Quantitative easing (QE) has grow to be synonymous with the COVID-19 pandemic because the blowout from the lockdowns stalled the expansion of the worldwide economic system and threatened to show right into a monetary disaster.

To artificially create financial progress, central banks started shopping for up authorities bonds and different securities, whereas governments started increasing the cash provide by printing extra money.

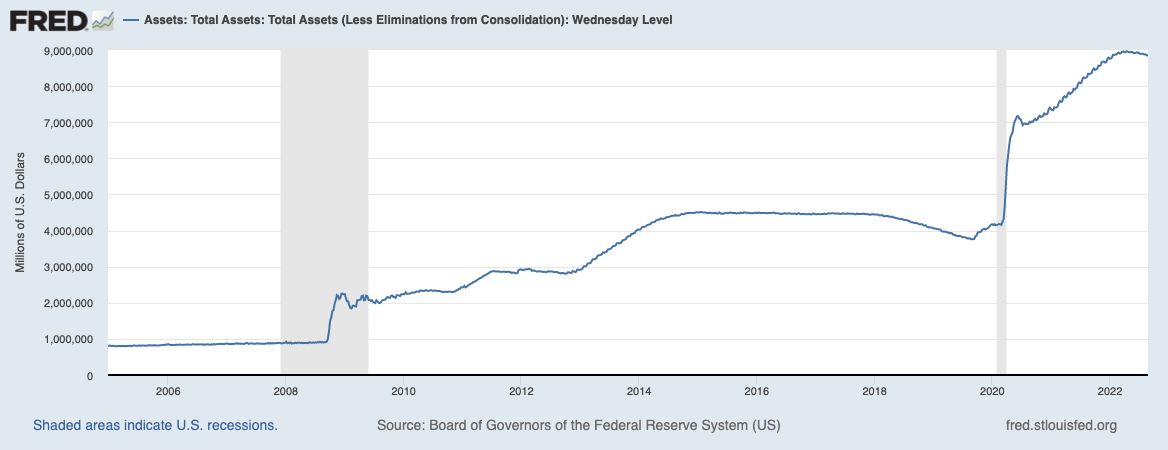

This was felt essentially the most within the U.S., the place the Federal Reserve elevated the speed of {dollars} in circulation by a document 27% between 2020 and 2021. The Fed’s stability sheet reached round $8.89 trillion on the finish of August 2022, a rise of over 106% from its $4.31 trillion measurement in March 2020.

None of this, nonetheless, managed to discourage a monetary disaster. Fueled by the continued battle in Ukraine, the present disaster is slowly gearing as much as grow to be a full-blown recession.

To mitigate the results of its ineffective QE insurance policies, the Federal Reserve has launched into a quantitative tightening (QT) spree. Additionally known as stability sheet normalization, QT is a financial coverage that reduces the Fed’s financial reserves by promoting authorities bonds. Eradicating Treasurys from its money balances removes liquidity from the monetary market and, in principle, curbs inflation.

In Could this 12 months, the Fed introduced that it might start QT and lift the federal funds price. Between June 2022 and June 2023, the Fed plans on letting round $1 trillion price of securities mature with out reinvestment. Jerome Powell, the Chairman of the Federal Reserve, estimated this could equal one 25-basis-point price hike in how it might have an effect on the economic system. On the time, the cap was set at $30 billion per 30 days for Treasurys and $17.5 billion for mortgage-backed securities (MBS) for the primary three months.

Nevertheless, more and more worrying inflation has pushed the Fed to double its shrinking tempo for September, rising it from $47.5 billion to $95 billion. Which means that we will anticipate $35 billion in mortgage-based securities to be offloaded in a month. And whereas the market appears extra anxious about Treasurys, offloading the mortgage-backed securities might be what truly triggers a recession.

The hazards of the Fed unloading mortgage-backed securities

Whereas mortgage-backed securities (MBS) have been a big a part of the monetary market within the U.S. for many years, it wasn’t till the 2007 monetary disaster that most of the people grew to become conscious of this monetary instrument.

A mortgage-backed safety is an asset-backed safety that’s backed by a group of mortgages. They’re created by aggregating an analogous group of mortgages from a single financial institution after which bought to teams that bundle them collectively right into a safety that traders should purchase. These securities had been thought of a sound funding earlier than the 2007 monetary disaster, as in contrast to bonds which paid out quarterly or semi-annual coupons, mortgage-backed securities paid out month-to-month.

