That is an opinion editorial by Mike Ermolaev, head of public relations and content material at Kikimora Labs.

Setting The Context: World Economic system Fundamentals

The economic system remains to be recovering from the COVID-19 outbreak as new issues come up. We at the moment are in a time of rampant inflation with central banks attempting to treatment that by elevating rates of interest.

The U.S. CPI information (shopper worth index), launched on October 13, got here in increased than anticipated (8.2% year-over-year), negatively impacting the bitcoin worth. However inflation just isn’t the one problem, the worldwide economic system can be combating the vitality disaster, affecting Europe greater than the U.S., on account of its robust dependency on Russian pure fuel and uncooked materials.

On the japanese aspect, the conflict in Ukraine with ensuing sanctions on Russia, add additional geopolitical instability and financial uncertainty. Additionally, China’s zero-COVID coverage is disrupting the provision chain worldwide, and the Evergrande default undermines one of many world’s largest economies.

If we have a look at the principle currencies, the greenback index seems to be robust, in comparison with others. The Federal Reserve raised rates of interest by 75 foundation factors in November, and the Financial institution of England raised rates of interest by the identical quantity. This coverage of quantitative tightening goals to cut back the cash provide and mitigate worth strain. It’s prone to proceed into subsequent yr and past. Nonetheless, a worldwide recession and danger of stagflation remains to be very robust, so no nation might really feel protected from central financial institution financial coverage.

Bitcoin Correlation With The Economic system

Bitcoin has proven to not be immune from this world turmoil. Though the value in its early stage was unbiased of conventional finance, correlation started to indicate in 2016.

The concept of bitcoin as a “digital gold” turned standard as a result of each shared the shortage and issue of extraction (mining), in addition to fulfilled the function of being a retailer of worth. Since many view bitcoin as a danger asset, its correlation with the S&P 500 and Nasdaq-100 turned seen — no totally different than conventional shares.

On the time of writing, bitcoin’s 40-day worth correlation with gold reached 0.50 (after being round zero in August). In line with Alkesh Shah and Andrew Moss, strategists from Financial institution of America:

“A decelerating optimistic correlation with SPX/QQQ and a quickly rising correlation with XAU point out that buyers might view bitcoin as a relative protected haven as macro uncertainty continues and a market backside stays to be seen.”

Unfavourable Occasions

There are some macroeconomic elements within the bigger cryptocurrency ecosystem that contributed to a bearish market: the Terra/LUNA collapse, compelled liquidation of Three Arrows Capital and the chapter of Celsius being the principle ones.

The incoming bitcoin mining rules by the EU and the present profitability disaster of bitcoin mining have to be additionally considered.

Bitcoin: Current And Future

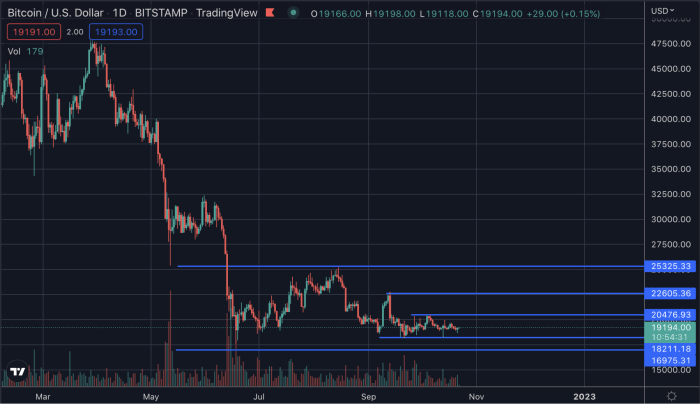

Regardless of all of the above antagonistic occasions, bitcoin was capable of by some means maintain its worth within the $19,000-$20,000 vary, with record-low volatility. At the moment, we’re observing uncommon stability within the bitcoin worth, not too long ago even matching volatility of the British pound.

Quite the opposite, shares have skilled excessive volatility and whipsaw worth motion, additionally following speculations in regards to the Fed’s future selections. In line with Bloomberg’s Chief Commodity Strategist Mike McGlone, that’s why bitcoin might rise after a steep low cost and finally beat the S&P 500. He believes that bitcoin’s finite provide and deflationary strategy might assist it get better its earlier worth ranges.

For the reason that final flash crash in mid-June, the value has been fairly regular, however we all know it hardly ever sits nonetheless for too lengthy. Which means that the likelihood of a sudden (bullish or bearish) breakout will increase over time. The longer the value stays idle, the stronger the breakout goes to be.

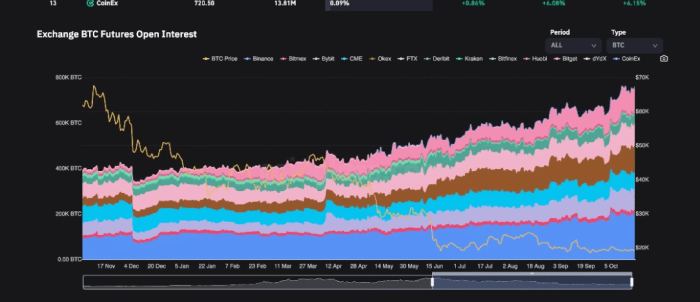

Moreover, the BTC futures open curiosity is increased than ever, with liquidations reaching all-time low. Lots of liquidity is accumulating right here, which means that there shall be a fair stronger impulse when the value begins to maneuver once more.

