Zcash is a decentralized blockchain-based cost system that enables privateness. It permits funds with out disclosing the events and quantities concerned within the transactions. It was launched in 2016 and has been widespread due to its options and user-friendly dashboard. Furthermore, it’s open supply, so it may be carried out in different choices platforms.

Zcash has triggered plenty of controversies within the crypto world due to its open-source group and privacy-centric options. Many argue that each one these privacy-centric cryptocurrencies is not going to be sustainable in the long term. The federal government will ban these cryptos as a result of they’re dangerous for the world financial system.

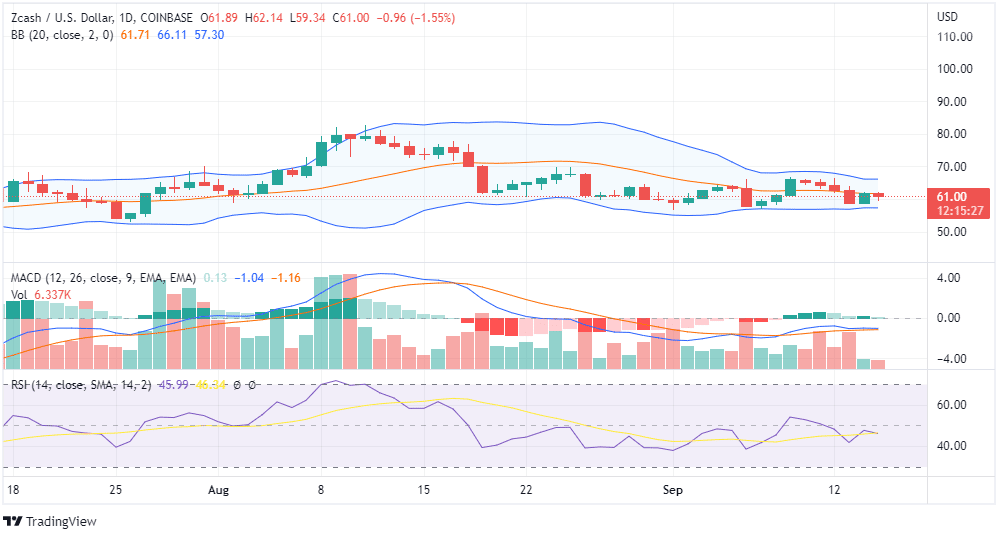

ZEC was buying and selling at $61, which is across the baseline of the Bollinger Bands. After an extended downtrend, Zcash has been consolidating inside a worth vary of $68 and $50 from final June, nevertheless it doesn’t present any sort of momentum for the brief time period. Learn our ZEC worth prediction to know what you need to do along with your holdings!

Bollinger Bands lack volatility, and most technical indicators are impartial; RSI is round 45, so we don’t suppose it’s the very best time to purchase Zcash coin for the brief time period as a result of it can consolidate inside a variety.

After hitting a excessive of round $350, Zcash has been in a steady downtrend, nevertheless it has taken assist at round $53. On the weekly chart, we will discover one other assist of round $60, however most technical indicators are nonetheless bearish.

Candlesticks are forming within the decrease vary of the Bollinger Bands, and RSI is beneath 40, which doesn’t point out a really perfect time for long-term funding. We expect you need to wait till ZEC crosses the essential resistance stage after which begin your long-term funding on this token.