The US market is eagerly ready for the second inflation report of 2025. The report is scheduled to be launched at present. Analysts predict a slight drop in each headline and core inflation. If confirmed, this could be the primary time since July 2024 that each inflation indicators have declined.

US Inflation Expectations for February

In January 2025, the core inflation fee rose from 3.2% to three.3%. The consensus is that the speed will drop from 3.3% to three.2% in February. In line with TEForecast, the speed is predicted to say no sharply from 3.3% to three.1%.

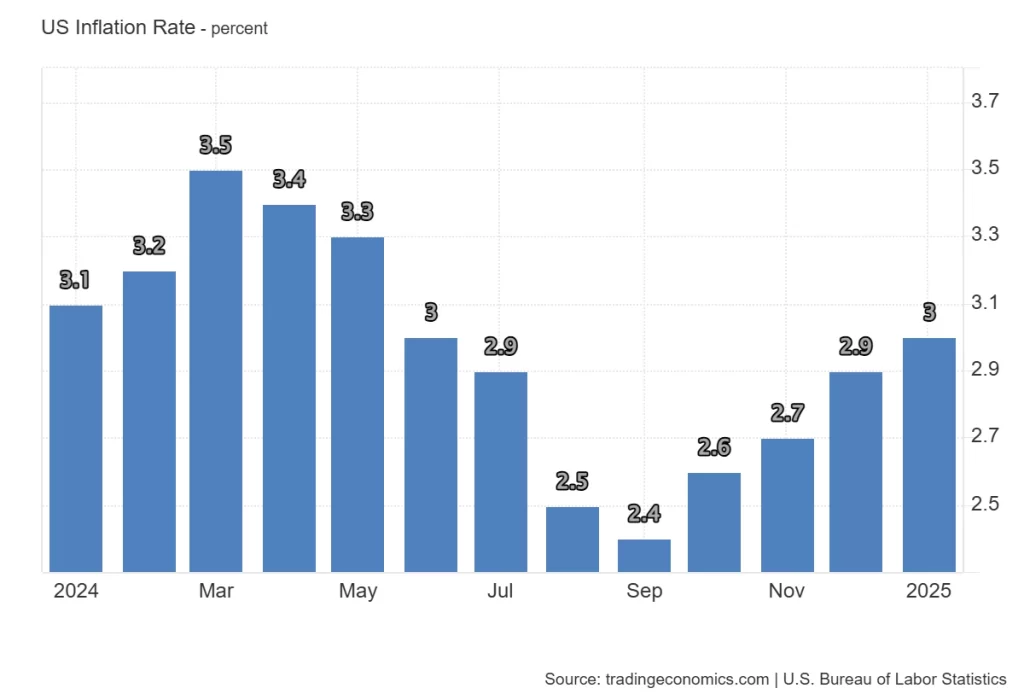

In January 2025, the US inflation fee elevated from 2.9% to three%. The consensus is that the speed will decline from 3% to 2.9% in February.

If confirmed, this could be the primary time since July 2024 that each inflation indicators have declined.

In July 2024, the core inflation fee fell from 3.3% to three.2%, and the US inflation fee dropped from 3% to 2.9%.

Since September 2024, the US inflation fee has risen constantly. In the meantime, the core inflation fee elevated from 3.2% to three.3% in September. It remained on the identical stage for the subsequent two months. In December, it dropped to three.2% from 3.3%.

Market Confidence in Inflation Cooling

Markets are extraordinarily optimistic that inflation will lower. Kalshi merchants predict that the headline CPI will drop to 2.9%. Notably, Kalshi merchants have precisely predicted at the least 6 of the final 8 CPI numbers.

- Additionally Learn :

- Crypto Information At this time, twelfth March : XRP Information , Pi Community Worth, XLM Crypto, Financial Calendar

- ,

Influence of Trump’s Commerce Insurance policies on Inflation

US President Donald Trump

At this time’s inflation report would be the first to replicate inflation underneath Trump’s robust commerce insurance policies.

Influence on the Cryptocurrency Market

If inflation declines as predicted, it might impression the cryptocurrency market in a number of methods. A cooling inflation fee will increase the chance of the Federal Reserve easing financial coverage, doubtlessly resulting in decrease rates of interest. This might create a extra beneficial setting for threat property like cryptos, driving investor confidence. Nonetheless, uncertainty surrounding Trump’s commerce insurance policies would possibly set off volatility, as international financial instability usually pushes traders towards safe-haven property like gold. If inflation stays stubbornly excessive as towards the expectation, the Fed could preserve tight financial insurance policies, placing stress on the broader monetary and crypto markets.

By no means Miss a Beat within the Crypto World!

Keep forward with breaking information, knowledgeable evaluation, and real-time updates on the most recent tendencies in Bitcoin, altcoins, DeFi, NFTs, and extra.