XLM, the native token of Stellar and an XRP rival, is poised for a large worth decline because it has shaped a bearish worth sample on the four-hour timeframe. The asset is holding above an important degree, however because of bearish market sentiment and steady worth drops, it has reached a essential make-or-break degree.

XLM Technical Evaluation and Upcoming Degree

In accordance with professional technical evaluation, XLM has shaped a bearish head and shoulders sample and is on the verge of a breakout because it at present sits on the neckline. Based mostly on latest worth momentum and historic patterns, if the asset breaches this degree and closes a four-hour candle beneath $0.265, there’s a sturdy chance it might drop by 30% to succeed in $0.19 within the coming days.

Amid the continuing bearish market sentiment and steady worth decline, the asset has already traded beneath the 200 Exponential Shifting Common (EMA) on each the every day and four-hour timeframes. This means a downtrend in each the brief time period and long run.

At the moment Worth Momentum

XLM is at present buying and selling close to $0.275 and has skilled a worth drop of over 4.5% prior to now 24 hours. Throughout the identical interval, because of the market’s surprising transfer, its buying and selling quantity dropped by 35%, indicating decrease participation from merchants and buyers in comparison with earlier days.

Merchants Over-Leveraged Positions

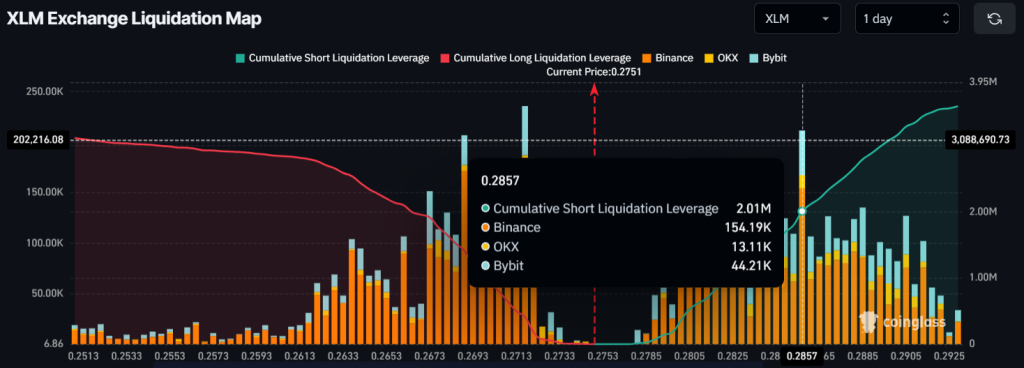

At press time, merchants are over-leveraged at $0.27 on the decrease degree and $0.285 on the higher degree, as reported by the on-chain analytics agency Coinglass.

Information additional reveals that merchants have constructed $500K price of lengthy positions on the decrease degree and $2 million price of positions on the higher degree, indicating that bears are at present dominating. This implies a powerful chance that the asset might decline within the brief time period.