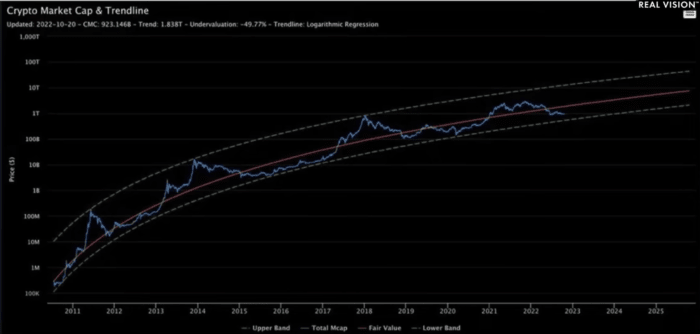

In line with the strategist Benjamin Cowen, bitcoin is predicted to rise to “truthful worth,” after falling an extra 15%. “Proper now, the information would recommend that we’re about 50% undervalued in comparison with the place the truthful worth is.” Cowen thinks we might have to attend till early 2024 to see this rise occur.

Goldman Sachs strategist Kamakshya Trivedi has a distinct view, claiming that the U.S. greenback index, exhibiting document values since 2002, could also be dangerous information for the at present bearish bitcoin.

A Bearish Situation: May The 2018 Drop Occur Once more?

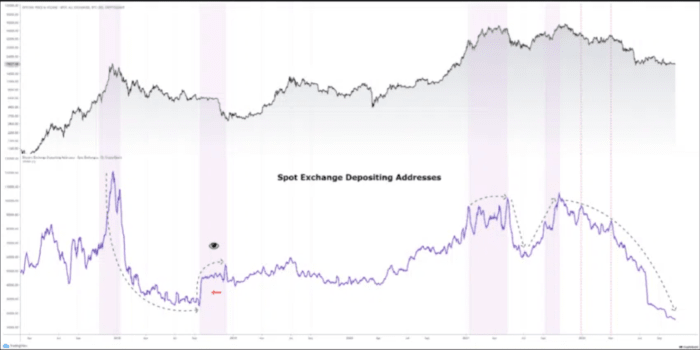

Some analysts have been questioning if the 2018 situation (low volatility, then huge worth drop) might occur once more at the moment as a result of the market circumstances look fairly related. Now we have the identical 10% buying and selling vary and we all know one thing goes to occur quickly.

Comparability between 2022 BTC worth (prime) versus 2018 (backside) utilizing eight-hour candles. (Supply)

A outstanding distinction between the 2 cycles is that in 2018 there was a rise in addresses despatched to identify exchanges, whereas in our present cycle we’re observing liquidity shifting away from exchanges and never many new addresses being created. In line with a CryptoQuant analyst, this could imply that we received’t witness an analogous situation to 2018.

What About Uptober and Moonvember?

Traditionally, This fall is a good time for bitcoin, with bullish tendencies beginning in October and rising in November. So the months of October and November had been colloquially renamed “Uptober” and “Moonvember” — at the least, that is what occurred again in 2021.

Can we nonetheless anticipate such a bullish This fall in 2022? It’s arduous to say, however the antagonistic macroeconomic scenario and geopolitical points make it more durable to think about the identical rally we noticed final yr. In spite of everything, the bitcoin market has been down for 10 consecutive months and we don’t see any explicit signal of restoration for the time being.

We should additionally understand that, regardless of the unfavourable world situation, the “protected haven” function of bitcoin might contribute to giving the value some extra power, particularly in these troubled instances.

Trade Knowledge Evaluation

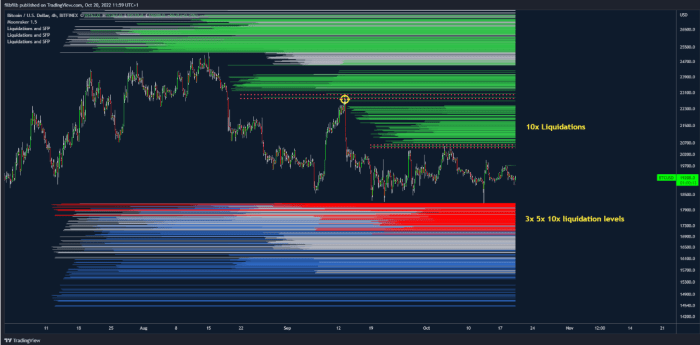

Liquidation information on the Bitfinex change was analyzed by filbfilb. He concluded that an upward breakout would have much less momentum than a downward one. In reality, liquidity above $20,500 is generally 10x, whereas liquidity under $18,000 is predominantly 10x, 5x and 3x, which signifies that a bullish breakout can be “much less brutal” than a bearish one.

Bitfinex liquidation chart. (Source)

Conclusions

We’re at present witnessing a interval of stasis within the bitcoin market. The bitcoin worth wants to start out shifting once more after two months of consolidation. The general financial situation doesn’t look vivid in any respect, and bitcoin is correlated to occasions in the true world, however buyers can nonetheless acknowledge the digital gold, safe-haven function of the preferred cryptocurrency. A powerful bitcoin worth breakout is predicted, with new volatility incoming.

The potential situations could also be: a fast dump after which a bullish restoration (V-shaped bounce) or an extended and deeper worth collapse, after the break of the $19,000 resistance degree.

No matter occurs, bitcoin will maintain being probably the most progressive know-how of the final decade, permitting monetary freedom and direct management over one’s personal wealth. Bitcoin has traditionally witnessed quite a few robust bearish instances and has at all times recovered from them.

This can be a visitor publish by Mike Ermolaev. Opinions expressed are solely their very own and don’t essentially replicate these of BTC Inc. or Bitcoin Journal.