The price incurred by African migrants or expatriates when sending funds by way of the so-called formal corridors stays manner above the UN goal of lower than three p.c, the newest information from the World Financial institution has proven. However, the fee is far decrease than the goal when cryptocurrencies are used.

World Common Greater Than SDG Goal

In accordance with the newest World Financial institution (WB) remittance information, Sub-Saharan Africa has as soon as once more emerged as the most costly area to ship funds to. With a mean price of seven.8% for each $200 despatched, the area, which acquired $49 billion in remittances in 2021, solely bettered the 2020 determine by 0.4%.

Nigeria, which accounts for the biggest chunk of the area’s remittances, noticed its inflows go up by 11.2 p.c. In accordance with the WB, the expansion within the worth of remittances despatched to Nigeria by way of formal channels might be attributed to the nation’s insurance policies which encourage recipients to money out at regulated platforms. Different international locations from the area that noticed important progress of their inflows embody Cabo Verde, whose incoming remittances rose by 23.3%, Gambia (31%), and Kenya (20.1%).

Globally, the typical price of remitting funds throughout borders stood at 6% throughout the identical interval. In accordance with the World Financial institution, each Sub-Saharan Africa and the worldwide common transacting prices are nonetheless a lot increased than the Sustainable Improvement Objective (SDG) 10.3 goal of below 3%.

But, regardless of the continued efforts to decrease this determine, the price of transferring funds throughout borders merely stays excessive and has been for years. This means that the aim to realize the United Nations SDG 10.3 goal of decreasing the transaction prices of migrant remittances to lower than 3% by 2030 is unlikely to be achieved. Equally, the UN’s mission of eliminating remittance corridors with prices increased than 5 p.c seems unattainable.

Why Migrants Are Turning to Crypto

In the meantime, the excessive price of sending remittances by way of formal channels and the accompanying rigorous KYC requirements which are utilized usually drive migrants to search for extra handy and fewer cumbersome channels. Couriers, cross-border vans, or bus drivers are a number of the casual methods migrants use to ship funds to their family members. Nevertheless, such casual strategies have their very own challenges with the principle one being the safety of the funds.

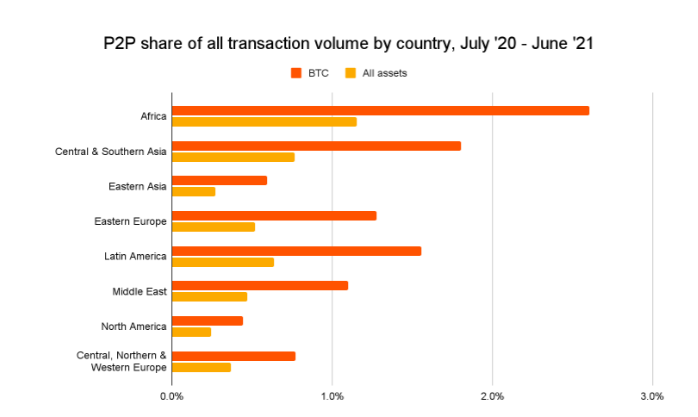

So whereas cryptocurrencies weren’t initially created to unravel this dilemma, their rising use by migrants remitting cash to their family members reveals that they are often a part of the answer. Because the 2021 Geography of Cryptocurrency report by the blockchain intelligence agency Chainalysis will attest, a rising variety of African migrants may now be utilizing peer-to-peer crypto change platforms when sending funds again dwelling.

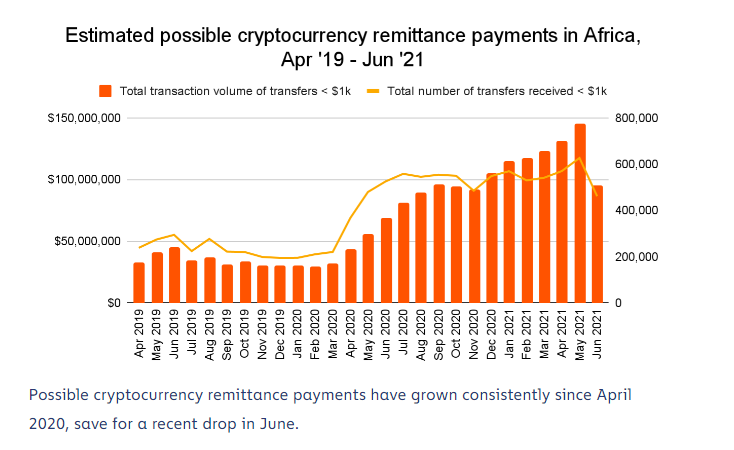

For example, the intelligence agency’s information means that between July 2020 and June 2021, a complete of $105.6 billion price of cryptocurrency was despatched to recipients on the African continent. Out of this complete, cross-region transfers accounted for almost 96%.

The variety of incoming transfers which are under $1,000 is the opposite metric used within the report, which once more helps the assertion that African migrants are utilizing digital currencies to remit funds. In accordance with Chainalysis, the variety of such transfers went previous the 200,000 mark for the primary time in Could 2020 and has stayed above this degree since. In reality, by Could 2021, the variety of transfers under $1,000 was slightly below 800,000.

In addition to being a sooner and maybe safer manner of sending funds, cryptocurrencies are noticeably less expensive when in comparison with the so-called formal channels. Whereas it might price as a lot as $10 (10%) to maneuver $100 from South Africa to Zimbabwe when utilizing common corridors, it prices roughly $0.01 to ship $200 by way of the BCH community or lower than one per cent, as an example. It even prices a lot lower than one cent to switch the identical worth on the Stellar community. In addition to these two examples, there are a number of extra examples which show that cryptocurrencies is usually a higher different to common remittances channels.

Regulators Should Not Curtail the Use of Practical Innovation

Subsequently, whereas critics — significantly these primarily based in superior economies — are keen to focus on the issues in cryptocurrencies, migrants from not solely from Africa however throughout the globe are proving that cryptos are higher than conventional channels. If cryptocurrencies have been instantly to develop into the broadly used technique of transferring funds throughout totally different jurisdictions, then the attainment of the SDG 10.3 aim of attaining remittance prices decrease than three p.c may occur effectively earlier than the 2030 deadline.

It due to this fact stands to purpose that regulators ought to be guided extra by details and never malice when coping with cryptocurrencies. Regulation of cryptocurrencies shouldn’t be about curbing their use because the United Nations Convention on Commerce and Improvement (UNCTAD) really useful in a current coverage transient.

As a substitute, regulators ought to promote or encourage the elevated use of cryptocurrencies the place they’re proving to be helpful. An innovation that emancipates the poor or one which makes an attempt to degree the enjoying discipline ought to be protected and never ostracized.

Register your e-mail right here to get a weekly replace on African information despatched to your inbox:

What are your ideas on this story? Tell us what you assume within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, instantly or not directly, for any injury or loss prompted or alleged to be attributable to or in reference to using or reliance on any content material, items or providers talked about on this article.