The beginning of US spot Ethereum trade traded funds has been fairly unusual. After the SEC approval, 8 out of 9 ETFs started buying and selling on Tuesday. Whereas one ETF noticed heavy inflows, Grayscale’s transformed fund, ETHE, skilled important outflows. Let’s discover out why Grayscale, a administration agency, is going through such outflows.

The launch of ETH ETFs

Everybody is aware of that buying and selling for US ETH ETFs began on July 23, and all 8 funds noticed inflows of over $1 billion on the primary day. Nevertheless, Grayscale’s ETHE ticker, which has been buying and selling on the OTC market, began experiencing heavy outflows from the primary day. Grayscale’s Ethereum belief, which began as a non-public placement in 2017 and started publicly buying and selling on the OTC markets in 2019, additionally launched an ETF underneath the ticker ETHE on NYSE on July 23. Whereas the brand new ETFs noticed substantial inflows, Grayscale’s present ETF skilled $1.16 billion in outflows over the previous three days.

Grayscale’s ETH Outflow

Specialists imagine that if this outflow continues on the present price, the ETF may very well be depleted of all its Ethereum in lower than a month. This may very well be attributable to ETHE’s excessive payment of two.5%, whereas Grayscale’s new mini belief ETH ETF costs the bottom payment among the many new ETFs at 0.15%.

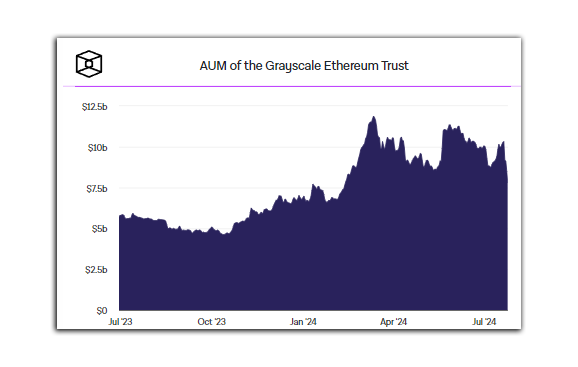

Grayscale’s new ETF noticed inflows of $119.1 million over the previous three days. When combining the ETHE outflow information with the 7% drop in Ethereum’s value, the worth of belongings underneath Grayscale’s administration fell from $10 billion to $7.5 billion in the identical interval.

Grayscale is at present experiencing a internet day by day outflow of round $385 million. If this development continues, the ETHE may very well be emptied of all its Ethereum in lower than a month. One more reason for this outflow may very well be that the older ETF ETHE now not gives any reductions and has a excessive payment, as beforehand talked about. Due to this fact, buyers discover it useful to exit the older ETF and spend money on the brand new ones.

Evaluation Influx and Outflow

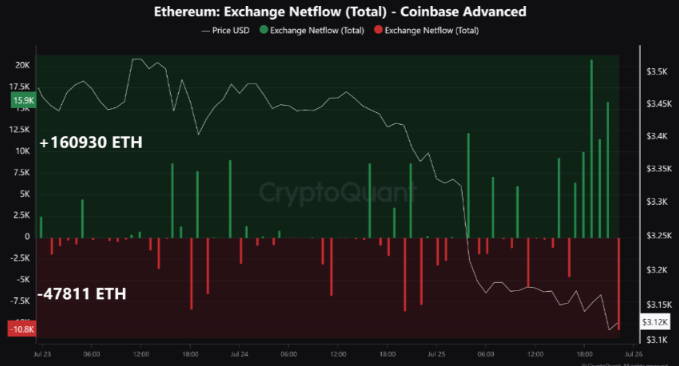

Together with Grayscale, there are 5 different ETF issuers utilizing Coinbase crypto trade as their custodian, whereas VanEck makes use of Gemini, and Constancy manages its Ethereum itself. Within the first two days, Coinbase noticed an influx of about 160,930 ETH. Nevertheless, attributable to ETHE’s outflows, $811 million value of funds exited Coinbase. The entry of 113,119 ETH into the Coinbase trade created promoting strain out there, resulting in the noticed drop in Ethereum’s value.

The Future Outlook

all these elements, it appears that evidently the Ethereum ETF launch has turn out to be a basic case of “promote the information.” Traders are looking for their advantages, which is why Grayscale’s ETHE is going through heavy outflows. However, all the brand new ETH ETFs, together with Grayscale’s mini belief, are seeing important inflows. The present scenario signifies that Grayscale will proceed to expertise heavy outflows from its older ETF, sustaining promoting strain on Ethereum. Solely time will inform what occurs subsequent.