Whereas the U.S. Federal Reserve ramped up the benchmark financial institution charge with a barrage of charge hikes, U.S. Treasury markets and world bond markets, typically, have seen one of many worst selloffs in over a decade. The Fed’s actions has fueled criticism towards the U.S. central financial institution as some strategists consider the onslaught of rate of interest hikes may spur illiquidity on the earth’s largest bond market. Furthermore, a report revealed on Tuesday, explains that the Fed and overseas central banks worldwide are “shedding billions” by paying extra curiosity.

The Fed Is Shedding Billions

The U.S. Federal Reserve has elevated the federal funds charge (FFR) on plenty of events this 12 months and thrice in a row, the central financial institution raised the speed by 75 foundation factors (bps). The speed hikes have induced politicians and the funding financial institution Barclays to query the central financial institution’s must decelerate the speed hikes. Even the United Nations Convention on Commerce and Growth (UNCTAD) chimed in and urged the Fed to decelerate and enhance public spending.

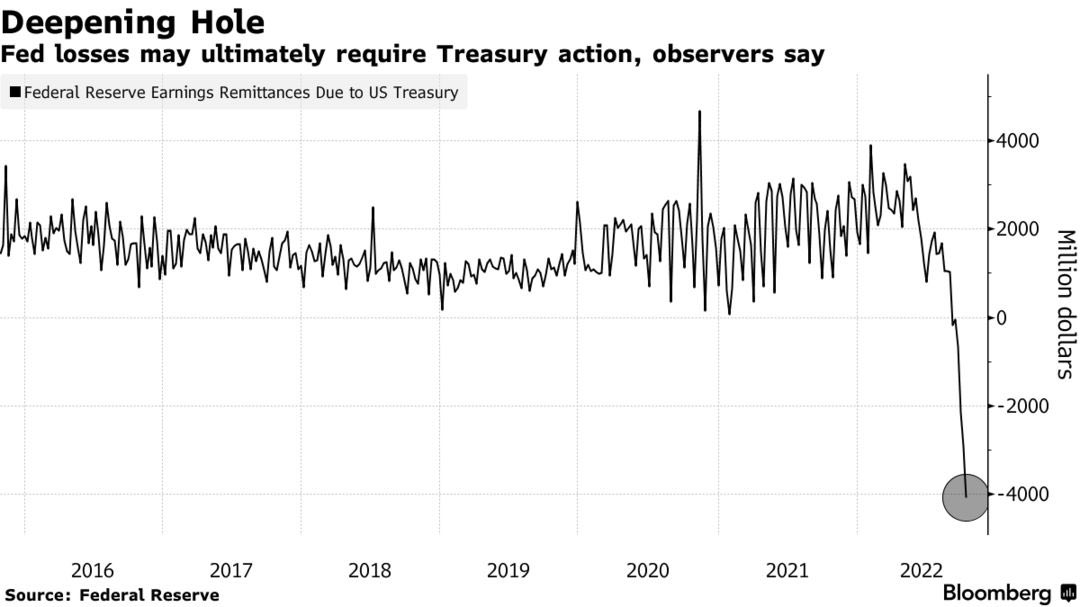

Regardless of the requests, observers working intently with Fed members and markets suspect one other 75bps charge hike is assured to occur subsequent month. On Tuesday, Bloomberg reported that, as of proper now, the U.S. central financial institution is “shedding billions.” Bloomberg contributor Jonnelle Marte says “with out the revenue from the Fed, the Treasury then must promote extra debt to the general public to fund authorities spending.” Regardless of, the necessity to promote extra debt the chief world economist for Morgan Stanley and former member of the U.S. Treasury, Seth Carpenter, insists the losses haven’t any materials impact on near-term financial selections.

Carpenter additional careworn:

The losses don’t have a cloth impact on their capability to conduct financial coverage within the close to time period.

Reporter Says ‘Different Central Banks Are Additionally Dealing With Losses as Charges Go up’

The Bloomberg reporter Marte tweeted that the “increased charges imply the central financial institution is now paying extra curiosity on reserves than it collects from its portfolio.” Marte added that this case may result in “some political complications.” “I received’t get away the accounting lingo, however the brief model is that the Fed used to ship its revenue to the Treasury,” Marte’s Twitter thread added. “Now that the Fed is shedding cash, the losses are piling up into an IOU that the Fed can pay later with future revenue.”

The Bloomberg reporter added:

Different central banks are additionally coping with losses as charges go up all over the world to fight inflation. The accounting losses threaten to gas criticism of the asset buy applications undertaken to rescue markets and economies.

The report that notes the Fed is shedding billions and wreaking havoc on different central banks worldwide, follows plenty of analysts insisting that the Fed is trapped as a result of mountain climbing the FFR too excessive may result in “blowing up the Treasury.” The founding father of the hedge fund Praetorian Capital, Harris Kupperman, mentioned this might occur in a weblog put up revealed on October 18. J. Kim of skwealthacademy substack additionally predicts {that a} “U.S. Treasury bond market flash crash is inevitable underneath these market situations.”

The specialists Marte interviewed defined, nevertheless, that the U.S. central financial institution’s losses might be recapitalized. Jerome Haegeli, chief economist at Swiss Re instructed the Bloomberg reporter that even though it might probably at all times be recapitalized, central banks will face political criticism over the policy-making.

“The issue with central financial institution losses are usually not the losses per se — they’ll at all times be recapitalized — however the political backlash central banks are prone to more and more face,” Haegeli mentioned in an announcement to Marte.

Tags on this story

What do you consider the report that claims the U.S. Federal Reserve and central banks worldwide are shedding billions? Tell us what you consider this topic within the feedback part under.

Jamie Redman

Jamie Redman is the Information Lead at Bitcoin.com Information and a monetary tech journalist residing in Florida. Redman has been an lively member of the cryptocurrency group since 2011. He has a ardour for Bitcoin, open-source code, and decentralized functions. Since September 2015, Redman has written greater than 6,000 articles for Bitcoin.com Information concerning the disruptive protocols rising at the moment.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, editorial photograph credit score: Bloomberg

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, instantly or not directly, for any injury or loss induced or alleged to be attributable to or in reference to using or reliance on any content material, items or companies talked about on this article.