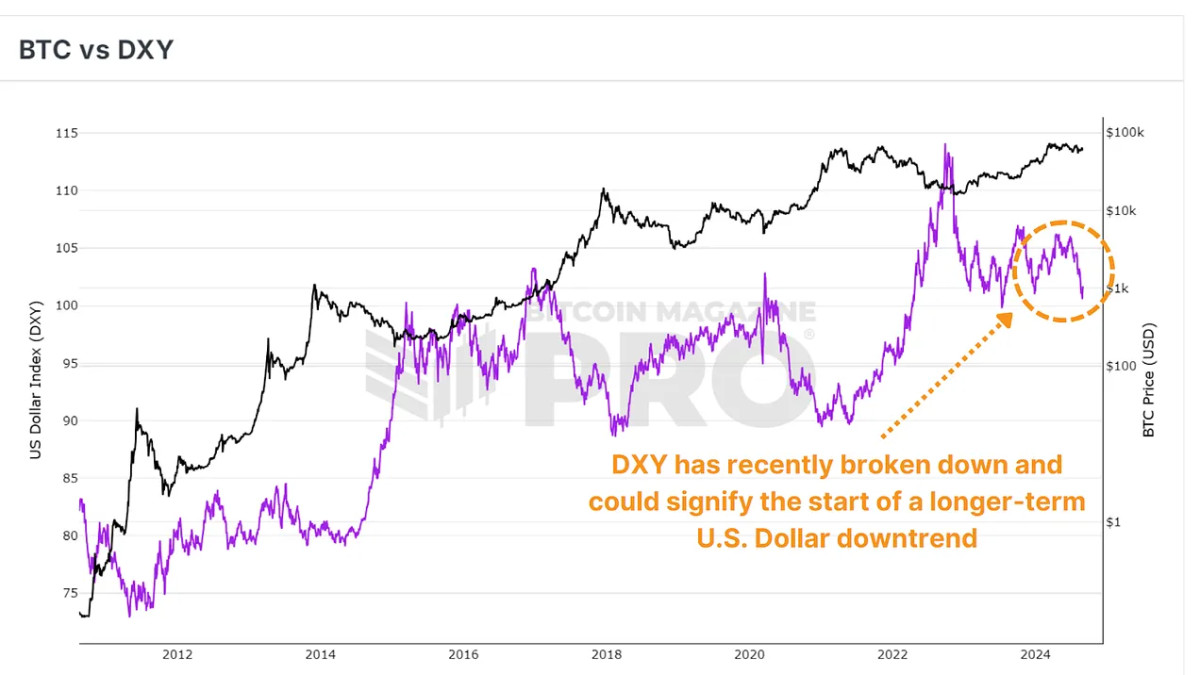

Bitcoin and the U.S. greenback have a long-standing inverse correlation, notably when observing the Greenback Power Index (DXY). When the greenback weakens, Bitcoin typically positive aspects energy, and this dynamic would possibly now be setting the stage for restarting the BTC bull cycle.

DXY

The Greenback Power Index (DXY) measures the worth of the U.S. greenback towards a basket of different main international currencies. Traditionally, a declining DXY has typically coincided with vital rallies in Bitcoin’s worth. Conversely, when the DXY is on the rise, Bitcoin tends to enter a bearish part.

We’ve got just lately seen a major decline within the DXY, which may very well be signaling a shift towards a extra risk-on setting in monetary markets. Usually, such a shift is favorable for property like Bitcoin. Regardless of this downturn within the DXY, Bitcoin’s worth has remained comparatively stagnant, elevating questions on whether or not BTC would possibly quickly expertise a catch-up rally.

