For over a decade, Bitcoin’s mainstream use circumstances have largely been restricted to single one-off transfers (for shifting massive sums) or as a retailer of worth, particularly compared to extra programmable blockchains.

Nonetheless, with the emergence of environment friendly liquidity mechanisms just lately, it has grow to be potential to unlock billions in worth whereas sustaining the identical ethos of safety and trustlessness which have helped forge the flagship crypto’s status.

To elaborate, conventional strategies of using Bitcoin inside the DeFi panorama have usually concerned wrapping or creating artificial representations of the token on different chains, thereby introducing extra layers of threat and complexity. On this context, the thought of shared liquidity essentially modifications this status-quo by permitting holders to keep up publicity to Bitcoin’s worth appreciation whereas concurrently placing their belongings to work in securing decentralized companies.

Furthermore, the idea of liquid safety builds upon the confirmed safety mechanisms of proof-of-stake (PoS) techniques however applies them to Bitcoin’s large fund pool. By enabling BTC holders to make use of their belongings as collateral, it creates highly effective financial incentives that align the pursuits of holders with the safety wants of the broader ecosystem.

This alignment is especially essential for rising protocols and companies that wrestle with the “chilly begin” drawback – i.e., the problem of creating enough safety and belief following the primary few months/years of their launch. In that sense, BTC’s unmatched status and important market capitalization make it the perfect safety spine for these nascent techniques.

The implications of such common yield layers on the DeFi market stand to be far-reaching as past merely enabling yield technology, they’ll create a brand new paradigm of belief minimization and safety. Thus far, when Bitcoin is used as collateral in these liquidity effectivity protocols, it introduces robust financial safety ensures for validators and repair suppliers. Any malicious habits can lead to penalties, the place the offered Bitcoin is confiscated or burned.

A couple of pioneers are main the best way

From the surface trying in, creating an environment friendly liquidity layer requires subtle technical infrastructure that’s able to bridging Bitcoin’s comparatively restricted programmability with the advanced necessities of recent DeFi purposes.

Among the many platforms working to meet this imaginative and prescient, SatLayer has emerged as a standout entity. Based in early 2024 by MIT alumni, it operates as a shared safety platform particularly designed to leverage Bitcoin as its main safety collateral. By being deployed as a set of good contracts atop the favored platform Babylon, SatLayer allows BTC holders to safe any kind of decentralized utility or protocol as a Bitcoin Validated Service (BVS), successfully remodeling how Bitcoin’s large worth will be harnessed inside Web3.

On a extra technical be aware, one can see that SatLayer connects three essential participant teams, particularly Bitcoin suppliers who improve financial safety by depositing their cash; BVS builders who create and keep companies secured by this Bitcoin; and Operators who present the technical infrastructure to run these companies.

This three-sided market allows Bitcoin holders to earn rewards for offering safety whereas builders can bootstrap new companies with strong safety ensures. Lastly operators can obtain compensation for his or her technical experience and infrastructure provision.

One other really standout facet of SatLayer — one which differentiates it from different platforms — is its implementation of absolutely programmable penalty situations. For example, when a penalty situation is triggered inside a BVS’s on-chain contract, operators who violate established guidelines can have their offered belongings confiscated (creating robust monetary incentives for accountable operation whereas giving BVS builders appreciable flexibility in designing their safety parameters).

These penalized belongings will be redirected as protocol income or completely burned, creating accountability inside a trustless system.

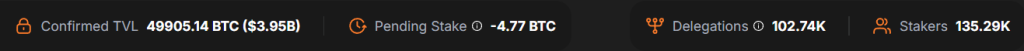

Lastly, it bears mentioning that in latest months SatLayer has solid strategic partnerships with main entities like Babylon Labs (which at present possesses over $3.5 billion in Whole Worth Locked (TVL). Not solely that, the challenge’s upcoming integration with Sui — an L1 designed for near-instant and low-cost transactions — has showcased its dedication to increasing Bitcoin’s utility throughout a number of ecosystems.

Latest metrics related to the Babylon ecosystem (as of April 8, 2025)

A limitless future

Whether or not one likes it or not, SatLayer’s common yield layer stands to signify some of the important evolutions for BTC and the way it can work together with the broader DeFi ecosystem. Because the know-how continues to mature, one can anticipate to see more and more subtle purposes of Bitcoin’s safety throughout the Web3 panorama, probably paving the best way for a extra value-driven crypto ecosystem.