That is an opinion editorial by Pierre Corbin, the producer and director of “The Nice Reset And The Rise of Bitcoin” documentary.

Within the 18th century, the Dutch launched the idea of mutual funds, permitting traders to diversify between completely different worldwide bonds. The identical idea was embraced in London within the nineteenth century. This idea is what allowed corporations like F&C Funding Belief to be based in 1868. F&C managed a portfolio of high-yielding worldwide bonds, which pushed ahead the idea of portfolio diversification by placing collectively completely different securities that lowered the danger of the portfolio. That is true in monetary concept, and anybody who has the next training in finance absolutely labored on constructing completely different fashions round that. On the time, they believed that including any sort of extra asset right into a portfolio lowered its danger — we now know this isn’t the case.

After all, London was the place the cash was on the time. After beating France in the course of the Napoleonic Wars, the U.Ok. established its place because the world’s strongest empire and unfold the British pound the world over. This diversification concept was an excellent motive to spend money on the whole world. Inventory exchanges began sprouting all over the world and have been an indication of a developed capital metropolis. In keeping with William Goetzmann of the Nationwide Bureau of Financial Analysis, “Between 1880 and 1910, greater than half the world’s markets have been launched.”

The British empire was far-reaching and majestic, however after World Struggle I, World Struggle II and the a number of bankruptcies inside this era, it needed to transfer apart and let one other robust energy take over: the USA.

The U.S. has grown its affect similarly:

- That is the place the cash middle was.

- By leveraging worldwide markets and worldwide investments.

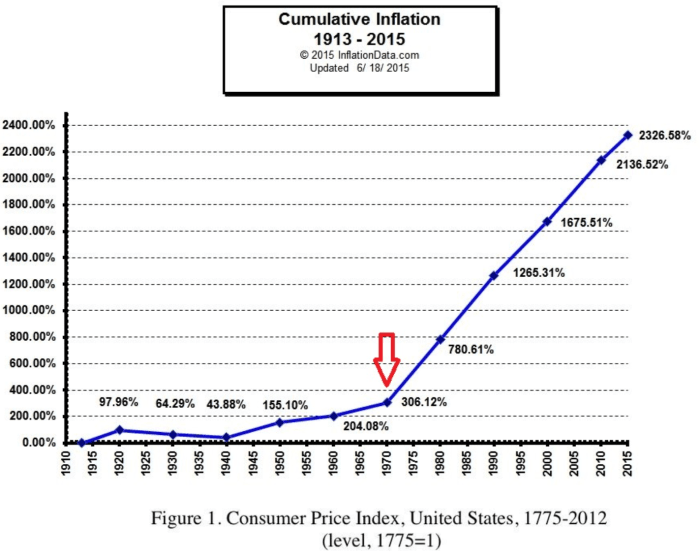

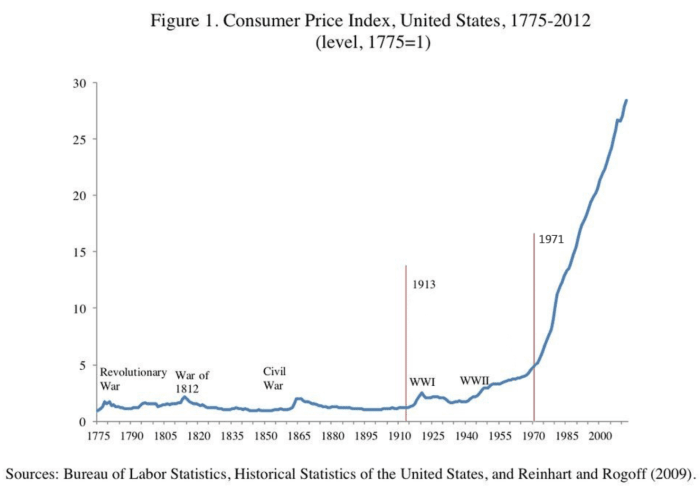

The U.S. greenback was on the middle of this enlargement, and the U.S. was answerable for the forex, giving them enormous leverage over the remainder of the world. Since then, time and time once more, the USA has used army energy to ascertain and to defend the standing of the greenback. We’ve seen this in Iraq and in different worldwide conflicts. The U.S. has to defend the standing of the greenback as a result of with out the standing of world reserve forex, the established order of the U.S. is in danger and will have massive impacts on the U.S. and world financial system. The actual fact is that in attempting to maintain its standing and the system created on account of the Bretton Woods settlement, the U.S. leaders have slowly destroyed the worth of the U.S. greenback and have impoverished their residents alongside the best way. There are some clear charts that illustrate this long-term phenomenon that may be considered right here.

