The brand new CEO of FTX, appointed after the crypto change filed for chapter, has blasted the corporate beneath former CEO Sam Bankman-Fried. “By no means in my profession have I seen such an entire failure of company controls and such an entire absence of reliable monetary info as occurred right here,” he mentioned in a court docket submitting.

‘Full Failure of Company Controls’

John Ray III, the brand new CEO of FTX and a veteran insolvency skilled who oversaw the liquidation of Enron, revealed in a court docket submitting on Thursday that FTX is the worst case of company failure that he had seen in his greater than 40-year profession.

Ray, who was appointed to interchange Sam Bankman-Fried (SBF) when FTX filed for Chapter 11 chapter on Nov. 11, wrote:

By no means in my profession have I seen such an entire failure of company controls and such an entire absence of reliable monetary info as occurred right here.

“From compromised techniques integrity and defective regulatory oversight overseas to the focus of management within the fingers of a really small group of inexperienced, unsophisticated and probably compromised people, this example is unprecedented,” he described.

‘Unacceptable Administration Practices’

“Most of the firms within the FTX Group, particularly these organized in Antigua and the Bahamas, didn’t have applicable company governance,” Ray defined, noting that many entities by no means had board conferences.

As well as, “The FTX Group didn’t hold applicable books and information, or safety controls, with respect to its digital belongings,” the brand new CEO detailed, elaborating:

Unacceptable administration practices included … the absence of each day reconciliation of positions on the blockchain, using software program to hide the misuse of buyer funds, the key exemption of Alameda from sure points of FTX.com’s auto-liquidation protocol, and the absence of impartial governance.

He added that the crypto agency beneath Bankman-Fried used “an unsecured group e-mail account as the foundation person to entry confidential non-public keys and critically delicate knowledge for the FTX Group firms all over the world.”

Bankman-Fried ‘Continues to Make Erratic and Deceptive Public Statements’

“Some of the pervasive failures of the FTX.com enterprise specifically is the absence of lasting information of decision-making,” Ray mentioned, including:

Bankman-Fried usually communicated through the use of functions that have been set to auto-delete after a brief time period, and inspired workers to do the identical.

Moreover, he harassed that “Bankman-Fried, presently within the Bahamas, continues to make erratic and deceptive public statements.”

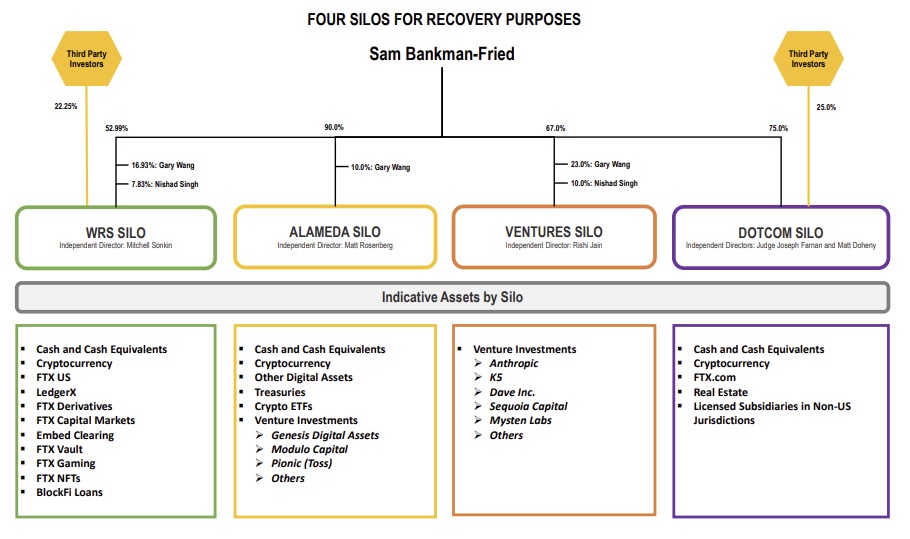

FTX’s 4 Enterprise Silos

Ray divided FTX’s companies into 4 teams, which he calls “silos,” the court docket submitting exhibits.

One is the WRS Silo, which incorporates crypto change FTX US that’s registered with the Division of the Treasury’s Monetary Crimes Enforcement Community (FinCEN) as a cash providers enterprise and holds a collection of state cash transmission licenses within the U.S.

The subsequent silo is the Alameda Silo, which incorporates Alameda Analysis LLC, organized within the State of Delaware. The others are the Ventures Silo, which incorporates FTX Ventures Ltd., and the Dotcom Silo, which incorporates crypto buying and selling platform FTX.com. FTX Buying and selling Ltd., the dad or mum firm of FTX.com, is organized in Antigua.

In accordance with Ray, many of the monetary statements for FTX’s 4 silos, together with stability sheets, don’t seem to have been audited. Emphasizing that every monetary assertion was created whereas the corporate was managed by Bankman-Fried, the chief mentioned:

I would not have confidence in it, and the knowledge therein is probably not appropriate as of the date acknowledged.

What do you consider the findings by the brand new FTX CEO? Tell us within the feedback part under.

Kevin Helms

A pupil of Austrian Economics, Kevin discovered Bitcoin in 2011 and has been an evangelist ever since. His pursuits lie in Bitcoin safety, open-source techniques, community results and the intersection between economics and cryptography.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, instantly or not directly, for any harm or loss triggered or alleged to be brought on by or in reference to using or reliance on any content material, items or providers talked about on this article.