For the reason that cryptocurrency launched ethereumpow (ETHW) has seen spot market costs decline by near 12% over the last seven days. Even if over the last two weeks ETHW has shed 35% in USD worth, the community’s token economic system and decentralized finance (defi) ecosystem has swelled.

ETHW Spot Market Costs Slide, Whereas the Community’s Complete Worth Locked in Defi Climbs

Ethereumpow (ETHW) markets haven’t been so scorching in latest instances and for the reason that crypto asset’s worth was recorded earlier than the mainnet went dwell, ETHW is down roughly 88% from the all-time excessive recorded two months in the past on September 3, 2022.

Over the last two weeks in opposition to the U.S. greenback, ethereumpow (ETHW) has shed round 35% in worth. On Tuesday, October 18, 2022, the crypto asset has been exchanging arms for $6.94 to $7.34 per unit over the last 24 hours.

Moreover, after capturing near 70 terahash per second (TH/s) of hashrate, ETHW’s whole hashpower worldwide is all the way down to 37.66 TH/s. Whereas the community’s native crypto asset ETHW has carried out poorly market-wise in latest instances, ETHW’s whole worth locked (TVL) in defi has skyrocketed.

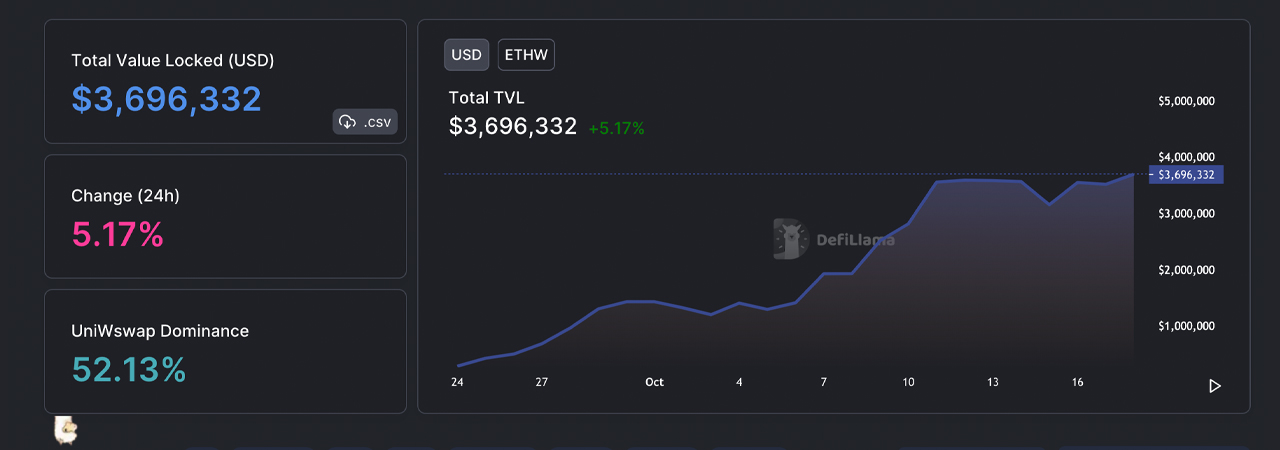

Statistics from defillama.com point out that ETHW’s TVL is round $3.69 million after data present on September 24, that the TVL was $283,153. Which means that since September 24, or during the last 24 days, ETHW’s TVL in defi elevated in worth by 1,209%.