This, after all, just isn’t solely a U.S. phenomenon, however is true for the remainder of the world too. By means of using the petrodollar, and since the U.S. greenback is the worldwide reserve forex, each different forex has been devalued quicker, resulting in the identical end result, if not worse, in all places else.

At the moment, it looks as if we’re at a shifting level. The battle for U.S. greenback hegemony goes robust in Europe, exactly in Ukraine. The headlines of the whole world focus solely on the battle, however omit to say what is occurring within the background with the fiat system, on the danger of exposing the true geopolitical performs. The BRICS nations have given clear hints about their mid-to-long-term opinion about the way forward for the U.S. greenback. They’ve formally introduced that they’re constructing a brand new reserve forex based mostly on actual onerous property, which embrace a couple of valuable metals, additional forcing the U.S. to attempt to strengthen their place because the world police. We’re seeing this by the affect that was used following the end result of the presidential elections in Pakistan and the place they’re attempting to absorb the China-Taiwan relationship.

The battle for the U.S. greenback can be taking place on one other continent: Central America has at all times been beneath massive affect from the USA. Thomas Jefferson as soon as stated, “In no matter governments they finish, they are going to be American governments, not to be concerned within the never-ceasing broils of Europe. America has a hemisphere to itself.” This meant the U.S. would be sure that European nations go away the area, to allow them to affect the area themselves.

A small nation, traditionally destroyed by the U.S. and their overreach within the area, is attempting to detach from the greenback for the reason that nation adopted it 20 years in the past, following the poor native financial coverage that was in place for many years. In September 2021, in a historic transfer, El Salvador, the smallest nation within the area, was the primary nation on this planet to undertake bitcoin as authorized tender, sparking the hearth that pressured the U.S. authorities to set its eyes on the area once more. Since then, El Salvador has turn out to be a extra necessary matter in worldwide media. Due to this transfer, El Salvador’s tourism has elevated by 30% for the reason that launch of the Bitcoin Regulation, and as talked about by their president, Nayib Bukele, the El Salvador gross domestic product (GDP) grew 10.3% in 2021, the primary 12 months of their historical past to have a double-digit GDP development.

On the worldwide scene, although, their geopolitical relationships appear to have modified for the reason that nation’s adoption of bitcoin. The most effective signal of that is the Accountability for Cryptocurrency in El Salvador (ACES) Act launched by U.S. senators Jim Risch (R-Idaho), Bob Menendez (D-N.J.) and Invoice Cassidy (R-La.). The objective of this laws is to permit the U.S. to watch the adoption of bitcoin in El Salvador and take actions in the event that they contemplate that it could actually signify a danger for the U.S. financial system. As a reminder, the U.S. GDP in 2021 was $23 trillion, whereas the El Salvador GDP was $28.7 billion. This makes the El Salvador financial system an order of magnitude smaller than the one within the U.S. It looks as if the objective of this laws is to not mitigate the dangers El Salvador represents to the U.S. financial system, however to have a sufferer in case they contemplate bitcoin to be harmful to the U.S. greenback.

Samson Mow, CEO of JAN3, described this the very best:

(Source)

One other necessary level to notice is the recognition of Nayib Bukele within the area. Adopting bitcoin comes with adopting higher long-term values. He’s among the many hottest presidents within the historical past of his nation and is the most well-liked president in Latin America.

Because the adoption of bitcoin in El Salvador, different nations within the area have thought-about adopting it too, however have slowed their adoption due to exterior stress. Honduras is slowly shifting ahead although, because of areas or cities appearing independently within the hopes of attracting overseas investments and tourism.

The U.S. authorities’s battle for the greenback is an enchanting story. We’re at a turning level in historical past, the place the greenback may lose its reserve forex standing, and the U.S. authorities will do virtually something to defend it. Considered one of their actions on this path is to censor bitcoin adoption on this planet.

This can be a visitor put up by Pierre Corbin. Opinions expressed are solely their very own and don’t essentially mirror these of BTC Inc. or Bitcoin Journal.