The worldwide digital asset funding market has considerably rebounded not too long ago, marking a powerful restoration for crypto-based funds. In line with CoinShares, international crypto funding merchandise introduced in $321 million in web inflows final week.

This follows two weeks of outflows, signaling a shift in investor sentiment as macroeconomic situations, such because the latest US Federal Reserve’s choice to chop rates of interest, play a serious function within the crypto market’s route.

Bitcoin And Solana Lead The Influx Surge

As revealed within the CoinShares report, Bitcoin-based funding merchandise proceed to dominate the market, accounting for many of final week’s inflows.

CoinShares reveals that Bitcoin merchandise alone noticed web inflows of $284 million. This marked a serious shift in momentum for the main crypto, which has constantly outperformed different digital property in attracting institutional funding.

Curiously, short-Bitcoin merchandise—those who revenue from a drop in Bitcoin’s value—additionally noticed modest inflows of $5.1 million, exhibiting that some buyers stay cautious, hedging towards potential volatility.

Solana-based funds have additionally been a standout in latest weeks. In line with CoinShares, the asset noticed $3.2 million in web inflows final week.

Nonetheless, whereas Bitcoin and Solana loved constructive momentum, Ethereum-based funding merchandise noticed one other week of web outflows.

CoinShares report reveals that final week alone, Ethereum merchandise recorded $29 million in outflows, extending their shedding streak to a fifth consecutive week. This brings the whole outflows for Ethereum-based funds to $187.7 million throughout this era.

What About Regional Flows?

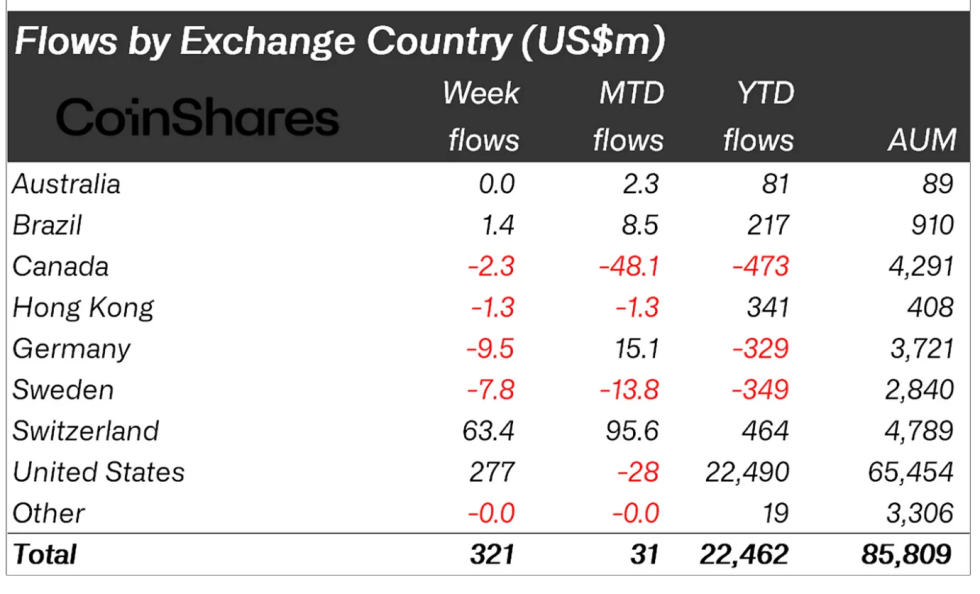

Regionally, the US stays the dominant participant within the international crypto funding market, with American-based funds bringing in $277 million in web inflows.

Switzerland adopted with its second-largest weekly inflows of $63 million, whereas nations like Germany, Sweden, and Canada confronted web outflows, exhibiting a extra combined image of worldwide crypto funding.

Notably, the rebound seen in each Bitcoin and Solana, as revealed by CoinShares Head of Analysis James Butterfill was largely pushed by a shift in US financial coverage, notably the Federal Open Market Committee’s (FOMC) “extra dovish stance” and the 50-basis-point rate of interest minimize.

This financial easing offered a positive surroundings for danger property, together with cryptocurrencies, encouraging elevated international inflows into digital asset merchandise.

Thus far, Bitcoin’s constructive inflows have been mirrored in its market efficiency, with BTC now buying and selling again above the psychological $60,000 stage. Significantly, on the time of writing, Bitcoin trades for $62,775, down barely by 1.1% prior to now day.

This enhance in value efficiency has additionally boosted Bitcoin’s market capitalization valuation from under $1.15 trillion final week to presently above $1.25 trillion.

Featured picture created with DALL-E, Chart from TradingView