That is an opinion editorial by Josef Tětek, a Bitcoin analyst at Trezor.

Think about this: It’s payday however earlier than the cash reaches your account, another person has already determined what you’ll spend your cash on — one third of your paycheck on housing, one third on meals (solely plant and bug protein allowed), 10% on transportation (with little allowance for gasoline), 10% on a compulsory pension plan (largely allotted to authorities bonds) and the remaining 14% on clothes, alcohol and prescription drugs in state-licensed outlets. Spending outdoors of those allocations comes with big markups and, as if this isn’t dangerous sufficient, saving is not possible as this cash comes with an expiration date: after three months, it merely disappears out of your account.

This dystopian world is nearer than you suppose. Central financial institution digital currencies, or CBDCs, might make it a actuality. CBDCs are an try and duct-tape the failing financial system again collectively, and within the course of present the State with practically limitless management over the monetary system, and thus our spending habits and the best way we lead our lives.

On this article, I clarify the motivation for governments pursuing the CBDC applications, why it is likely one of the biggest threats to our freedoms right this moment and what steps you’ll be able to take to restrict its impression on you and your loved ones.

All Fiat Fails

Fiat foreign money is the one type of cash most of us have identified all through our lives. It might appear pure and inevitable however once we look a bit farther into historical past, we discover out that it’s something however that; actually, fiat foreign money appears extra like a lifeless finish within the context of financial historical past.

For 1000’s of years, mankind has converged to gold and silver because the dominant type of cash. Just for the previous 100 or so years have we diverged from this historic development. And the outcomes have been disastrous. As Joakim Guide famous in his current article on hyperinflations, 61 out of the 62 documented instances of hyperinflation occurred previously 100 years — within the period of fiat cash, when the ties to valuable metals have been minimize.

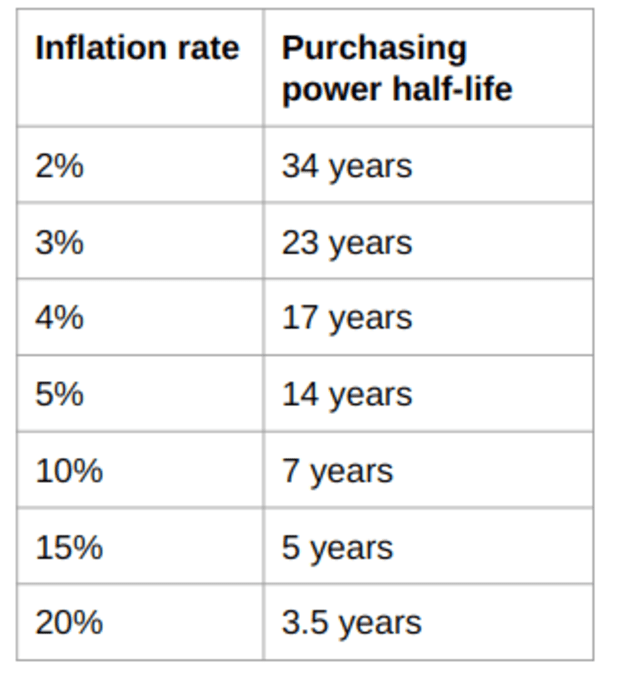

Even when a foreign money isn’t present process hyperinflation, folks and economies nonetheless endure. A “common” inflation in single or double digits is sufficiently harmful by way of its cumulative impact. Per my very own calculations, inflation of two% — a typical inflationary goal that many central banks goal for — halves the buying energy of the given foreign money in about 35 years, whereas the current inflation charges round 10% handle to take action in seven years.

In brief, fiat currencies both die shortly or evaporate slowly. In the long run, all of them fail.

Why CBDCs Now?

