Ethereum (ETH), the world’s second-largest cryptocurrency by market cap seems bullish and is poised for a notable upside rally attributable to its bullish value motion and favorable on-chain metrics. Along with this, whales and buyers have moved a big quantity of ETH from the exchanges up to now week.

Fall of Ethereum Alternate Reserves

In response to the on-chain analytics agency CryptoQuant, Ethereum’s change reserves have dropped from $42 billion to almost $38.5 billion, a decline of roughly $3.5 billion. This important decline within the change reserve suggests a possible signal of accumulation or acquisitions by whales or buyers.

Moreover, the decline in change reserves has occurred close to a robust help space, the place ETH is presently buying and selling.

Ethereum Technical Evaluation and Upcoming Ranges

In response to knowledgeable technical evaluation, ETH seems bullish and is shifting inside a bullish channel sample, whereas forming larger excessive and better low. At present, ETH is on the decrease boundary of the sample, forming the next low.

Based mostly on the historic information and value correction, there’s a sturdy risk that the asset may soar by 12% to succeed in the resistance stage of $2,800 within the coming days. Actually, this stage serves not solely as resistance but in addition aligns with the 200-day Exponential Transferring Common (EMA) and the higher boundary of the bullish sample.

This bullish thesis will solely maintain if ETH stays above the $2,400 stage, in any other case, it might fail.

Bullish On-Chain Metrics

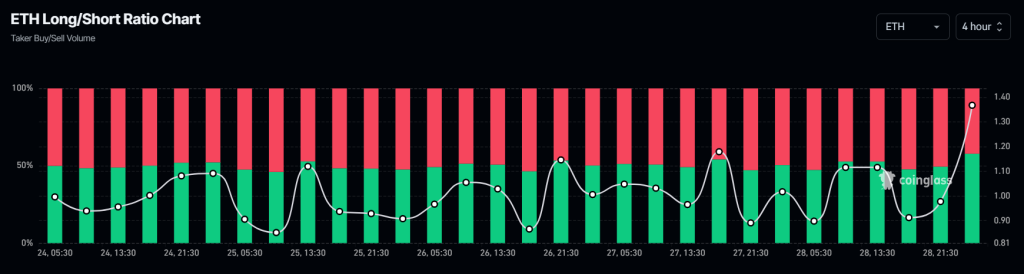

ETH’s optimistic outlook is additional supported by on-chain metrics. In response to the on-chain analytics agency Coinglass, ETH’s lengthy/brief ratio presently stands at 1.36 over the previous 4 hours, indicating sturdy bullish sentiment amongst merchants. Throughout the identical interval, 57.76% of high merchants opened lengthy positions, whereas 42.24% opened brief positions.

ETH’s open curiosity has jumped by 4.9% over the previous 24 hours and three.1% over the previous 4 hours. This rising open curiosity suggests rising dealer curiosity within the asset, resulting in the formation of latest positions.

Whereas analyzing bullish on-chain metrics with technical evaluation, it seems that bulls are presently dominating the asset and should proceed to help it within the upcoming rally.

Present Value Momentum

At press time, ETH is buying and selling close to the $2,520 stage and has skilled an upside rally of 1.20% over the previous 24 hours. Throughout the identical interval, its buying and selling quantity has jumped by 90%, indicating heightened participation from merchants and buyers amid a possible upside rally.