Current buying and selling patterns have led QCP Capital, a distinguished buying and selling agency, to focus on potential indicators of a market backside within the crypto market. Bitcoin, the main digital foreign money, not too long ago dipped under $58,000, inflicting analysts to concentrate on the habits of miners and their attainable capitulation.

Such capitulation might point out a market backside, just like previous market cycles. In 2022, a parallel hash charge drop noticed Bitcoin costs plummet to $17,000, suggesting a recurring theme that would sign an upcoming rebound.

Associated Studying

Bitcoin Backside In?

Bitcoin’s fall from the crucial $60,000 help degree to a present low under $58,000 on the time of writing has triggered discussions amongst QCP’s analysts.

Of their newest replace on Telegram, they describe this downturn as aligned with historic precedents that often precede vital worth recoveries. This pattern means that whereas the market seems bearish, underlying actions may trace at an rising bullish state of affairs.

Regardless of the market’s downward trajectory, QCP stays optimistic concerning the potential for restoration, pushed by particular market mechanisms and upcoming monetary merchandise.

The choices market, particularly in Ethereum (ETH), is seeing a skew in direction of name choices for upcoming months, reflecting a bullish sentiment amongst merchants.

Moreover, QCP analysts have recognized vital liquidation clusters for Bitcoin and Ethereum that, if triggered, might result in aggressive brief squeezes, probably driving up costs.

QCP has additionally proposed a strategic ETH buying and selling technique utilizing KIKOs (Knock-In, Knock-Out choices) to capitalize on market volatility whereas defending in opposition to extreme draw back dangers.

This technique underlines the agency’s anticipation of optimistic shifts within the ETH market, probably fueled by the approval of latest monetary merchandise just like the anticipated S-1 varieties for Ethereum exchange-traded funds (ETFs).

BTC Sharp Decline Amid Widespread Liquidations

Within the final 24 hours, Bitcoin and Ethereum have skilled notable declines, with costs falling to $58,057 and $3,134, respectively.

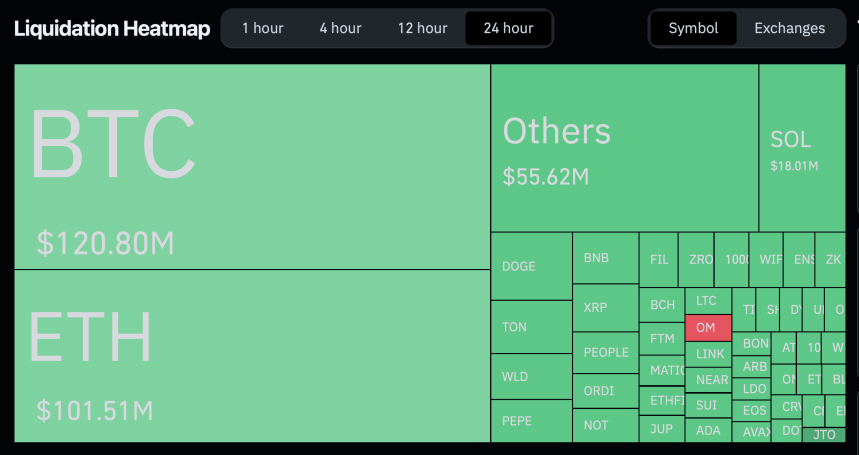

This downturn has considerably affected the buying and selling neighborhood, with Coinglass reporting complete market liquidations of roughly $387.78 million; a big portion concerned Bitcoin and Ethereum.

The liquidation patterns counsel a predominance of lengthy positions, indicating that many merchants anticipated a worth enhance, which didn’t materialize.

Whereas the speedy market situations seem grim, deeper evaluation by crypto specialists like Crypto Patel suggests this might be the precursor to a extra vital market motion.

Associated Studying

Patel’s evaluation factors to Bitcoin dropping to lows of round $55,000, a sentiment which will seem unfavourable to others who stay optimistic that the underside is in and surge is subsequent.

#Bitcoin Evaluation Replace 🚨

Hope you adopted my evaluation! $BTC hit Break of Construction (BOS) and made a brand new low, completely rejecting from the Bearish OB. I’m nonetheless bearish and see a possible drop to $55,000.

Anticipating a brand new OB to type at $61k-$62k, resulting in a small pump… https://t.co/LiMD6e4mdF pic.twitter.com/HiY5OWX6tt

— Crypto Patel (@CryptoPatel) July 4, 2024

Featured picture created with DALL-E, Chart from TradingView