Regardless of seeing a 3.11% drop in worth in September, bitcoin nonetheless outperformed each the S&P 500 and Nasdaq, the newest Cryptocompare report has proven. Ethereum, alternatively, was named “the worst performer after the long-awaited Merge proved to be a ‘purchase the hearsay, promote the information’ occasion.” Elevated tether and U.S. greenback commerce volumes for bitcoin are stated to recommend panicking buyers had been dumping depreciating currencies in favor of the cryptocurrency.

Ethereum Sees ‘Largest Decline’

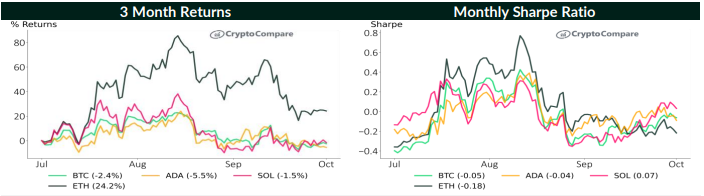

In keeping with the newest Cryptocompare report, bitcoin, which noticed a detrimental return of three.11% in September, nonetheless outperformed “each the S&P 500 and Nasdaq which noticed detrimental returns of 9.34% and 10.5% respectively.” Solely Solana — the cryptocurrency among the many tracked 4 that noticed a optimistic month-to-month return of 5.59% — and gold (2.87%) had higher risk-adjusted returns than bitcoin.

Ethereum, alternatively, is recognized within the report as “the worst performer [among four tracked cryptocurrencies], after the long-awaited Merge proved to be a ‘purchase the hearsay, promote the information’ occasion.”

To help this assertion, the report factors to the crypto asset’s contrasting fortunes in August and September. After seeing its finest risk-adjusted returns in August, ETH nonetheless went on to have “the largest decline” in September, the identical month the Ethereum blockchain was switched to a proof-of-stake (PoS) consensus mechanism.

Merchants Dumped Fiat and Piled Into BTC

By way of the completely different belongings’ volatilities, the report stated bitcoin was the “least risky asset and essentially the most dominant” amongst 4 cryptocurrencies that had been tracked within the month of September.

Explaining the examine’s crypto market volatility findings, the report states:

Volatility throughout cryptocurrency markets noticed a slight improve in September amid the rates of interest spikes and the unstable macro surroundings. ETH and SOL continued to be essentially the most risky belongings, with 30-day volatility of 80.0% and 82.6% respectively. Bitcoin’s volatility rose 19.2% in September breaking a declining pattern that began in June.

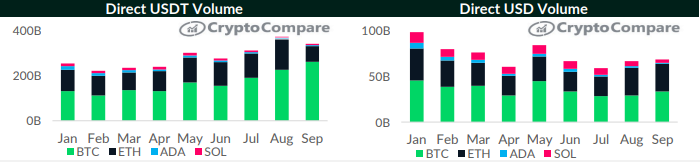

In the meantime, the findings of Cryptocompare’s examination of each USDT and U.S. greenback traded volumes recommend that panicking buyers had been dumping depreciating currencies in favor of BTC. In September alone, traded volumes in tether and the buck went up “by 15.4% and 15.1% respectively.”

In keeping with the report, this might imply “market contributors are piling into BTC following latest volatility in fiat currencies, together with the British pound and Japanese yen.”

In distinction, USDT volumes for ETH throughout the identical “noticed an enormous drop of 49.4%,” whereas SOL noticed “a noticeable rise of 10.5% in USDT volumes in September.” ADA and SOL each noticed declines in USD volumes.

Do you agree with Cryptocompare’s newest findings? Tell us what you suppose within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, 24K-Manufacturing / Shutterstock.com

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, straight or not directly, for any injury or loss triggered or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or providers talked about on this article.