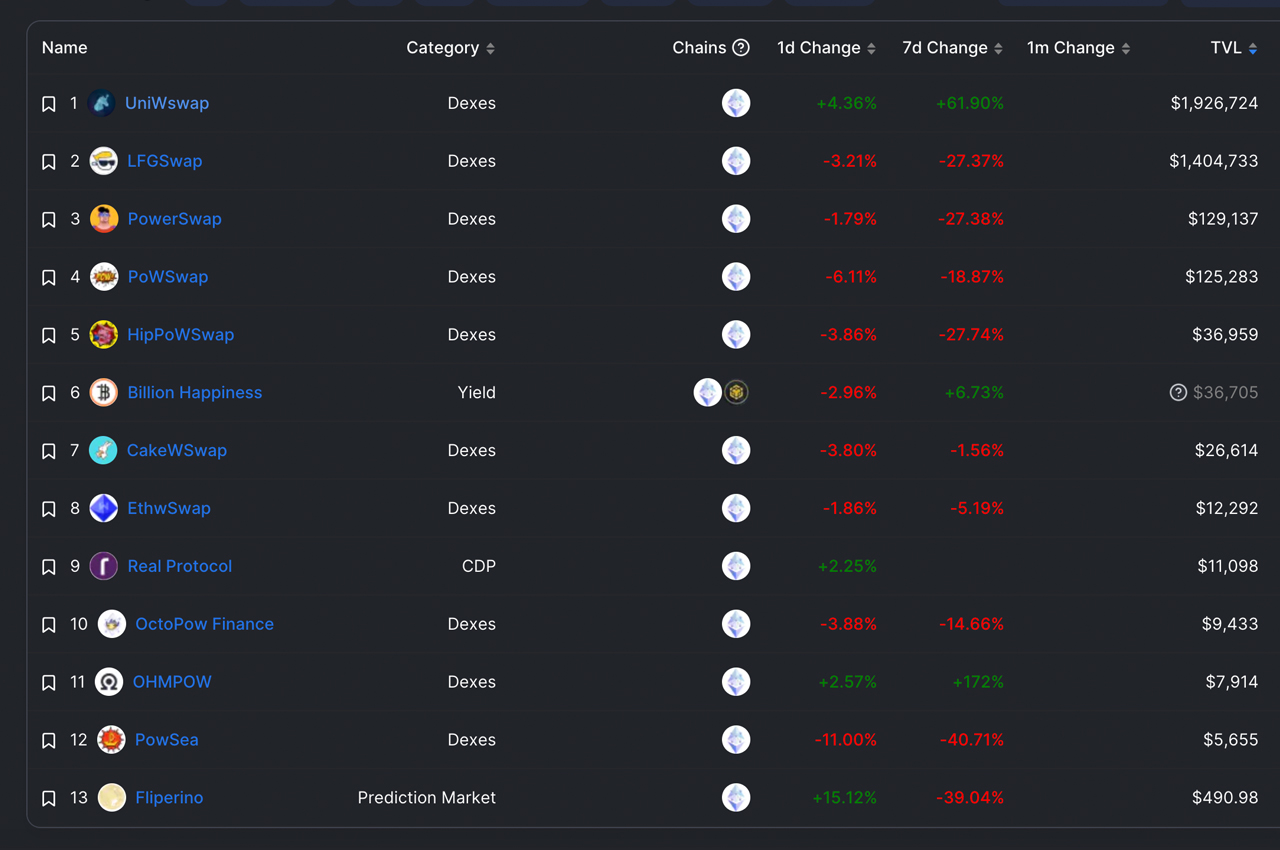

Defillama.com stats point out that there’s roughly 13 totally different ETHW defi protocols devoted to the community. The decentralized change (dex) Uniwswap, to not be confused with Uniswap, is the most important defi protocol on ETHW right now with 52.13% dominance of the present $3.69 million.

The dex platform has round $1.92 million in keeping with information recorded on October 18. The second-largest ETHW defi-related protocol Lfgswap has round $1,404,733 in worth locked. Which means that Uniwswap and Lfgswap dominate most of ETHW’s defi ecosystem when it comes to TVL.

ETHW has roughly a dozen tokens with all the ETHW token ecosystem (together with ETHW) valued at roughly $800 million. The ETHW protocol is quantity 83 when it comes to positions held by TVL in defi right now, whereas Ethereum Traditional (ETC) community is round 119 right now. ETC’s defi ecosystem is way smaller than ETHW’s, when it comes to TVL measurement, as defillama.com metrics present Ethereum Traditional’s TVL right now is $537,243 amongst 5 totally different defi protocols.

A lot of the ETC TVL is held between two defi protocols on that leverage the Ethereum Traditional chain which embody Hebeswap and Etcswap. ETC’s worth in comparison with ETHW’s is loads bigger and the asset’s $3.24 billion market cap can be colossal in comparison with the newly launched crypto asset.

Tags on this story

What do you concentrate on ETHW’s latest spot market motion and the community’s defi TVL growing throughout the previous few weeks? Tell us what you concentrate on this topic within the feedback part beneath.

Jamie Redman

Jamie Redman is the Information Lead at Bitcoin.com Information and a monetary tech journalist dwelling in Florida. Redman has been an energetic member of the cryptocurrency group since 2011. He has a ardour for Bitcoin, open-source code, and decentralized functions. Since September 2015, Redman has written greater than 6,000 articles for Bitcoin.com Information concerning the disruptive protocols rising right now.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, immediately or not directly, for any harm or loss triggered or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or companies talked about on this article.