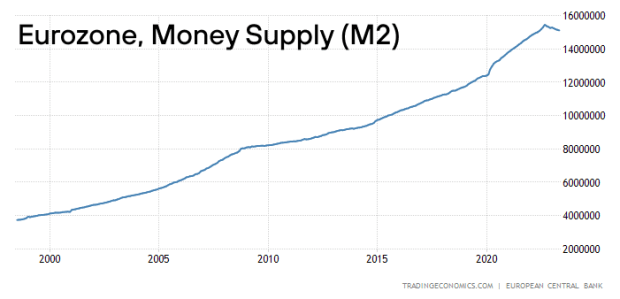

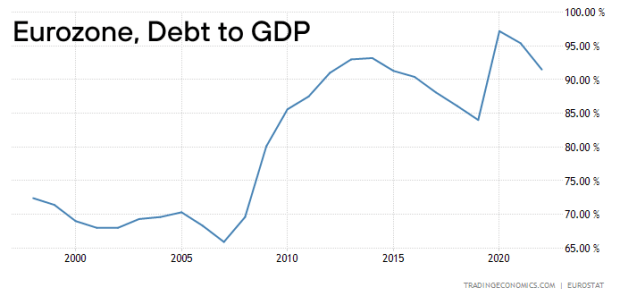

Some coverage makers are conscious of this intrinsic nature of fiat currencies, and attempt to duct-tape their financial programs by way of a reform — as an alternative of letting the foreign money die in a spectacular hyperinflationary episode, they euthanize it as an alternative and substitute it with one other fiat foreign money. That is in essence what occurred throughout Europe on the flip of the century, when the euro was rolled out: smaller currencies affected by excessive inflation charges (such because the Italian lira, Greek drachma and Spanish peseta) have been overhauled into a brand new fiat foreign money that, at the least till lately, allowed the institution to kick the can down the street through rampant cash printing and ballooning money owed, as demonstrated within the chart beneath.

The state of affairs seems to be strikingly related all world wide: cash provides inflating, buying energy steadily declining, debt ranges ballooning. The outcomes are the identical, as a result of the trigger is identical: financial programs primarily based on currencies that may be printed at will are failing.

Some governments reform their foreign money in a really naive means, by merely eradicating a few zeros from the prevailing denominations and calling it a day. A typical instance of such a reform was the 2016 overhaul of the Belarusian ruble, throughout which the federal government merely scratched off 4 zeros from the foreign money.

Utilizing central financial institution digital currencies is a barely extra subtle try at reforming failing financial programs, although they received’t change fiat currencies in any basic means. If something, CBDCs are placing extra energy within the arms of governments and can doubtless result in a good larger erosion of the buying energy of odd residents.

The Final Corruption Of Cash

Probably the most environment friendly methods to enslave a society is to destroy a foreign money’s two predominant capabilities: its roles as a retailer of worth and as a medium of trade.

Fiat currencies already ceased working as a dependable retailer of worth a very long time in the past, by way of an intentional coverage of everlasting inflation. Stopping residents from saving independently and incentivizing society to enter ever-deeper money owed results in a larger dependence on the state and its insurance policies. Fiat currencies result in debt slavery, and CBDCs received’t reverse this development.

CBDCs As A Retailer Of Worth

To know why CBDCs will doubtless result in a a lot larger erosion of the store-of-value perform of cash, let’s have a look at how right this moment’s monetary programs function. Let’s take the U.S. banking system for instance (most monetary programs world wide are structured in just about the identical means).

