Knowledge exhibits that ‘paper’ Bitcoin has noticed a notable surge lately whereas the cryptocurrency’s spot value has plunged down.

Paper Bitcoin Has Been Rising Whereas Spot BTC Has Stayed Stale

In a brand new thread on X, analyst Willy Woo has talked concerning the state of the Bitcoin market. BTC has been seeing a bearish pattern lately, with the German Authorities promoting and Mt. Gox distributions being two of the key sources of FUD amongst buyers.

Woo identified that Germany offered round 10,000 BTC, with 39,800 BTC nonetheless within the authorities’s custody.

The info for the holdings confiscated by the German authorities | Supply: @woonomic on X

Mt. Gox hasn’t distributed as a lot BTC but, with solely 2,700 BTC being returned to their homeowners. The bankrupt trade nonetheless has 139,000 BTC left to distribute, however the bearish impression from these holdings will depend on whether or not the holders receiving the cash wish to promote.

The pattern within the Mt. Gox stability over time | Supply: @woonomic on X

It wouldn’t seem that these two entities have added that a lot precise promoting strain to the market but. So, what’s been the true offender behind Bitcoin’s crash? In keeping with the analyst, that might appear to be paper BTC.

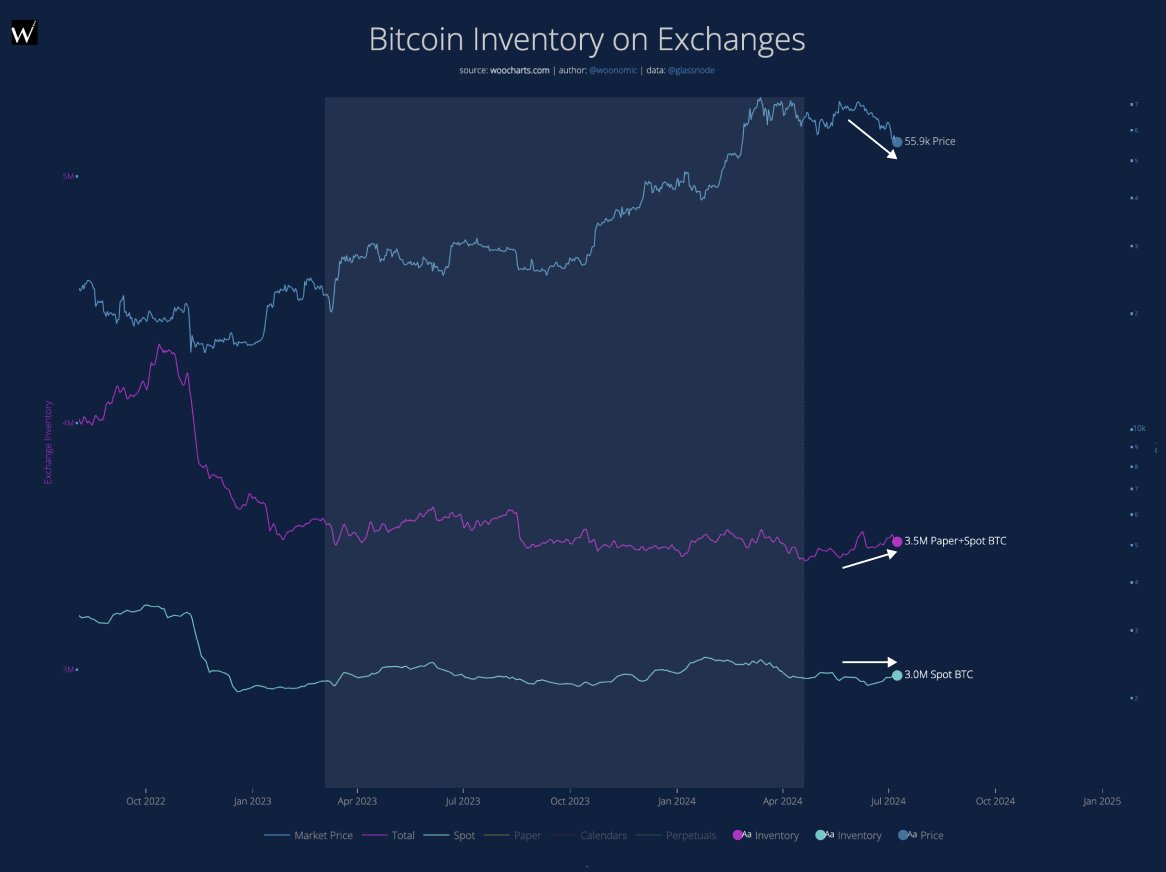

Paper BTC refers back to the derivatives merchandise associated to the cryptocurrency that don’t want possession of any precise BTC tokens. Beneath is a chart that exhibits BTC’s trajectory throughout this newest plunge within the asset.

Appears to be like just like the paper plus spot BTC stability has been on the rise on exchanges | Supply: @woonomic on X

Within the graph, the purple line displays the mixed paper and spot BTC stock at present sitting on the varied centralized exchanges within the sector. This stock has been on the rise lately.

