Solana and XRP noticed almost double-digit declines of their costs on the weekly timeframe as U.S. President Donald Trump made key tariff bulletins. Bitcoin’s decline dragged down most altcoins as crypto merchants assessed developments in synthetic intelligence and the ETF hype surrounding Solana and XRP.

Two new voices supply their experience on Solana’s meme coin ecosystem and the chance of altcoin ETFs in 2025, as crypto merchants regulate to shifting tides within the crypto market.

Solana ecosystem metrics and development

On-chain metrics monitoring the exercise, participation, and relevance of the Solana blockchain amongst merchants present a decline throughout all three components. The 7-day transferring common of lively addresses on the community is trending downward, as seen within the chart beneath.

A discount in lively addresses alerts declining consumer engagement, which may negatively impression charges collected and general protocol income.

The variety of new addresses can be in decline, indicating lowered participation from merchants. Mixed with a drop within the whole worth of belongings locked, this highlights Solana’s battle to take care of relevance and compete with different blockchains.

DeFiLlama knowledge exhibits that Solana’s TVL has dropped almost 16% from its January 20 peak of $12.1 billion to $10.227 billion. TVL is taken into account a key indicator of investor and developer curiosity in a blockchain.

Regardless of the decline, SOL’s TVL stays above the common degree noticed in 2024.

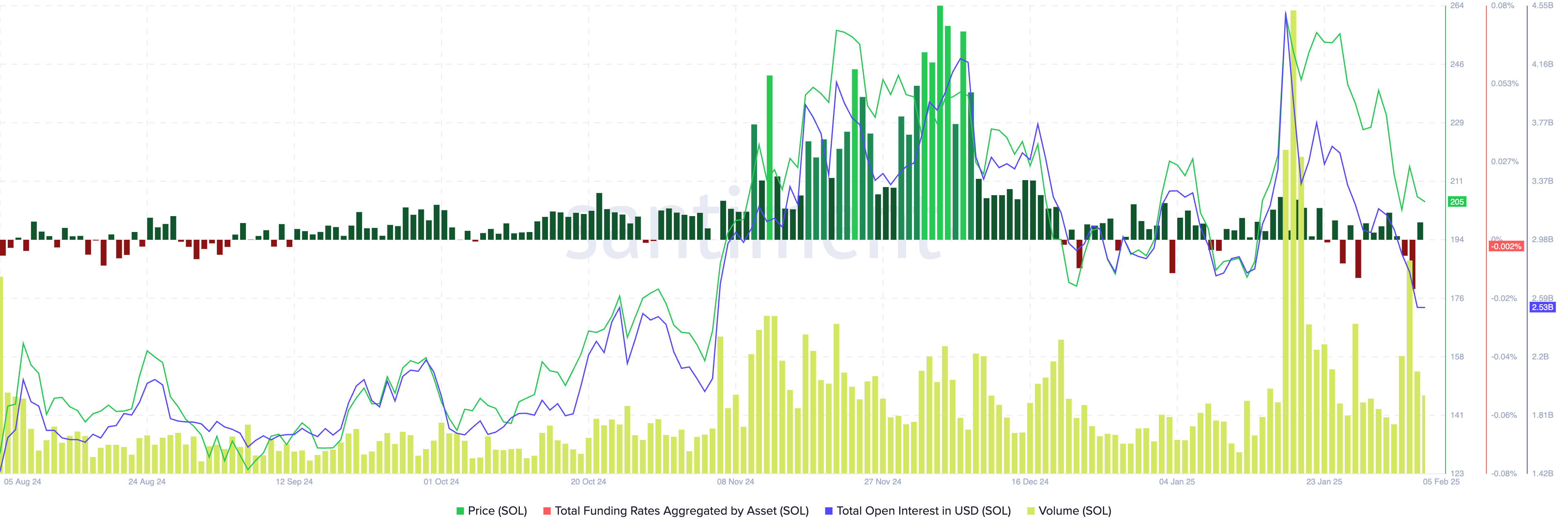

Santiment knowledge exhibits a gradual decline in open curiosity and quantity, whereas funding charges fluctuate between unfavorable and constructive. This means derivatives merchants stay undecided on Solana’s value path, at the same time as SOL experiences a pointy drop.