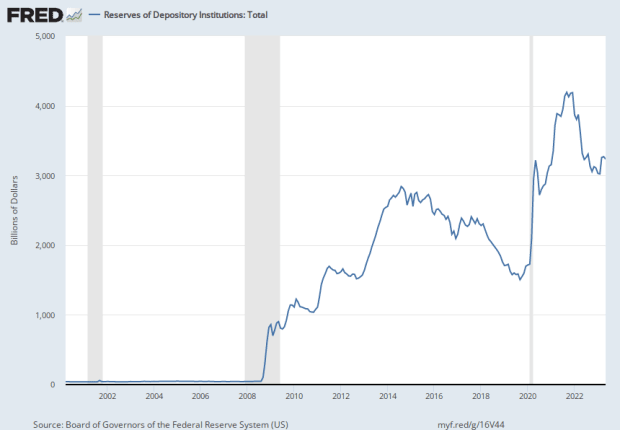

The Federal Reserve, the U.S. central banking system, regulates the monetary system and executes financial insurance policies. Throughout and after the 2008 monetary disaster, the Fed carried out a really unfastened financial coverage with rates of interest close to zero to stimulate the financial system. That is the place we get to a second essential component of the U.S. monetary system, within the type of business banks. Banks have been unwilling to lend out the brand new influx of cash and as an alternative deposited trillions of {dollars} with the Fed, as we are able to see on the chart beneath. This, partially, restricted the effectiveness of the central financial institution’s insurance policies.

Now, if a CBDC was in place, it might be potential for the Fed to go across the business banks and deposit the newly-created cash straight into the accounts of odd residents, who would most probably spend it instantly as an alternative of saving it for a wet day. Sounds nice, proper? Free cash! However that’s exactly the issue: such cash can be made out of skinny air and would solely contribute to an accelerated erosion of everybody’s buying energy.

When it comes to the store-of-value perform of cash, CBDCs can be worse than something earlier than, permitting the central financial institution to digitally “print” cash at a tempo beforehand unimaginable, depositing it straight into folks’s accounts, and probably even implementing an expiration date to the foreign money items.

CBDCs As A Medium Of Alternate

The liberty to transact is a prerequisite to just about all different freedoms. This may sound counter-intuitive, however remember the fact that cash is utilized in half of all of the financial transactions in a society — each single trade of products or companies requires a handover of cash. If cash is beneath the complete management of the State, then the State in flip positive aspects management of just about all the things that goes on in that society. Up till now, even probably the most totalitarian governments haven’t actually had full management over all of the transactions, as they haven’t discovered a means for the respective societies to perform with out money. However CBDCs are meant as a full-fledged alternative of money, and with the penetration of smartphones over 80% in developed nations, a fully-cashless society operating solely on a State-managed CBDC is in sight.

Additionally, present cost programs, whereas providing some extent of management, are nonetheless fairly decentralized. Within the U.S. and EU, the nationwide cost system is made up of dozens of economic banks, cost suppliers, bank card firms and different companies that comprise the cost ecosystem. Censoring funds in such environments is feasible, however isn’t easy to execute and normally solely occurs when critical crime is suspected.

If CBDCs work as envisioned, a single entity — the central financial institution — would have full management over the nationwide cost system, doubtlessly permitting for easy interventions when it comes to blocking the funds of anybody, realizing a totalitarian’s dream. It’s exactly for these causes that China has probably the most superior CBDC program on the earth; ought to that be an instance for the Western world?

How Critically Are Governments Pursuing CBDCs?

Per No Bullshit Bitcoin, 130 nations representing 98% of world GDP are at the moment pursuing a CBDC program. In response to the Atlantic Council CBDC Tracker, which intently follows the progress of particular person applications, 11 nations have already launched their respective digital currencies, 21 are in a pilot stage and the rest are in varied phases of analysis and improvement.

CBDC Progress In The U.S.

On its web site, the Fed states that it’s exploring the potential advantages and dangers from all potential angles. On the identical web page, it says that “as a legal responsibility of the Federal Reserve, nonetheless, a CBDC can be the most secure digital asset accessible to most of the people, with no related credit score or liquidity threat,” failing to acknowledge that whereas a CBDC may be superficially “protected” from the counterparty threat, the chance associated to an inflationary coverage would keep at the least the identical as with right this moment’s money. That may be a frequent theme throughout the central banks’ communications on the subject of CBDCs — the elephant within the room within the type of pervasive inflation stays unaddressed. Clearly, a CBDC can be a continuation of the inflationary financial coverage.

We will additionally observe a rising opposition to a CBDC rollout, with Ted Cruz (a U.S. senator representing Texas) introducing an anti-CBDC invoice, whereas Florida and North Carolina have outright banned the usage of a federal CBDC of their borders.

