As the general cryptocurrency market hints at indicators of value restoration, a crypto whale recognized Solana (SOL) as a super asset and positioned a big wager.

Whale Buys $20 Million Value Solana (SOL)

At the moment, February 19, 2025, the blockchain-based transaction tracker Lookonchain posted on X (previously Twitter) {that a} whale pockets tackle “AA21…VxH9” moved 123,500 SOL price $20.80 million from Binance.

This substantial SOL switch from Binance throughout market restoration seems to be a possible accumulation, which may create shopping for strain and drive additional upside momentum. Nonetheless, Solana (SOL) has not reacted considerably, as its value stays unchanged.

Solana’s Present Value Momentum

At press time, the asset is buying and selling close to $169, experiencing a modest 1% upward momentum up to now 24 hours. Nonetheless, throughout the identical interval, its buying and selling quantity dropped by 20%, indicating that merchants and traders are nonetheless hesitant to take part within the asset.

Solana (SOL) Technical Evaluation and Key Ranges

The potential cause behind this worry is the current breakdown of the essential help degree at $180, which SOL failed to carry. Moreover, it has fallen beneath the 200 Exponential Transferring Common (EMA), indicating that the asset is in a downtrend.

Primarily based on current value motion and historic patterns, it seems that SOL is bearish, with a excessive likelihood of staying between $160 and $180 till it crosses the $190 mark. Nonetheless, if the bearish sentiment and value decline proceed, and SOL falls beneath the $160 degree, there’s a sturdy risk it may drop one other 20% to achieve $120 sooner or later.

Merchants’ $145 Million Value Lengthy Wager

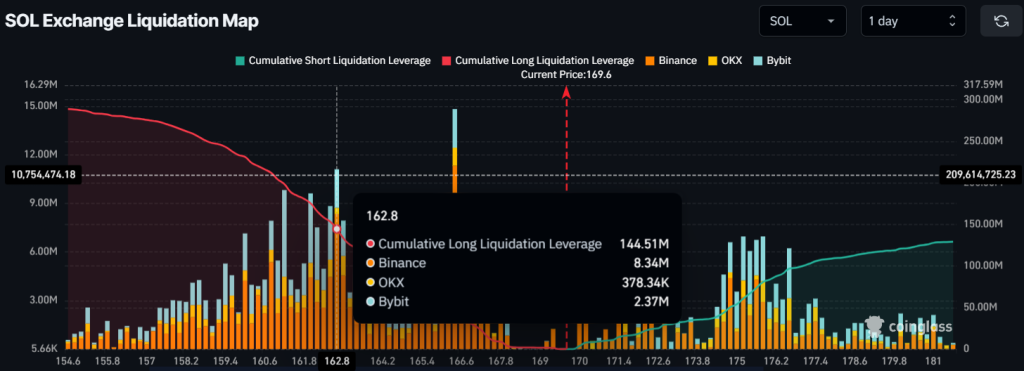

Regardless of this bearish outlook, merchants and traders appear unaffected, as they proceed accumulating and betting on the token, in accordance with on-chain analytics agency Coinglass.

In keeping with the info, merchants betting on the bullish aspect are presently dominating the asset, as they’re over-leveraged on the $162.8 degree and maintain $145 million price of lengthy positions. This over-leveraged degree means that merchants imagine SOL’s value received’t fall beneath this level, which presently acts as sturdy help.