XRP ecosystem updates, lawsuit and Trump impact

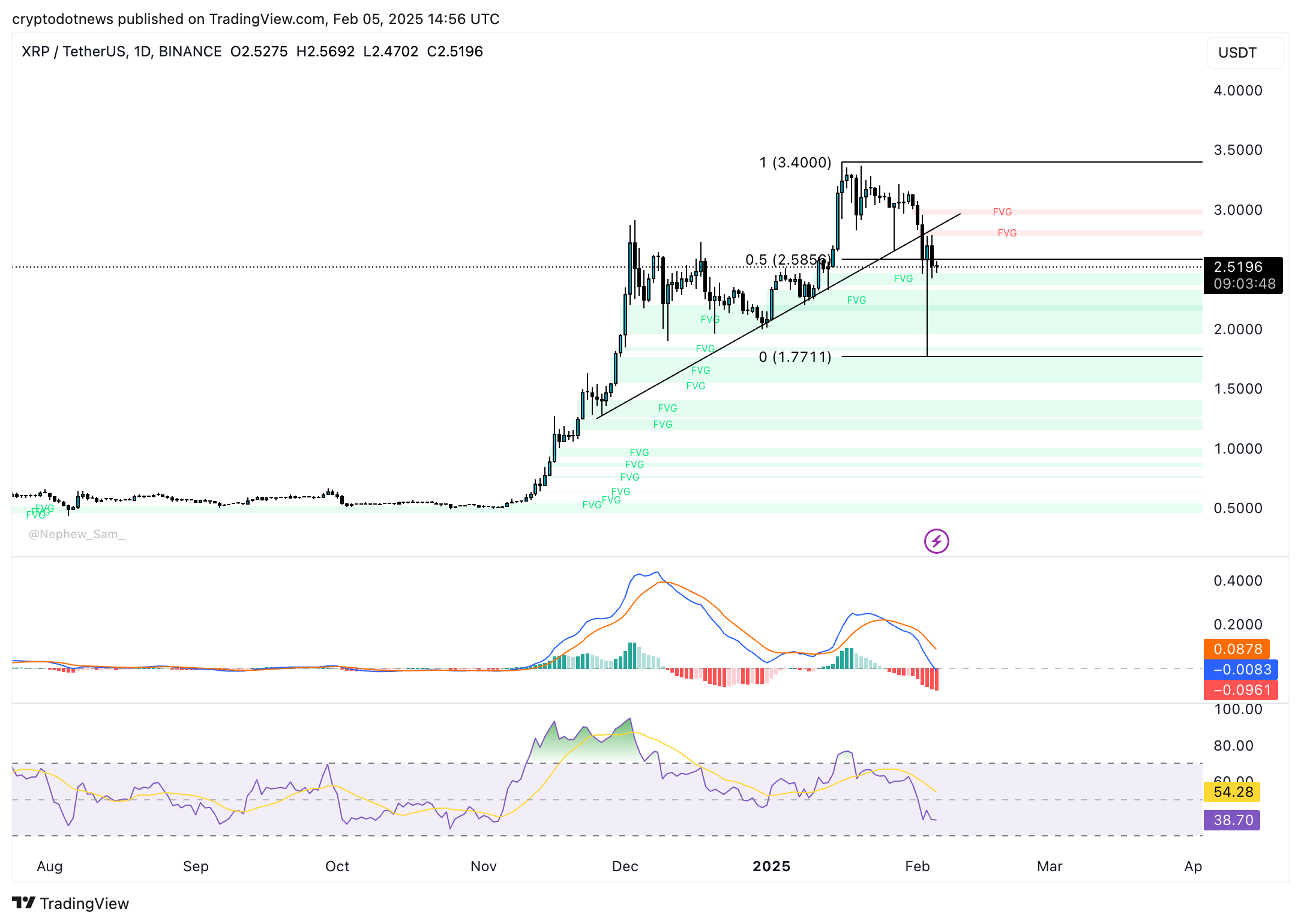

XRP value fell 16% over the previous week, in keeping with TradingView knowledge. This decline is basically attributed to a broader market correction, with Bitcoin’s drop dragging altcoins decrease amid issues over inflationary pressures.