Sentiment Shifting

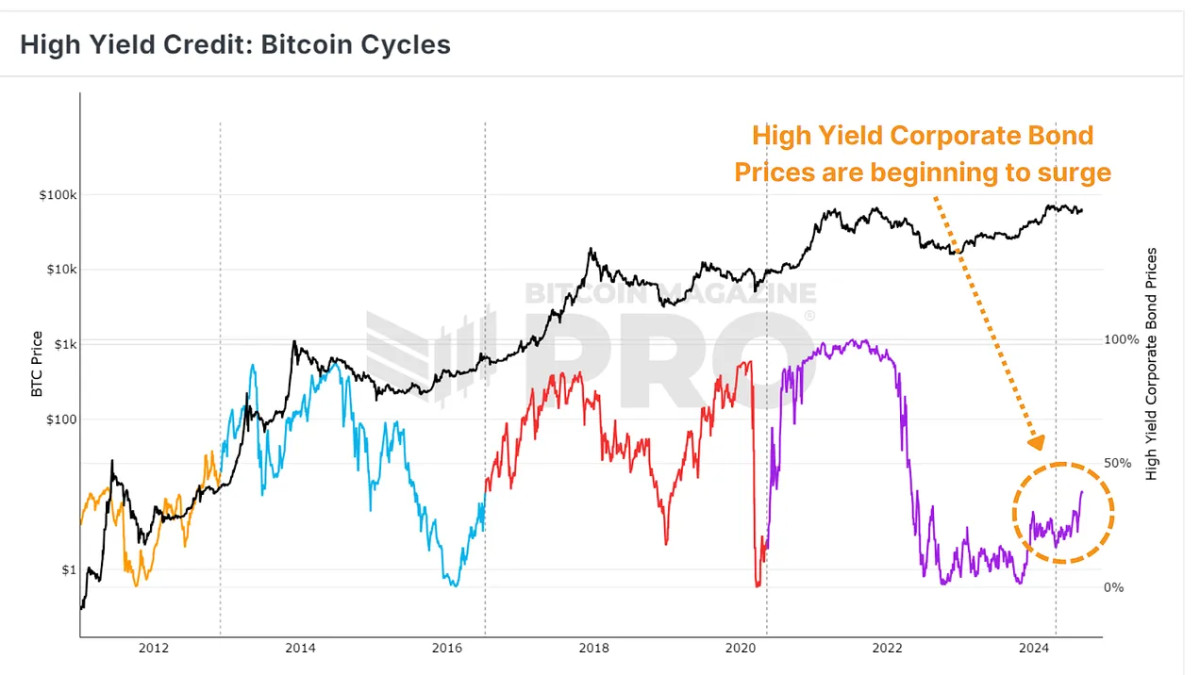

Coinciding with the lower in demand for the U.S. greenback, the high-yield credit score information suggests growing demand for higher-yielding company bonds. This means that traders are extra keen to acquire outsized returns, and traditionally this urge for food has resulted in additional vital capital inflows and better costs in consequence for Bitcoin.

Lagging Behind?

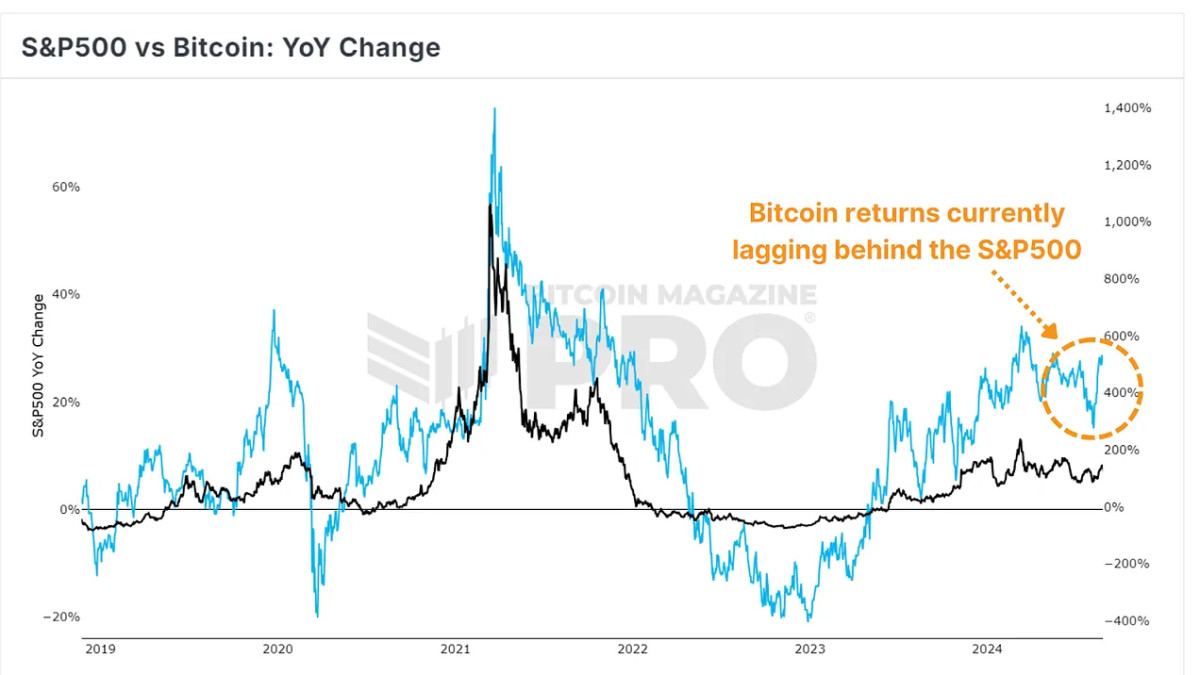

Compared, the S&P 500 has seen substantial development in latest weeks, whereas Bitcoin has remained comparatively stagnant. Nonetheless, the growing correlation between Bitcoin and the S&P500 means that Bitcoin would possibly quickly observe the upward development we’ve seen in conventional equities.

Conclusion

In abstract, whereas Bitcoin has been sluggish to react to the latest decline within the DXY, the broader market situations counsel a possible for a bullish part in our present cycle. We’ve seen a shift in sentiment amongst conventional market traders and, subsequently, a interval of outperformance for the S&P500.

Whether or not the market is overestimating the influence of the greenback’s decline stays to be seen, however the potential for a rally is there.

For a extra in-depth look into this matter, take a look at a latest YouTube video right here: The US Greenback Decline Will Be the BTC Bull Market Catalyst