Dogwifhat (WIF), the favored Solana-based meme coin has turned bearish as Bitcoin (BTC), the world’s largest cryptocurrency breached its essential assist degree. Following this incident, the sentiment throughout the cryptocurrency panorama has considerably shifted in direction of a downtrend.

Dogwifhat Technical Evaluation and Upcoming Ranges

In response to knowledgeable technical evaluation, WIF has turned bearish because it breached its essential assist degree of $2.10 and is about to shut a day by day candle under it. Primarily based on latest worth motion and historic momentum, if the meme coin closes its day by day candle under that assist, there’s a robust chance of a big 35% worth decline within the coming days.

Presently, WIF is buying and selling under the 200 Exponential Shifting Common (EMA) on the day by day time-frame, indicating a downtrend. Nevertheless, this bearish thesis will solely maintain if the meme coin closes its day by day candle under the $1.97 degree, in any other case, it could fail.

WIF’s Bearish Affirmation

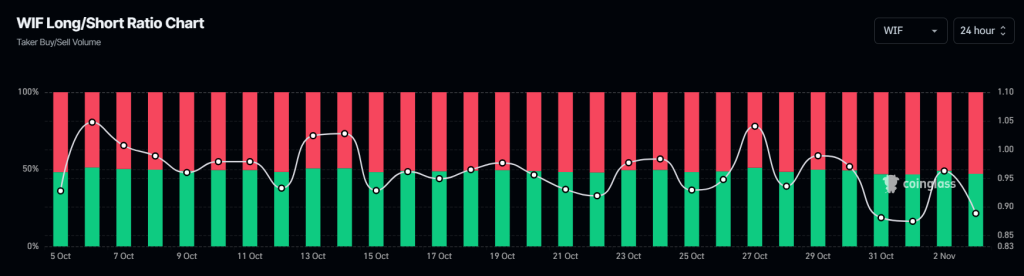

Along with the technical evaluation, on-chain metrics additional assist WIF’s detrimental outlook. In response to the on-chain analytics agency Coinglass, the WIF lengthy/quick ratio at the moment stands at 0.88, indicating a robust bearish sentiment amongst merchants.

Moreover, its open curiosity has dropped by 7.9% over the previous 24 hours, indicating liquidation of merchants’ positions as the worth started to say no and merchants hesitated to construct new positions.

Nevertheless, the falling open curiosity and a protracted/quick ratio under 1 point out weak bearish sentiment, as merchants maintain quick positions, however no important new quick positions are forming.

Present Worth Momentum

At press time, WIF is buying and selling close to $1.98 and has skilled a worth decline of over 6.9% prior to now 24 hours. Throughout the identical interval, its buying and selling quantity elevated by 13%, indicating merchants’ and traders’ participation in comparison with the day prior to this.