President Trump introduced new tariffs on Canada, Mexico, and China, fueling fears of rising inflation whereas the U.S. Federal Reserve stays hesitant to chop rates of interest in 2025.

Ripple’s Chief Know-how Officer (CTO) Stuart Alderoty, expressed confidence within the new administration below Trump and expects a decision to the U.S. Securities and Alternate Fee’s (SEC) lawsuit towards Ripple.

All through the previous administration’s Struggle on Crypto, Commissioner Peirce remained a gradual voice for regulatory sanity. In the present day’s memo is one other speedy step towards turning the web page on the mess all of us inherited (and suffered via). https://t.co/IqdmefhgyX

— Stuart Alderoty (@s_alderoty) February 4, 2025

CTO Alderoty is optimistic that Trump’s new crypto job pressure lead SEC’s Hester Peirce, may pave the best way for constructive regulation. This might assist resolve the battle between the U.S. monetary regulator and the cross-border cost agency Ripple.

As merchants digest the information of the commerce struggle, XRP value outlook stays unfavorable, because it does for the remainder of the altcoins within the high 30 tokens ranked by market capitalization.

Solana and XRP derivatives and on-chain evaluation

Derivatives knowledge from Coinglass exhibits that over $332 million in crypto derivatives had been liquidated up to now 24 hours. Greater than $11 million in Solana derivatives positions had been worn out, with bullish bets struggling probably the most in comparison with bearish positions.

