As Bitcoin as soon as once more finds itself in value discovery mode, market watchers and lovers are curious: has retail FOMO set in but, or is the retail surge we’ve seen in previous bull cycles nonetheless on the horizon? Utilizing knowledge from energetic addresses, historic cycles, and numerous market indicators, we’ll look at the place the Bitcoin market presently stands and what it would sign concerning the close to future.

Rising Curiosity

One of the crucial direct indicators of retail curiosity is the variety of new Bitcoin addresses created. Traditionally, sharp will increase in new addresses have typically marked the start of a bull run as new retail traders flood into the market. In current months, nevertheless, the expansion in new addresses hasn’t been as sharp as one would possibly anticipate. Final 12 months, we noticed round 791,000 new addresses created in a single day—an indication of appreciable retail curiosity. Compared, we now hover considerably decrease, though we’ve got not too long ago seen a modest uptick in new addresses.

View Reside Chart 🔍

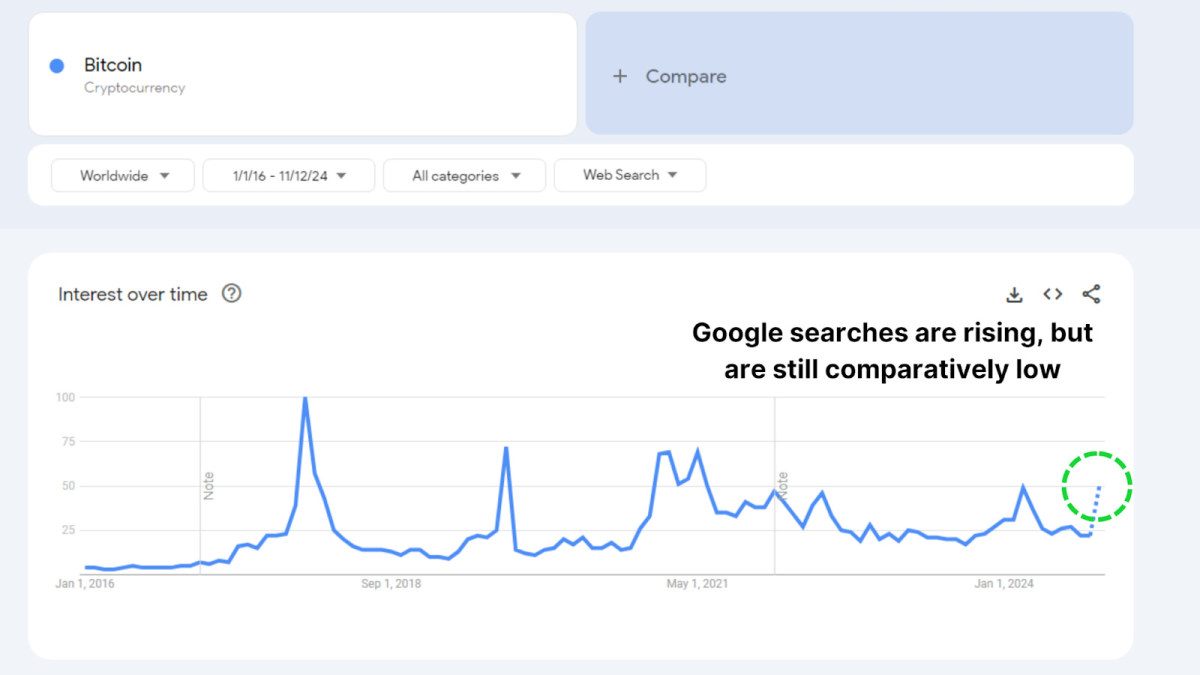

Google Traits additionally displays this tempered curiosity. Though searches for “Bitcoin” have been rising up to now month, they continue to be far under earlier peaks in 2021 and 2017. Plainly retail traders are displaying a renewed curiosity however not but the fervent pleasure typical of FOMO-driven markets.

