That is an opinion editorial by Jenna Bunnell, senior supervisor for content material advertising at Dialpad.

It doesn’t matter what your opinions are on bitcoin, it’s apparent that it’s right here to remain and can proceed to develop in use.

As a digital peer-to-peer forex bitcoin has turn into extensively accepted in lots of nations. You possibly can promote your bitcoin for money, or commerce them with friends throughout totally different networks and use it to spend money on something from artwork to property.

Nevertheless, as it’s a digital forex, the query arises; what occurs while you die? Whereas it’s a morbid thought, it is very important plan forward for your loved ones and family members. So, what occurs to bitcoin while you die and the way do you embody BTC in any inheritance plans? Is it a easy course of to incorporate BTC in a will such as you would with tangible property similar to your own home and your financial institution accounts?

What Is Bitcoin?

The origins of Bitcoin lie manner again in 2008 when a white paper was launched titled “Bitcoin: A Peer-to-Peer Digital Money System” authored by Satoshi Nakamoto (a reputation assumed to be a pseudonym, perhaps even belonging to a couple of particular person). The thought behind the white paper was to create a completely digital forex that will exist exterior the traditional centralized controls of banks and governments.

At its core lies peer-to-peer software program and using excessive ranges of encryption (primarily based on the SHA-256 algorithm designed by the U.S. Nationwide Safety Company). All transactions are recorded in publicly out there ledgers on servers world wide and anybody with a pc can arrange considered one of these servers, referred to as nodes.

Each time a transaction occurs, it’s broadcast to all the community and shared between nodes. These transactions are collected, roughly each 10 minutes, right into a block and added to the blockchain.

Folks typically have the misunderstanding that they should purchase entire models, however BTC can really be subdivided by as much as seven decimal locations, creating smaller and extra reasonably priced models — sats.

After getting purchased (or mined) bitcoins, then you definitely hold them in a digital pockets which you’ll entry utilizing particular software program. On condition that these cash don’t exist in actual life, and that possession is predicated on settlement amongst members of the community, simply how do you resolve what occurs to bitcoin while you die? Furthermore, as many BTC homeowners memorize the important thing to their pockets and hold no different data, what occurs in the event that they all of a sudden die?

Memento Mori

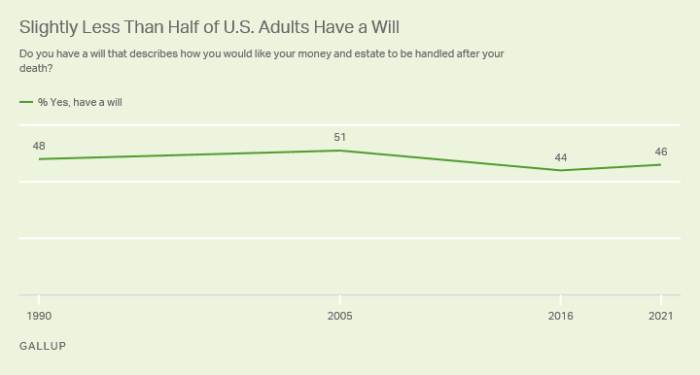

It’s not probably the most nice factor to speak or take into consideration, however dying is inevitable. Lower than 50% of adults within the U.S. have already made a will, although in fact, this determine varies throughout age teams — over 75% of individuals over 65 have made one whereas solely 20% of individuals beneath 30 have made a will.

From a authorized perspective within the U.S., it may be fairly complicated. The IRS does not view cryptocurrencies as currencies however somewhat as tradable commodities that may be taxed by the related authorities. But we deal with them as property too and thus will need to have some type of authorized management relating to inheritance.

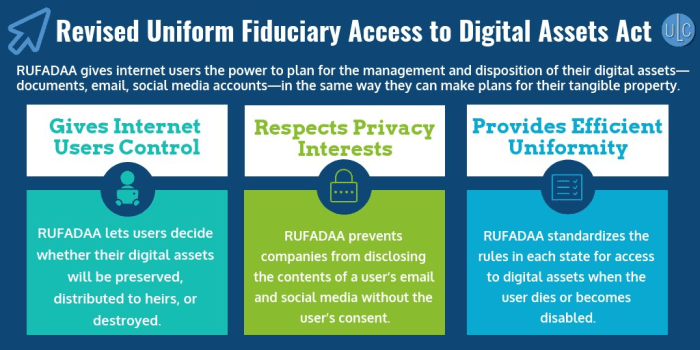

That management or oversight comes from the Revised Uniform Fiduciary Entry to Digital Property Act (RUFADAA). This regulation was developed in order to supply related events (similar to attorneys or fiduciaries) with readability and a authorized manner of coping with any digital property held by a deceased particular person’s property (or certainly when an individual is incapacitated).