This improve, nonetheless, may be due to spot deposits quite than paper Bitcoin being minted. Nonetheless, because the blue curve exhibits, spot BTC has been displaying a flat trajectory whereas the general stock has elevated. This could verify that paper BTC has certainly been behind the rise.

In whole, 140,000 further paper BTC has been printed lately. “Now evaluate that to 10,000 BTC that Germany offered, and also you see what precipitated the dump,” says Woo. Thus, it’s potential that derivatives must see a flush if the cryptocurrency needed to make some strong restoration.

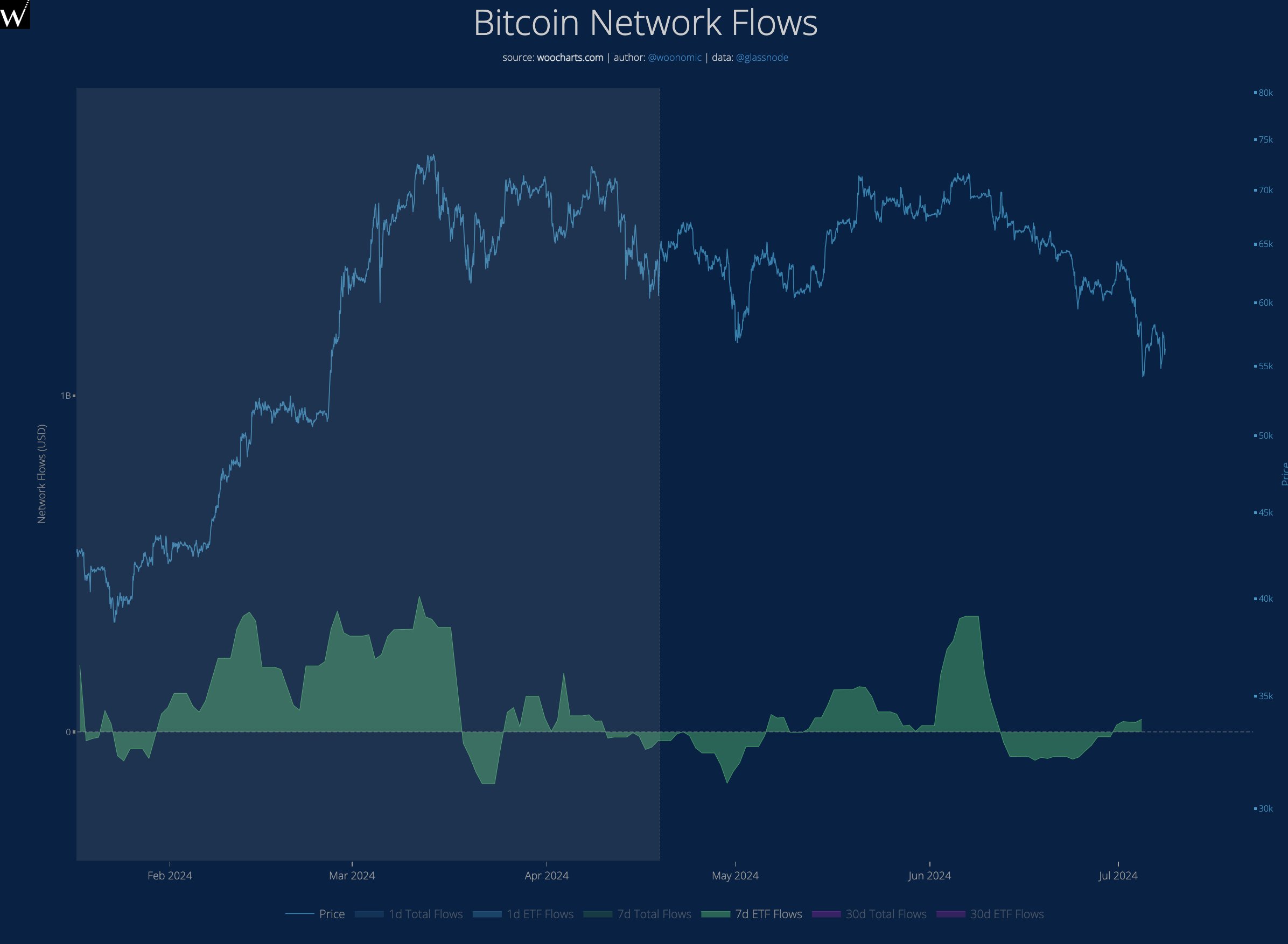

Whereas bearish winds are forward by way of the remaining Mt. Gox and German authorities offloading, a bullish improvement may additionally be forming for the coin. Because the analyst has defined, the spot exchange-traded funds (ETFs) have began to point out early indicators of accumulation.

The pattern within the 7-day netflows of the BTC spot ETFs | Supply: @woonomic on X

BTC Worth

The previous month has been a tough time for Bitcoin holders because the asset’s value has declined by greater than 17% and dropped to $57,200.

The value of the coin has been using on bearish momentum lately | Supply: BTCUSD on TradingView

Featured picture from Dall-E, woocharts.com, chart from TradingView.com