Share

CertiK’s Q2 2023 Web3 Safety report highlights a decline in quantity misplaced to malicious actors within the blockchain ecosystem, vital off-chain occasions, and vulnerabilities in main protocols and functions.

Dangerous actors nonetheless focusing on web3 initiatives

The just lately launched Q2 2023 Web3 Safety report by CertiK, a blockchain safety and auditing firm, sheds mild on the scams, rug pulls, and safety breaches that occurred within the trade over the past quarter.

Based on the report, malicious actors drained $313,566,528 from web3 corporations through the months of April, Might and June in 2023. Surprisingly, this determine intently mirrors the $320 million misplaced in Q1, indicating a comparatively constant pattern within the face of rising safety challenges.

Nonetheless, the info exhibits a optimistic end result when evaluating the present figures to these of Q2 2022 — the trade witnessed a 58% lower in worth misplaced to unhealthy actors throughout the identical interval final yr.

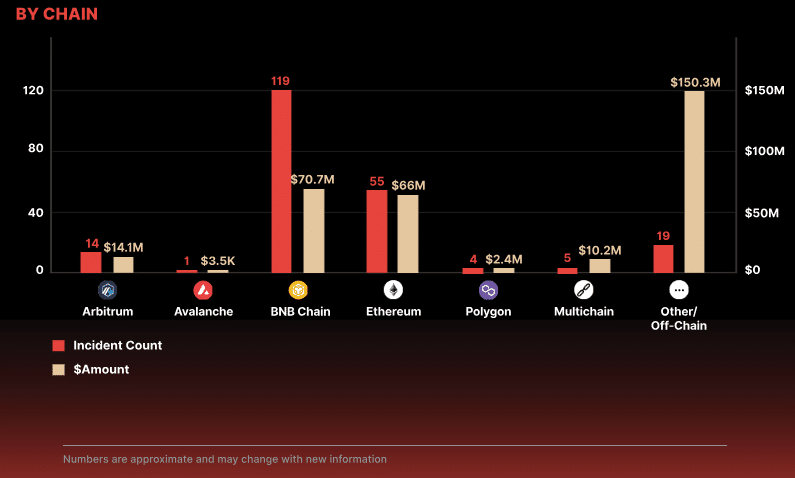

CertiK’s evaluation of 212 safety incidents within the second quarter of 2023 discovered that the typical monetary loss per assault amounted to $1,479,087. This determine is barely decrease in comparison with the typical lack of $1,562,595 reported within the first quarter. Though the lower is modest, it would point out optimistic developments in safety protocols.

One disturbing pattern highlighted within the report is the surge in exit scams and rug pulls. Ninety eight exit scams have been recognized, ensuing within the lack of $70,353,565 from unsuspecting buyers. This determine greater than doubled the $31 million misplaced to rug pulls in Q1, emphasizing the necessity for heightened vigilance when investing in new web3 initiatives.

Flash mortgage assaults fall

One other vital discovering within the report is the decline in worth attributed to flash mortgage/oracle manipulation exploits. In Q2 2023, attackers managed to web $23,749,032 via 54 such incidents. This represents a pointy lower in comparison with Q1, the place 52 flash mortgage assaults resulted in losses totaling $222 million, though it’s price noting {that a} single exploit, Euler Finance, accounted for 85% of the earlier quarter’s complete.

Off-chain occasions and vulnerabilities

Based on the report, the web3 trade additionally skilled vital occasions off-chain.

The SEC initiated authorized proceedings in opposition to the highest two crypto exchanges — Binance and Coinbase. Moreover, BlackRock, the world’s largest asset administration firm, submitted an software to the regulatory company for a bitcoin exchange-traded fund (ETF), indicating rising mainstream curiosity in cryptocurrencies (though the SEC later referred to as the applying “insufficient”).

CertiK’s safety researchers uncovered vulnerabilities in main blockchain protocols and functions. Notable findings embody safety dangers within the Sui validator nodes and ZenGo’s MPC pockets, emphasizing the significance of sturdy safety audits and fixed enchancment within the face of evolving threats.

Comply with Us on Google Information