Following the collapse of the housing market in 2007 and the next monetary disaster, MBS grew to become too tainted for personal sector traders. To maintain rates of interest steady and stop additional collapse, the Federal Reserve stepped in as a purchaser of final resort and added $1 trillion in MBS to its stability sheet. This continued till 2017 when it began letting a few of its mortgage bonds expire.

The 2020 pandemic compelled the Fed to go on one other shopping for spree, including billions in MBS to its portfolio to inject money into an economic system battling lockdowns. With inflation now hovering, the Fed is embarking on one other offloading spree to maintain rising costs at bay.

Along with permitting them to run out, the Fed can be promoting the mortgage-backed securities in its portfolio to non-public traders. When non-public traders purchase these mortgage bonds, it pulls money out of the general economic system — and will (a minimum of in principle) assist the Fed obtain precisely what it got down to do.

Nevertheless, the probabilities of the Fed’s plan truly working are lowering day-after-day.

Whereas offloading $35 billion in MBS each month may appear to be it’s curbing inflation within the quick time period, it might have a detrimental impact on the already struggling housing market.

For the reason that starting of the 12 months, mortgage charges have elevated from 3% to five.25%. The bounce to three% from a 2.75% fastened rate of interest was sufficient to boost crimson flags for a lot of. A bounce to five.25% and the potential to extend even larger implies that tons of of 1000’s of individuals might be pushed out of the housing market. The gravity of this downside turns into clearer when taking a look at it as a share enhance, and never as an absolute quantity — rates of interest have gone up 75% because the starting of the 12 months.

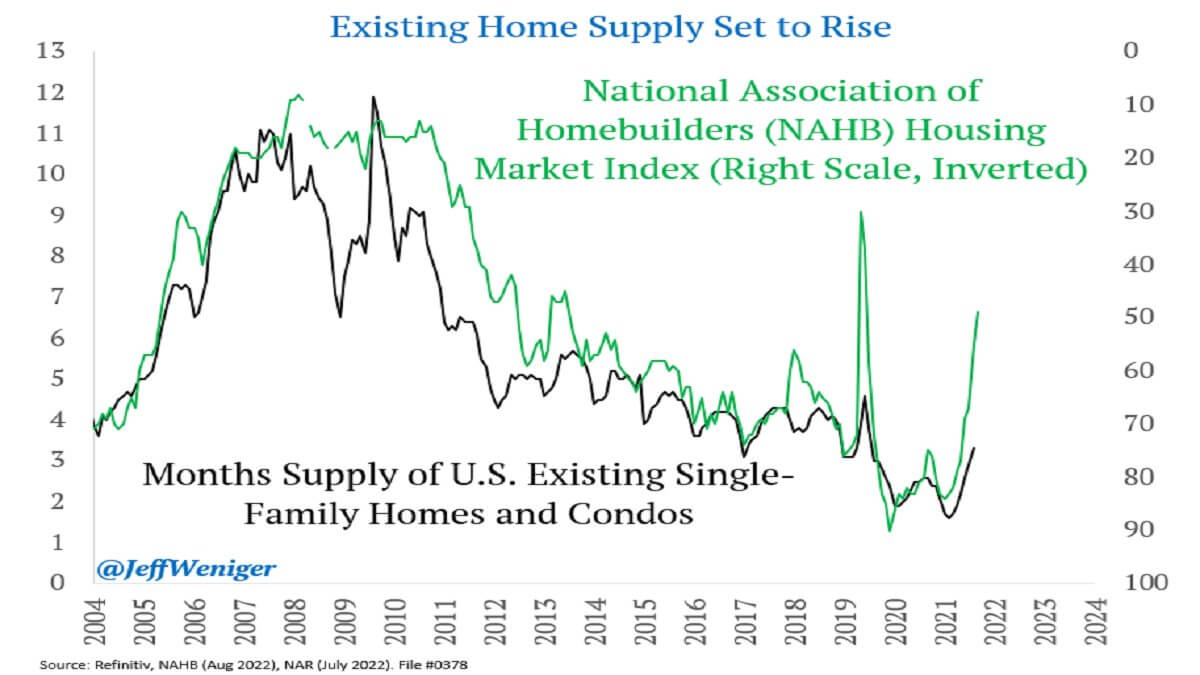

With mortgage funds 75% larger, the market might see many individuals defaulting on their funds and their houses in peril of foreclosures. If mass foreclosures like those we’ve seen in 2007 do occur, the U.S. housing market might be flooded with a contemporary provide of homes.

