Everybody has heard in regards to the 4-year cycle that Bitcoin goes via, however have you ever ever considered the concept Bitcoin may be going via an even bigger cycle? And will this greater cycle mirror the way in which people undertake new applied sciences? And is it attainable now we have seen one thing related earlier than with one other expertise just like the web? On this article, we will likely be diving into a brand new idea that means that Bitcoin is shifting via a bigger 16-year cycle which may help us predict the course of the Bitcoin worth within the coming years.

The Common 4 Yr Cycle

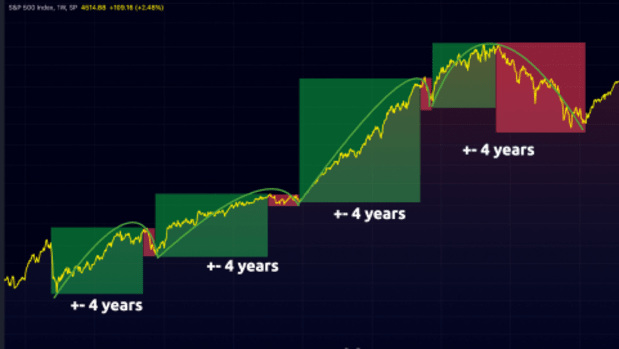

Bitcoin tends to undergo 4-year cycles that are divided into 2 components, the uptrend and the downtrend. A daily 4-year cycle consists of a 3-year uptrend adopted by a 1-year downtrend often known as a bear market. To this point Bitcoin has accomplished 4-year cycles they usually’ve proven unbelievable accuracy which catches the eye of the market individuals.

The DOTCOM Cycle

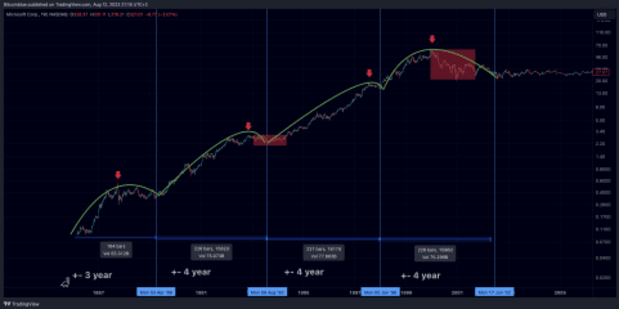

One can’t ignore the similarities between the market construction of the S&P500 in the course of the DOTCOM cycle and the Bitcoin cycle. The common monetary markets additionally went via clear 4-year cycles with the vast majority of the cycle being in an uptrend and the downtrend, often known as a bear market, shortly lived. From my perspective, the DOTCOM cycle began round 1986 as this was the second that Microsoft went public, one of many largest corporations of the DOTCOM cycle. The primary 3 4-year cycles of Bitcoin look similar to the primary 3 4-year cycles of the S&P500 ranging from 1986.

This actually spiked my pursuits as each intervals are based mostly on the adoption of a very new expertise that shifts the way in which our society perceives and makes use of data. The private laptop and the web modified our lives fully to the purpose that it’s nearly unthinkable to be unconnected to the web for greater than 24 hours. Sooner or later it should as nicely be unthinkable to not personal and use any Bitcoin, we’re simply nonetheless within the early section of its adoption.

So may the construction of the DOTCOM cycle assist us to find out a possible path for Bitcoin? Initially, I want to emphasize the truth that market cycles in my sincere opinion are top-of-the-line methods to make use of tough worth predictions and ascertaining when to enter and when to exit a selected market. However I actually need to emphasize the phrase “tough”. There goes a saying, “historical past

doesn’t repeat itself but it surely positive does rhyme”, and I believe this is applicable to cycles too. Nothing is ever a 100% replication of something that occurred earlier than, but it surely can provide us a tough estimate of what may occur.

As you may see within the construction of the DOTCOM cycle, the primary 3 4-year cycles are very related, an extended bull market adopted by a brief however generally shallow bear market or correction. It is solely that the final 4-year cycle is completely different, the tables are flipped the other way up. It begins with an acceleration within the worth which doesn’t final that lengthy and is adopted by a multi-year lengthy bear market. May Bitcoin do one thing related, disappointing those who count on a daily 4-year cycle and shock the bulk with a multi-year-long bear market?

Microsoft is following the same path. It begins with 3 4-year cycles which are right-translated, adopted by a 4-year cycle that’s left-translated, so a chronic bear market in an asset that has been in a powerful bull marketplace for years.