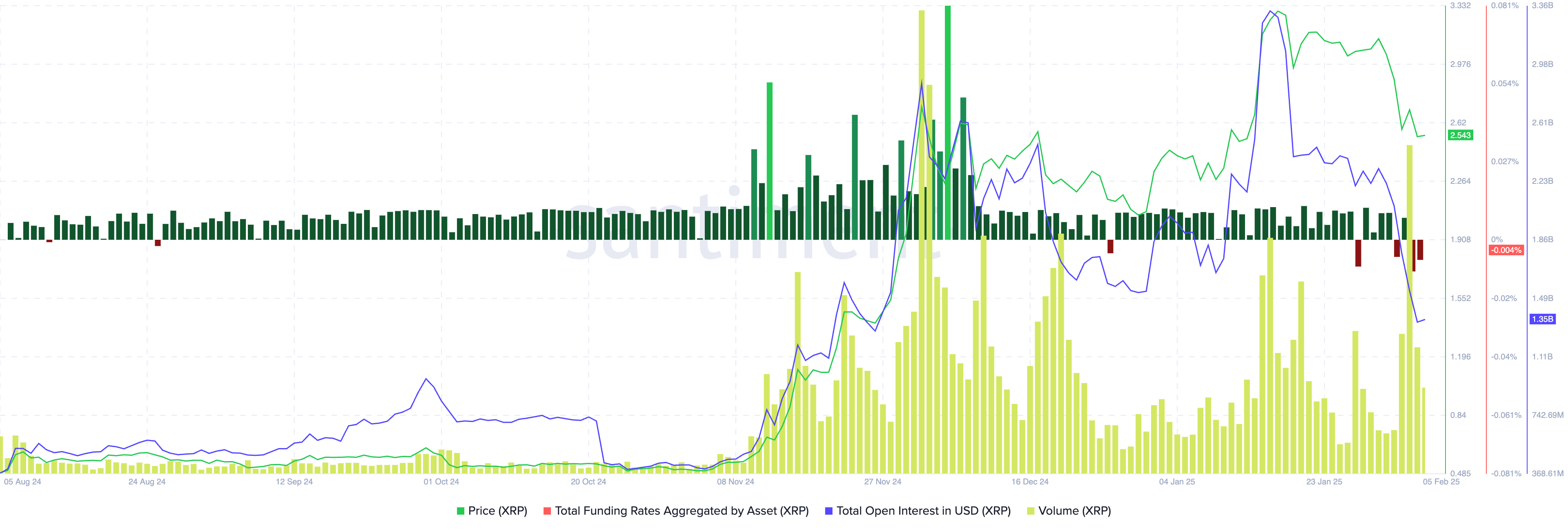

XRP additionally noticed a major improve in choices quantity and open curiosity, reflecting the web worth of all excellent derivatives contracts. In line with Coinglass knowledge, over $14 million in derivatives positions had been liquidated amid the market-wide correction.

On-chain knowledge for XRP mirrors Solana’s developments, with whole open curiosity and traded quantity declining over the previous week. That is mirrored within the spot market, the place XRP costs proceed to drop. Funding charges have remained unfavorable for 2 consecutive days, suggesting derivatives merchants are turning more and more bearish.

SOL and XRP technical evaluation and value targets

Solana maintains its long-term upward pattern at the same time as SOL consolidates close to key assist above the $200 degree. SOL may discover assist within the two imbalance zones between $190.11 and $198.47 and $169.39 to $185.84, as seen on the each day value chart on Binance.

Solana faces resistance at $218.90, the decrease boundary of the imbalance zone within the chart beneath.

Technical indicators such because the relative energy index and transferring common convergence/divergence assist a bearish outlook. The RSI is sloping downward at 42, whereas the MACD shows purple histogram bars beneath the impartial line, signaling unfavorable underlying momentum.

XRP is consolidating near assist at $2.3699, a key degree for the altcoin. XRP may discover assist within the FVG between $2.3699 and $2.4700. Technical indicators on the each day timeframe present comparable bearish outlook as for Solana.

RSI is sloping downwards and reads 38 and MACD exhibits unfavorable underlying momentum in XRP value pattern.

The meme coin ecosystem and its speedy development catalyzed an increase in Solana’s market capitalization and its competitors with Ethereum. Trump’s meme token launch on the Solana blockchain was one such strategic transfer that fueled additional good points within the SOL ecosystem.

Sharing his ideas on meme cash and the Solana meme coin ecosystem, Tim Ogilvie, World Head of Institutional at Kraken trade informed Crypto.information in an unique interview:

“Meme cash rework cultural moments into tradable belongings, permitting buyers to have interaction and capitalize on trending narratives. Solana has emerged because the epicenter of the meme coin ecosystem, due to its excessive throughput and low transaction prices.

Whereas the long-term trajectory stays unsure, meme cash have the potential to considerably broaden crypto adoption by tapping into up to date zeitgeist. As soon as people enter the area and expertise it firsthand, they could discover different alternatives inside crypto, probably driving better exercise on Solana in addition to different blockchain ecosystems.”

Nick Forster, founder at Derive.xyz maintains optimism on altcoin ETF approvals in 2025. Forster informed Crypto.information:

“We’re seeing plenty of lively spot ETF filings for belongings like Dogecoin (DOGE), Solana (SOL), XRP, and Litecoin (LTC) from main gamers like Bitwise and Grayscale. If the SEC approves these, it can sign better legitimacy for the digital asset trade and set off extra capital inflows, probably driving costs upward.

Moreover, a number of US states, together with Illinois, have introduced plans for BTC reserves, which is a robust sign of political intent to speed up crypto adoption. Whereas these measures will take time to bear fruit, we imagine they are going to contribute to a constructive long-term trajectory for the sector, laying the groundwork for development later in 2025.”

Disclosure: This text doesn’t signify funding recommendation. The content material and supplies featured on this web page are for academic functions solely.