MVRV) Ratio, which confirmed a substantial lower. This decline means that the common revenue or lack of BNB holders is presently decrease, reflecting the downward strain on the coin’s worth.

Consistent with the bearish pattern, whale curiosity in BNB has additionally waned, evident from the lower within the variety of whale transactions. This decline in whale exercise signifies a decreased involvement of large-scale traders or entities, probably including to the market’s cautious outlook.

Moreover, BNB’s velocity, representing the frequency at which the coin is utilized in transactions inside a given timeframe, registered a decline. This lower in velocity means that BNB is being utilized much less incessantly for transactions, presumably indicating a lower in total market exercise.

Featured picture from Tradedog