The regulation was written by the Uniform Regulation Fee (ULC) in order that states might then look at it and undertake it. As of 2021, 47 states had enacted the regulation. So, for the U.S. no less than, there’s a framework that governs administration of digital property, one thing that may come as a reduction to many who have been beforehand uncertain.

How Does RUFADAA Work?

You need to first take into account that there are three teams of people that have a vested curiosity in what occurs:

- The proprietor of the digital property who might need a degree of privateness.

- The custodian of these property (companies who make, retailer or promote on-line property).

- The fiduciary or legal professional coping with the property.

The foremost impediment the regulation confronted was that, in contrast to bodily property, there has all the time been a level of secretiveness round digital property. Within the early days, there have been no legal guidelines that clarified entry to these digital information and wallets within the occasion of dying or incapacitation. If the unique proprietor of the digital property had not left a observe of the way to entry these property, then the unhappy actuality is that they might be misplaced ceaselessly.

It is very important observe that RUFADAA doesn’t focus purely on cryptocurrencies, however on all digital and on-line property. That features issues similar to Fb or Google accounts. Custodians have sure rights as to what they will launch or whether or not they request a court docket order to show over entry and/or info. Within the case of issues like Fb accounts, the custodian also can resolve what’s “fairly vital” relating to releasing any information.

RUFADDA And Bitcoin

RUFADAA solely applies if the unique proprietor has licensed entry to their bitcoin. This can be by way of paperwork signed with and held by the custodian or it might take the type of a authorized doc similar to energy of legal professional, a will or a belief doc.

A custodian also can restrict how a lot entry your fiduciary has, normally to solely embody features that permit them perform their duties. The custodian additionally has the correct to levy administrative costs for any entry they supply. This may be essential information in the event you’re making an attempt to resolve what occurs to bitcoin while you die.

One of many primary advantages of RUFADAA is that it clarifies the authorized hierarchy relating to documentation — and later distribution — of your digital property. The custodian (or on-line administration system) is seen by RUFADAA as the best authority relating to possession of a cryptocurrency account.

What meaning in actuality is that in the event you made Individual A the beneficiary to your digital property in a doc together with your custodian, then that doc takes priority over different authorized avenues similar to wills, POAs or trusts. When you have no beneficiary settlement together with your custodian, then possession will go to anybody named in these regular inheritance paperwork.

Ought to a situation come up the place there may be not one of the regular agreements nor a custodian settlement, then any switch of possession or fiduciary accountability could also be established by the custodian’s personal phrases and circumstances.

What Ought to You Do?

You’ve gotten two primary decisions when interested by what occurs to bitcoin while you die.

You possibly can both ask your custodian if they’ve particular instruments or a framework for naming a beneficiary to your account, which might solely apply in the event you held your bitcoin on an trade — an unrecommended follow. Your different selection is to go the standard route and identify any beneficiary to your BTC in a will, a belief doc, beneath POA or in property paperwork.

In case your property consists of BTC (or every other cryptocurrency) then you must take into account a plan that features all features of your digital property. This implies having a manner of passing all particulars similar to account particulars, keys and entry to any {hardware} wallets to the particular person you wish to inherit these property or to your fiduciary/legal professional.

In any will or comparable doc, you could embody directives for passing on any knowledge, particularly probably the most delicate knowledge related to the account. Simply passing on the {hardware} gadget used is probably going not sufficient for the beneficiary to take management of the account.

The Takeaway

Regardless of its development, many individuals nonetheless query whether or not BTC is an actual forex. But the expansion, and figures very a lot present that it’s one thing that’s right here to remain.

You need to consider any bitcoin you personal as an asset; it will not be a bodily one like your own home or automobile, however it nonetheless has actual worth. So, you must fastidiously take into account what you wish to occur to your bitcoin within the occasion of your dying or incapacitation. Understanding the steps to take and what occurs to bitcoin while you die means your property could be handed to the beneficiaries you need.

It is a visitor submit by Jenna Bunnell. Opinions expressed are fully their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.