CBDC Progress In The EU

Within the eurozone, the efforts to introduce a digital euro — the official time period for Europe-wide CBDC — appear extra critical and fewer opposed. All the progress stories and different related paperwork might be discovered on the European Central Financial institution’s (ECB’s) web site; an attention-grabbing one is a current speech by Fabio Panetta (a member of the ECB board), through which he strongly rails in opposition to bitcoin and stablecoins and warns in opposition to public assist for unbiased cryptocurrencies, advising the general public sector to “as an alternative focus its efforts on contributing to the event of dependable digital settlement property, together with by way of their work on central financial institution digital currencies.”

In response to among the newest data, the ECB will decide on whether or not to roll out the digital euro in October 2023.

CBDC Progress In The U.Okay. And The Public Survey On “Britcoin”

Trezor has lately carried out a survey amongst Britons to evaluate the extent of consciousness in regards to the U.Okay.’s model of CBDC, colloquially referred to as “britcoin.” The findings level out that almost all of the general public is anxious about potentially-restricted entry to their funds, imposed time situations on the viability of the digital foreign money items and authorities management over which items and companies might be purchased.

It’s unclear when a CBDC within the U.Okay. will probably be launched, however per the Financial institution of England’s web site, the intention to take action is palpable. The British central financial institution additionally makes a veiled risk to bitcoin there, with its assertion that “there are additionally new types of cash on the horizon. A few of these might pose dangers to the UK’s monetary stability.”

Mitigating CBDCs

If the above-described prospects for central financial institution digital currencies concern you, I’ve obtained some excellent news: There’s a lot you are able to do to mitigate the dangers of CBDCs.

To begin with, it’s good to remain knowledgeable about CBDCs and alert others to the specter of such financial reform. Ignorance is the primary asset of central banks and governments: if the general public feels that CBDCs are only a beauty change to current programs and are higher left to skilled officers, that’s a serious victory for the institution. You may inform your family and friends in regards to the risks of full-fledged statist management of our cash in comprehensible phrases; all people ought to perceive the issue with the state defining what you’ll be able to and can’t spend your cash on, and the madness of setting an expiration date to a foreign money unit.

Second, use money at any time when potential. One of many widespread arguments for CBDCs is that persons are now not utilizing money and it must be changed by a digital foreign money managed — and surveilled — by the central financial institution. Show them improper by utilizing money at each event. Money is superior: money transactions are totally non-public, immediately settled and haven’t any processing charges for the service provider.

Third, use bitcoin. Proper now, bitcoin is usually used for preserving buying energy (on the time of writing, bitcoin has appreciated by about 80% in opposition to the greenback because the starting of the yr), but when CBDCs are launched and money is banned, bitcoin will doubtless turn out to be the one solution to spend your cash freely. Bitcoin is permissionless and totally usable with none middleman, and can stay so even after CBDCs are rolled out. It’s additionally fairly doubtless that CBDCs received’t be freely convertible into bitcoin, so getting some bitcoin now whereas fiat continues to be convertible may be a good suggestion. Simply remember the fact that you solely actually personal bitcoin should you maintain the non-public keys. A bitcoin stability on an trade isn’t proudly owning bitcoin. For the most effective safety, retailer your bitcoin in an open-source {hardware} pockets with a confirmed monitor report.

Conclusion

Below a CBDC regime, the statist financial insurance policies would proceed the present tendencies of devaluation and censorship, with a restricted technique of escape if the introduction of that CBDC is accompanied by a money ban. Whereas a black marketplace for foreign money, related to people who exist right this moment in nations with robust foreign money controls, would doubtless emerge and alleviate the impacts, the higher end result would nonetheless be if CBDCs have been strongly opposed by most of the people and by no means launched. The one possible way out of right this moment’s financial mess attributable to a long time of fiat insurance policies is natural, bottom-up bitcoin adoption, as bitcoin has superior financial traits to fiat and doesn’t want the state’s approval to perform as correct cash.

It is a visitor submit by Josef Tětek. Opinions expressed are fully their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.