Provide Shift

We’re witnessing a slight transition of Bitcoin from long-term holders to newer, shorter-term holders. This shift in provide can trace on the potential begin of a brand new market part, the place skilled holders start taking earnings and promoting to newer market contributors. Nevertheless, the general variety of cash transferred stays comparatively low, indicating that long-term holders aren’t but parting with their Bitcoin in vital volumes.

View Reside Chart 🔍

Traditionally, over the last bull run in 2020-2021, we noticed massive outflows from long-term holders to newer traders, which fueled a subsequent value rally. At present, the shift is barely minor, and long-term holders appear largely unfazed by present value ranges, opting to carry onto their Bitcoin regardless of market good points. This reluctance to promote means that holders are assured in additional upside potential.

A Spot-Pushed Rally

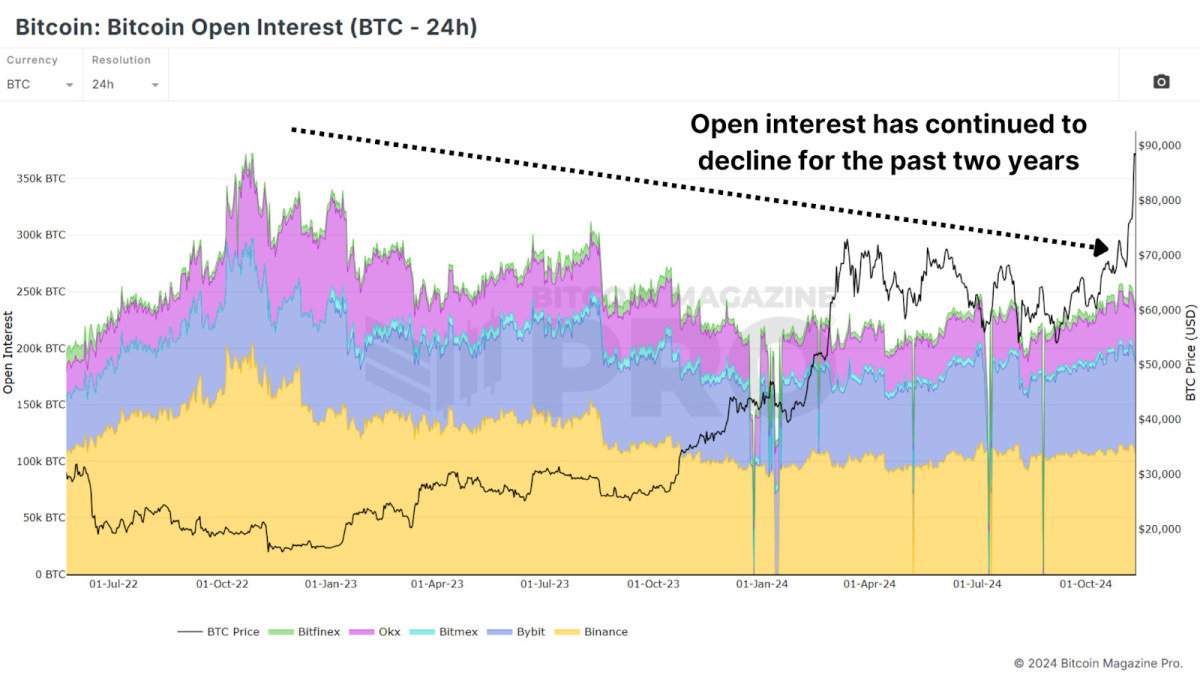

A key side of Bitcoin’s newest rally is its spot-driven nature, in distinction to earlier bull runs closely fueled by leveraged positions. Open curiosity in Bitcoin derivatives has seen solely minor will increase, which stands in sharp distinction to prior peaks. For example, open curiosity was vital earlier than the FTX crash in 2022. A spot-driven market, with out extreme leverage, tends to be extra secure and resilient, as fewer traders are prone to compelled liquidation.

