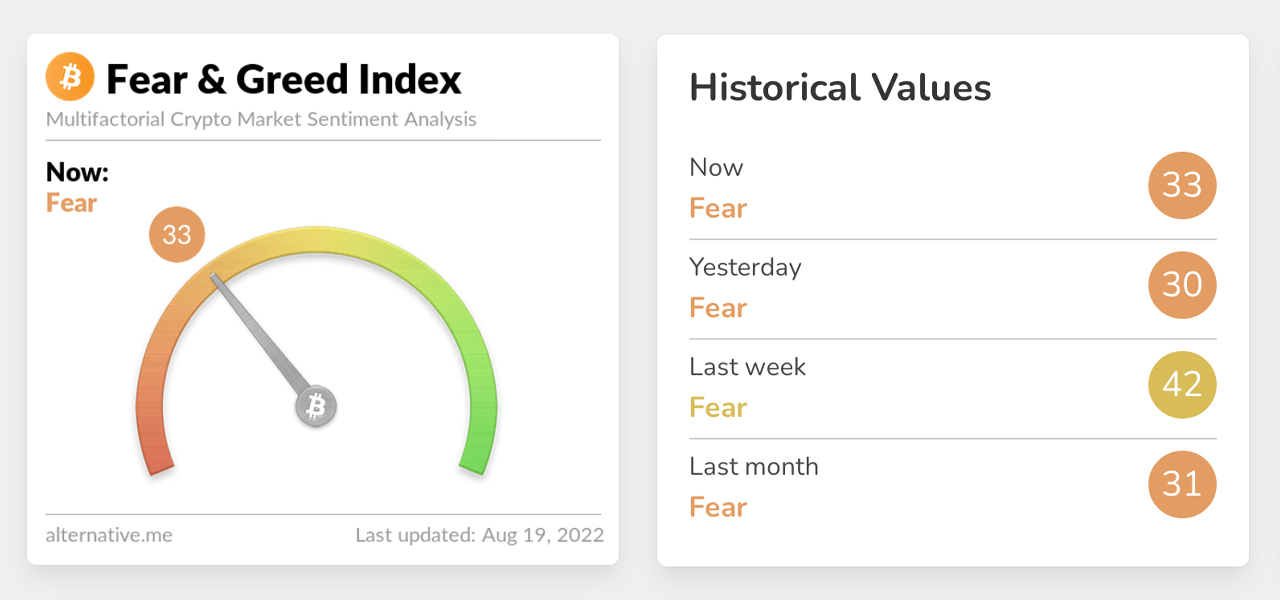

After the Crypto Worry and Greed Index (CFGI) dropped to vital lows and pointed to “excessive worry” in crypto markets on the finish of Could, and all through most of June, at this time the CFGI score remains to be within the “worry” zone, nevertheless it has seen an enchancment. On June 19, the CFGI score tapped a low rating of 6 which suggests “excessive worry,” and 61 days or two months later, the CFGI score now exhibits a rating of 33 or “worry.”

CFGI Rating Rating Reveals Crypto Winter Continues to Maintain Investor Sentiment within the ‘Worry’ Zone

Whereas the crypto economic system has jumped again above the $1 trillion vary, costs have began to drop once more after the final rally. Following the Terra blockchain implosion, the crypto economic system misplaced vital worth and excessive worry shook the neighborhood into June as properly. The Crypto Worry and Greed Index (CFGI) hosted on various.me dropped severely on the time, and on Could 31, 2022, Bitcoin.com Information reported the CFGI rating rating was 16 out of 100 or “excessive worry.”

On daily basis the CFGI rating rating analyzes “feelings and sentiments from totally different sources and crunch them into one easy quantity.” Different.me signifies that the worth of 0 means “Excessive Worry” whereas a price of 100 represents “Excessive Greed.” The web site provides:

The crypto market [behavior] could be very emotional. Individuals are inclined to get grasping when the market is rising which leads to FOMO (Worry of lacking out). Additionally, folks typically promote their cash in irrational response [to] seeing pink numbers — There are two easy assumptions: 1) Excessive worry could be a signal that traders are too nervous. That may very well be a shopping for alternative. 2) When Traders are getting too grasping, which means the market is due for a correction.

In mid-June, the CFGI rating rating sunk even decrease and slipped to a low rating of 6 out of 100 on June 19, 2022. Historic crypto value information exhibits that BTC was buying and selling for $20,553 per unit that day and the day prior on June 18, BTC tapped a 2022 low at $17,593 per unit. In the present day, the CFGI rating rating has improved and the sentiment worth has moved out of the “excessive worry” place into the “worry” zone with a rating of 33 out of 100.

BTC managed to recoup some losses after the market routs in Could and June, and on August 14, 2022, the value tapped $25,212 per unit. On that very same day, the CFGI rating rating jumped to a 47 exhibiting sentiment was turning. Nevertheless, over the past 48 hours, BTC has dropped considerably in worth, sliding from $23,593 per unit to at this time’s low of $21,268. The CFGI rating has not been capable of rise above the “worry” zone and appears to be heading again to the vary of “excessive worry” scores.

Tags on this story

What do you consider the current CFGI rating rating and the crypto economic system diving in USD worth once more? Tell us what you consider this topic within the feedback part under.

Jamie Redman

Jamie Redman is the Information Lead at Bitcoin.com Information and a monetary tech journalist dwelling in Florida. Redman has been an energetic member of the cryptocurrency neighborhood since 2011. He has a ardour for Bitcoin, open-source code, and decentralized functions. Since September 2015, Redman has written greater than 5,700 articles for Bitcoin.com Information concerning the disruptive protocols rising at this time.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, CFGI through Different.me

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, straight or not directly, for any injury or loss triggered or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or companies talked about on this article.