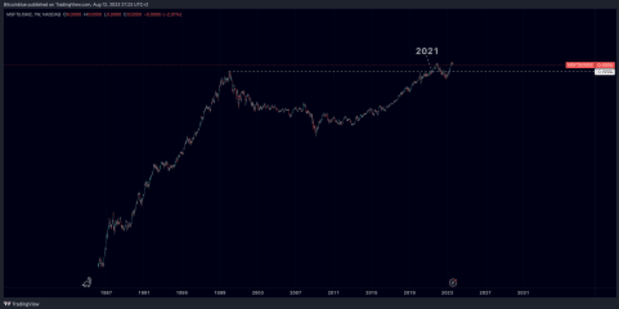

Microsoft topped within the 12 months 2000, marking a long-term prime within the worth at roughly $60. And it wasn’t till 2015 that that degree was damaged once more. It took 15 years from that top to fully get better and surpass that degree once more. If we had been to take the cash provide into consideration it truly takes longer for Microsoft to get better and break the excessive 21 years later in Might 2021.

Each of those charts, Microsoft and the S&P500, actually display the magnitude of a correction after a chronic bull-market. It’s difficult to think about from one’s perspective a chronic bear market of an asset you’ve skilled largely going up. Is it attainable that we’re going to see, in tough phrases, one thing related with Bitcoin?

Confluence Between Cycles

So let’s take a look at what these cycles are forecasting for Bitcoin and the way we probably may put together for these outcomes. Initially, it is attention-grabbing to notice that one date is forecasting the identical final result within the common 4-year cycle, the 16-year cycle.

A daily 4-year cycle would counsel that we’re staying in an uptrend till 2025, adopted by a 1- 12 months decline. This can be a typical 4-year cycle which we’ve seen 3 occasions within the historical past of Bitcoin.

The 16-year cycle would counsel that we’d comply with the same path because the DOTCOM bubble as talked about above. Bitcoin would peak inside the first half of the cycle, so by the newest on the finish of 2024, this might be adopted by a multi-year-long decline going into 2026 to type new lows.

How To Spot A High

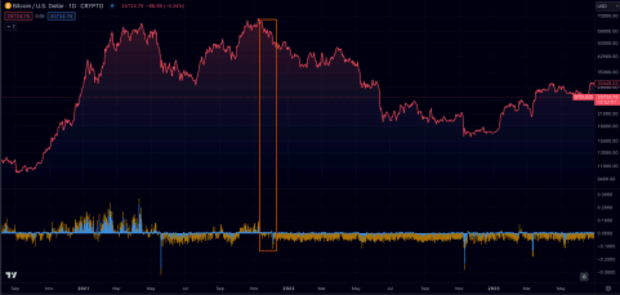

The most effective indicators a Bitcoin dealer can use are the Bitcoin funding charges. The funding charges are exhibiting mainly whether or not the vast majority of the market individuals on by-product markets are shorting or eager for Bitcoin. I’ve discovered this indicator very helpful to identify a prime within the Bitcoin worth as in a wholesome bull market when the funding charges are unfavorable, the worth tends to pattern up. In a bear market, when the funding is constructive, the worth tends to say no. So we are able to use this metric to identify which market circumstances the market is buying and selling in and if something has modified. One of many first alerts when Bitcoin entered a bear market in 2022 was that the worth of Bitcoin was declining with unfavorable funding charges, and that does typically not occur in a wholesome bull market.

One other technique to search for the cycle prime is timing, at any time when Bitcoin is within the interval of topping for let’s say the 16-year cycle and we break beneath a swing-low, possibilities improve {that a} cycle prime is in. This could then be invalidated by breaking again above that particular degree, to re-claim this degree. To view the interval of a possible cycle prime, one can take a look on the Bitcoin cycles development bars. As soon as the yellow dot enters the pink zone, it signifies that based mostly on that particular cycle we’re within the topping interval. Once more, you will need to point out that cycles may help to provide a tough estimate of potential outcomes, they usually don’t unfold very precisely and there’s room

Additional Issues

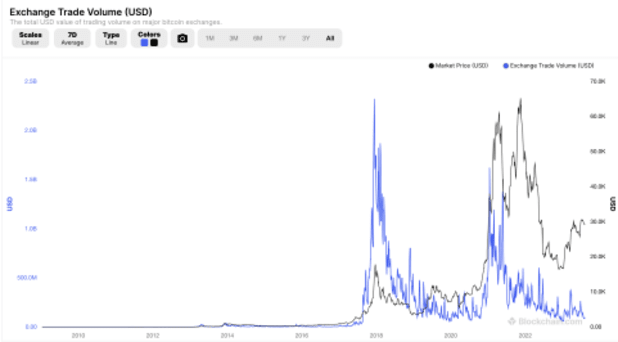

There are extra components at play right here that affect the worth of Bitcoin apart from these cycles. The truth that the Federal Reserve began to print enormous quantities of cash in 2020, actually spiked the chance urge for food for a lot of traders to search for a secure haven just like the monetary markets and Bitcoin. It’s very clear that the second the Federal Reserve began to inject cash into the financial system, the worth of Bitcoin and the monetary markets began to go up till the cash printer halted once more in 2022 and the worth of Bitcoin entered a 1-year declining section. These elementary adjustments within the financial system will most probably have an effect on Bitcoin and the way in which these cycles may unfold.

This can be a visitor publish by Jeroen van Lang. Opinions expressed are totally their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.