Solana’s (SOL) worth is ready for an enormous upside rally after dealing with important promoting strain at its sturdy resistance degree of $161. Previously few days, SOL has dropped by over 18% as a result of total bearish market sentiment and the current worth decline in Bitcoin (BTC).

Development Reversal Signal

Nevertheless, SOL’s day by day chart has fashioned a bullish divergence, signaling a possible pattern reversal from a downtrend to an uptrend. Because the starting of August 2024, SOL has been forming decrease lows, whereas the Relative Energy Index (RSI) has been creating increased lows.

The formation of bullish divergence on a day by day timeframe signifies a possible upside rally. Merchants and buyers view this as a really perfect shopping for alternative.

Solana Worth Prediction

Based on the skilled technical evaluation, SOL has been consolidating inside a good vary close to an important help degree of $127. This help degree has at all times been particular for Solana. Since March 2024, SOL has revisited this degree a number of occasions, and every time it has seen an enormous upside rally of a minimal of 20%.

Nevertheless, given the bullish divergence and historic worth momentum, there’s a robust risk that SOL may soar by 20% to the $161 degree.

On-chain Metrics and Market Sentiment

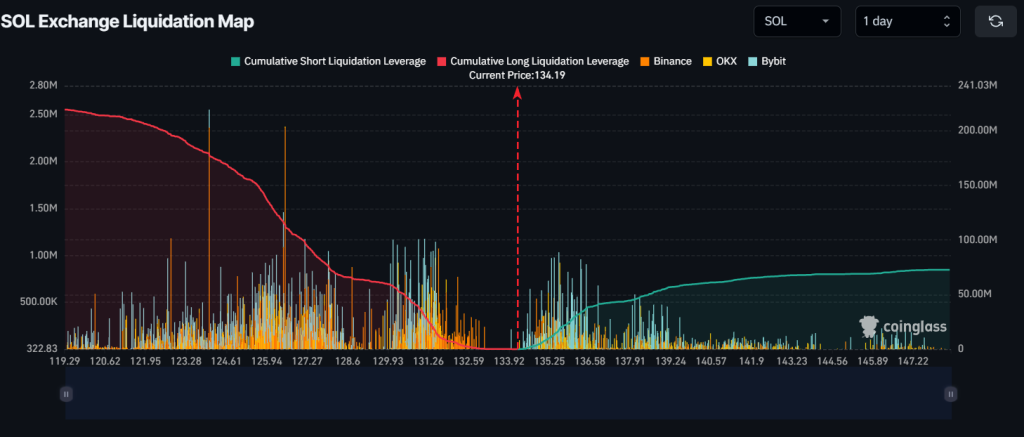

As of now, the most important liquidation ranges are close to $126.5 on the decrease aspect and $136.8 on the higher aspect, as merchants are over-leveraged at these ranges, in response to the on-chain analytic agency Coinglass.

If the market sentiment for SOL stays bullish and the value rises to $136.8 degree, almost $41 million price of quick positions shall be liquidated. Conversely, if the sentiment shifts and the value falls under the $126.5 degree, roughly $115 million price of lengthy positions shall be liquidated.

The upper lengthy liquidation reveals that at present bulls are dominating the asset and have the potential to liquidate bigger quick positions.

At press time, SOL is buying and selling close to $134 and has skilled a worth surge of over 3% within the final 24 hours. In the meantime, its buying and selling quantity has additionally skyrocketed by 65% throughout the identical interval, indicating increased participation amid a bullish outlook.