Solana (SOL), the fifth-biggest cryptocurrency by market cap seems bullish and poised for a large upside rally following its consolidation breakout. After consolidating in a decent vary between $141 and $150 for the final 5 days, SOL has lastly damaged out of that zone and is now prepared for the rally.

Solana (SOL) Present Worth Momentum

At press time, SOL is buying and selling close to $153.2 and has skilled a value surge of over 7.2% up to now 24 hours. Throughout the identical interval, its buying and selling quantity elevated by 25%, indicating rising participation from merchants and buyers amid the current breakout.

Solana Technical Evaluation and Upcoming Ranges

CoinPedia’s technical evaluation means that SOL is bullish, as it’s buying and selling above the 200 Exponential Shifting Common (EMA) on a each day timeframe. The 200 EMA is a technical indicator that crypto specialists use to find out whether or not an asset is in an uptrend or downtrend.

Primarily based on the historic value momentum, if SOL closes its each day candle above the $151.5 degree, there’s a robust risk it may soar by 13% to succeed in the $165 degree and even greater if sentiment stays unchanged.

This bullish thesis will solely maintain if SOL closes its each day candle above the $151.5 degree, in any other case, it might fail.

SOL’s Bullish On-chain Metrics

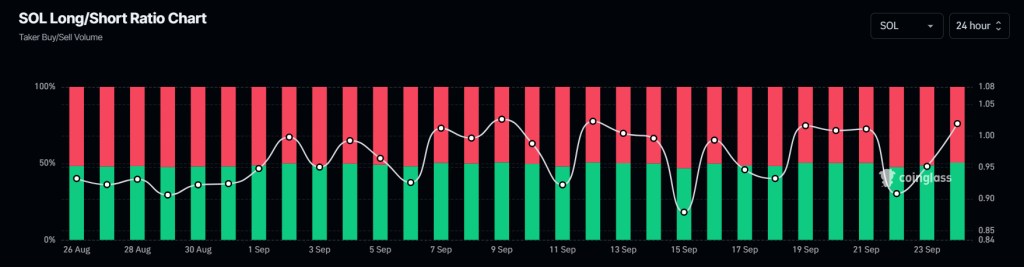

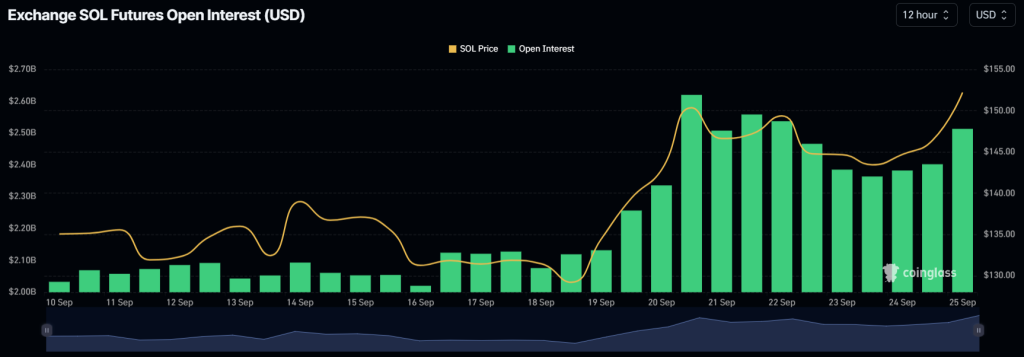

Presently, this optimistic outlook is additional supported by on-chain metrics together with SOL’s future open curiosity and Lengthy/Quick ratio. In response to Coinglass, SOL’s lengthy/quick ratio at present stands at 1.021, indicating robust bullish sentiment amongst merchants.

Moreover, its future open curiosity has jumped by 4.9% within the final 24 hours and has been steadily rising since September 10, 2024.

Merchants and buyers typically use the mix of rising open curiosity and lengthy/quick ratio above 1, whereas constructing lengthy positions. Presently, 50.5% of high merchants maintain lengthy positions, whereas 49.5% maintain quick positions.