Information from the Nationwide Affiliation of Homebuilders (NAHB) reveals that the month-to-month provide of single-family houses and condos within the U.S. has been on the rise since 2021. The NAHB Housing Market Index, which charges the relative degree of single-family dwelling gross sales, has been lowering considerably because the starting of the 12 months, coming into its eighth straight month of decline.

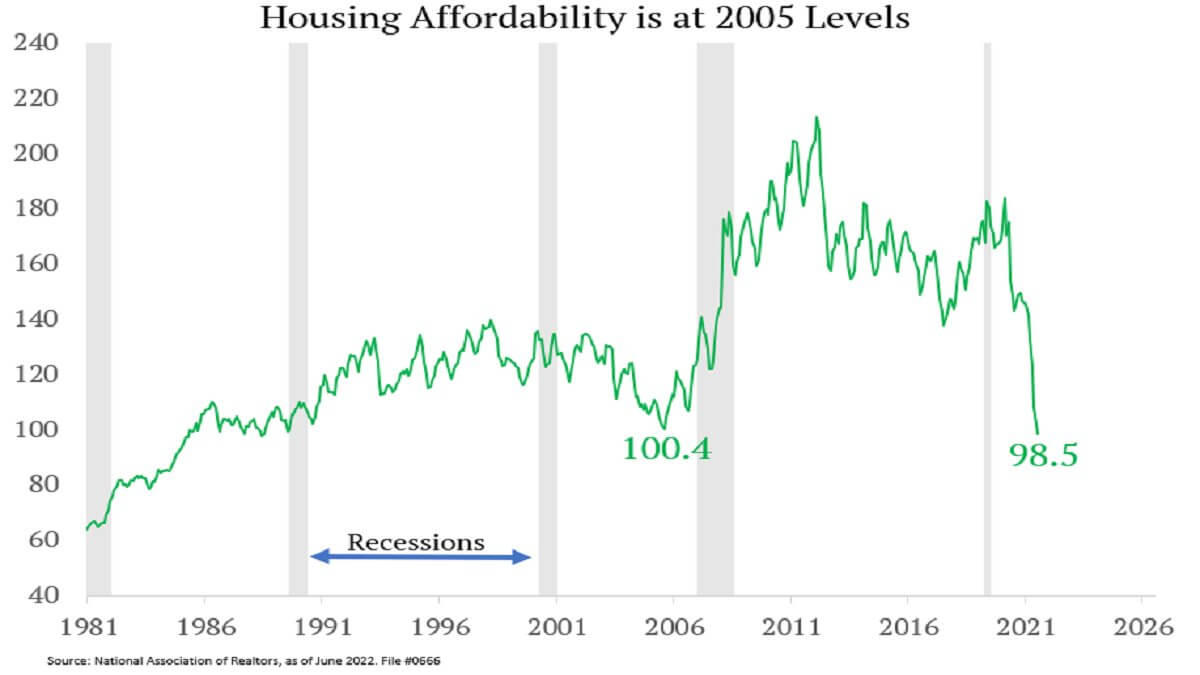

In response to information from the Nationwide Affiliation of Realtors, housing affordability within the U.S. has reached its 2005 ranges, suggesting that housing costs might peak simply as they did in 2006.

Redfin and Zillow, the 2 largest actual property brokerages within the U.S., noticed their share value drop 79% and 46% because the starting of the 12 months. The difficulty that’s been brewing within the housing market since final summer season reveals that the “gentle touchdown” the Fed is making an attempt to realize with QT might be something however gentle. With increasingly market situations lining up nearly completely with the situations seen in 2006, a brand new housing disaster might be ready across the nook. In its try and stabilize the monetary market, the Fed might inadvertently destabilize the housing one.

The results a housing disaster and a recession might have on the crypto market are laborious to foretell. Earlier market downturns have dragged cryptocurrencies down with them, however the digital asset market managed to get well extra rapidly than its conventional counterparts.

We might see the crypto market taking one other hit within the occasion of a full-blown recession. Nevertheless, forex devaluation might push extra folks to search for various “laborious belongings” — and discover what they’re in search of in crypto.

Get an Edge on the Crypto Market 👇

Change into a member of CryptoSlate Edge and entry our unique Discord neighborhood, extra unique content material and evaluation.

On-chain evaluation

Value snapshots

Extra context

Be a part of now for $19/month Discover all advantages