Knowledge exhibits the Bitcoin Choices 25 Delta Skew has seen a bullish flip, an indication that the merchants could also be anticipating a worth rebound.

Bitcoin Choices 25 Delta Skew Suggests Merchants Are Positioning For Upside

As identified by the analytics agency Glassnode in a brand new submit on X, the Choices 25 Delta Skew has lately noticed a reversal to constructive ranges for Bitcoin. The “25 Delta Skew” is an indicator associated to the BTC Choices market that mainly tells us concerning the sentiment current among the many merchants.

The metric does so by evaluating the Implied Volatility (IV) of bearish positions (places) and bullish positions (calls). Right here, the IV is a measure of how unstable the merchants count on the asset to be sooner or later.

The 25 Delta Skew particularly compares this expectation for the places and calls with a delta of 25. That’s, the Choices contracts whose worth adjustments by $0.25 for each $1 change within the BTC spot worth.

Naturally, for places, the change is in the other way to the worth, as these positions are betting on a bearish final result. This implies their worth rises by $0.25 at any time when BTC goes down $1. Alternatively, the $0.25 improve/lower occurs alongside a $1 worth improve/lower within the asset’s spot worth for the calls.

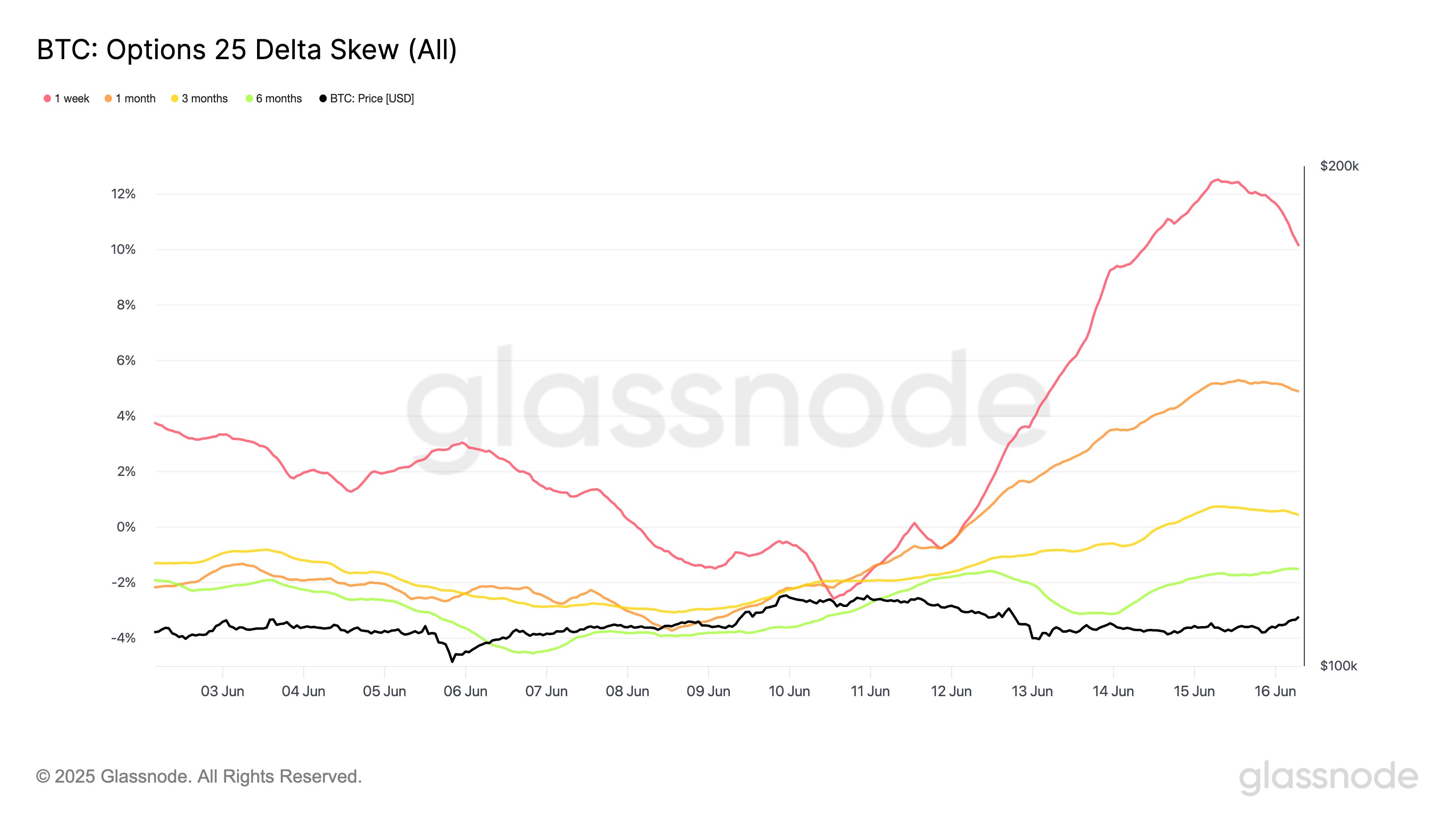

Now, here’s a chart that exhibits the pattern within the Bitcoin Choices 25 Skew Delta for a number of totally different expiration intervals during the last couple of weeks:

The worth of the metric seems to have gone up on all of those expiration timeframes in current days | Supply: Glassnode on X

As displayed within the above graph, the Bitcoin Choices 25 Delta Skew was beneath the 0% mark for all of those expiries earlier within the month. Through the previous week, nonetheless, a flip seems to have occurred out there, with the metric climbing to a constructive worth for all of them.

The pattern is particularly outstanding in short-dated contracts. The positions expiring in a single week have seen the indicator go from -2.6% to +10.1%. Equally, these expiring in a single month have noticed a reversal from -2.2% to +4.9%.

Primarily based on the pattern, the analytics agency notes, “merchants are aggressively positioning for near-term upside or volatility.” This bullish flip within the Choices market has curiously come whereas Bitcoin has confronted some bearish worth motion. It now stays to be seen whether or not the bullish confidence from the market will repay or not.

In another information, Technique has accomplished one more Bitcoin buy, as Chairman Michael Saylor has shared in an X submit. The acquisition, involving 10,100 tokens, has price the corporate round $1.05 billion. The agency now holds a complete of 592,100 BTC, with a value foundation of $41.84 billion.

BTC Value

Bitcoin has made a slight restoration through the previous day as its worth has returned to $106,600.

The pattern within the BTC worth over the previous 5 days | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, Glassnode.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our crew of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.