View Reside Chart 🔍

Large Holders Accumulating

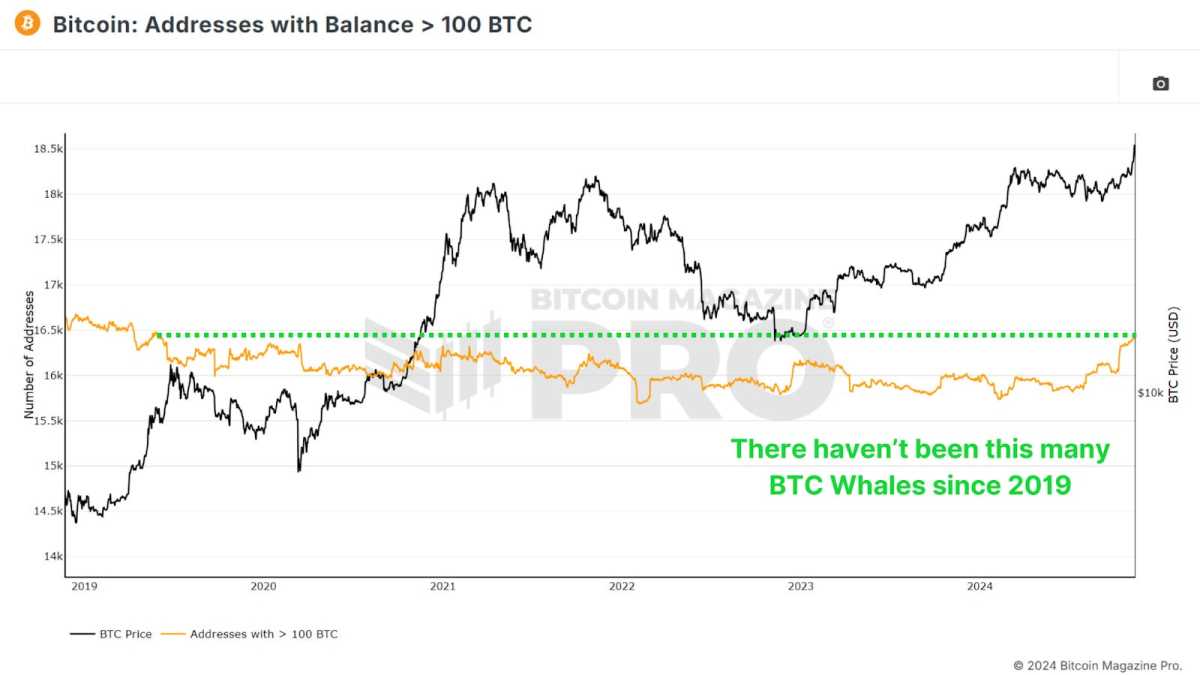

Curiously, whereas retail addresses haven’t elevated considerably, “whale” addresses holding at the least 100 BTC have been rising. Over the previous few weeks, wallets with massive BTC holdings have added tens of hundreds of cash, amounting to billions of {dollars} in worth. This improve alerts confidence amongst Bitcoin’s largest traders that the present value ranges have extra room to develop, at the same time as Bitcoin reaches all-time highs.

View Reside Chart 🔍

In previous bull cycles, we noticed whales exit or lower their positions close to market peaks, a conduct we’re not seeing this time. This development of accumulation by skilled holders is a robust bullish indicator, because it suggests religion available in the market’s long-term potential.

Conclusion

Whereas Bitcoin’s rally to all-time highs has introduced renewed consideration, we’re not but seeing the telltale indicators of widespread retail FOMO. The subdued retail curiosity suggests we could also be solely to start with part of this rally. Lengthy-term holders stay assured, whales are accumulating, and leverage stays modest, all indicators of a wholesome, sustainable rally.

As we proceed into this bull cycle, the market’s construction means that the potential for a bigger retail-driven surge stays forward. If this retail curiosity materializes, it may propel Bitcoin to new heights.

For a extra in-depth look into this matter, take a look at a current YouTube video right here: Has Retail Bitcoin FOMO Begun?