Since individuals are as soon as once more speaking about self-custody as one in every of crypto’s distinctive strengths, I want to remind everybody about an equally vital elementary worth proposition of crypto that, within the early days, was touted because the killer function. I’m speaking about censorship resistance.

The next opinion editorial was written by Bitcoin.com CEO Dennis Jarvis.

The Three Pillars of Censorship Resistance

Within the monetary context, censorship resistance is the power to hold out monetary actions regardless of the needs of any third get together.

In crypto, the three pillars of censorship resistance are:

- The liberty to transact. This implies third events can’t stop you from sending or receiving property.

- The liberty from confiscation. Third events can’t take away or freeze your property.

- The immutability of transactions. It’s not possible for third events to alter or revert transactions after the actual fact.

Troubling actions more and more taken by centralized entities in the private and non-private sector display the significance of censorship resistance. Let’s take a look at some examples:

Public Sector Censorship

Governments have proven an elevated willingness to exert management of economic establishments whereas additionally ratcheting up their crypto regulatory efforts. Earlier within the yr, Trudeau’s Canadian authorities took the unprecedented step of invoking emergency powers to freeze or droop the financial institution accounts of Canadian residents with out courtroom orders. Their crime? Donating funds to fellow residents collaborating within the Freedom Convoy protests.

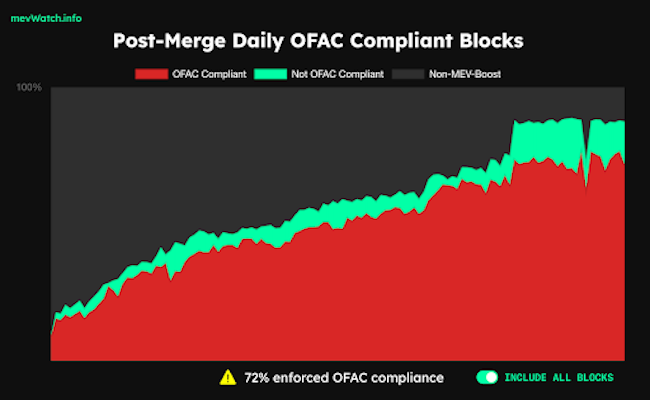

The U.S. Treasury Division’s watchdog the Workplace of International Asset Management (OFAC) made headlines this summer time by banning and sanctioning addresses that used Twister Money, a decentralized utility that improved privateness for customers by “mixing” ETH.

The U.S. Securities and Alternate Fee (SEC) elevated crypto regulatory actions, greatest exemplified by this quote from SEC Chairman Gary Gensler who mentioned, “…the SEC will function the cop on the beat. As with seat belts in vehicles, we have to make sure that investor protections come normal within the crypto market.” This isn’t merely empty rhetoric, the SEC almost doubled the scale of the Division of Enforcement’s Crypto Property and Cyber Unit in 2022.

Non-public Sector Censorship

Submit-merge, a majority of Ethereum’s blocks are compliant with OFAC. It is a potential downside as a result of OFAC-compliant relays won’t embrace any transactions that work together with the Twister Money good contract or different sanctioned pockets addresses as designated by OFAC. Not all blocks constructed by OFAC compliant relays are censoring, nonetheless, all blocks constructed by OFAC compliant relays will censor when non-compliant transactions are broadcast to the community. As Martin Köppelmann, the co-founder of Gnosis, noted in regards to the state of OFAC compliant relays, “[t]his means if the censoring validators would now cease testifying to non-censoring blocks they’d ultimately type the canonical, 100% censoring chain.”

Centralized stablecoin corporations Tether (USDT) and Circle (USDC) have a historical past of cooperating with legislation enforcement requests to freeze property. Circle complied with OFAC’s Twister Money sanctions by banning “tainted” USDC. Up to now Tether has determined to not comply, however that may change (and possibly will, given enough stress) sooner or later.

Outdoors of crypto, Paypal made worldwide information when it launched an up to date coverage that permit Paypal tremendous customers $2,500 for spreading ‘misinformation.’ Paypal rapidly retracted the coverage in public, although a lot of the language stays. This consists of $2,500 fines which have existed since September 2021 for the very obscure “promotion of hate, violence, racial or different types of intolerance that’s discriminatory…”

Whereas Paypal was virtually universally condemned, its actions are in keeping with a rising variety of web2 corporations, similar to Twitter, Youtube, and Fb, who’re utilizing their platforms to punish habits they deem “dangerous” by levers like demonetization, suspensions, and bans.

Censorship Resistance Is the Antidote

Censorship resistance is without doubt one of the principal worth propositions of decentralized finance normally and Bitcoin particularly as a result of it essentially separates the know-how from any conventional monetary instruments. The truth is, censorship resistance is so robust in Bitcoin as to render it an financial freedom enhancing know-how. This dramatization powerfully demonstrates why:

The silver lining to the regarding improve in authoritarian actions from each the private and non-private sector is that they’re serving to refocus consideration on censorship resistance.

Bitcoin, as soon as the embodiment of crypto, had grow to be ridiculed as worse than boring — antiquated. It’s good to see this start to shift again as individuals in and out of crypto reacquaint themselves with its deceptively easy energy.

Throughout the crypto {industry}, extra individuals are listening to the sluggish creep of web2-like options of velocity and low-cost transactions which are coming at the price of censorship resistance. For instance, distinguished builders just like the aforementioned Martin Köppelmann are sounding the alarms that the proportion of OFAC compliant blocks must be fastened. It’s additionally good to see debates about censorship resistance start to take up extra oxygen inside the broader crypto group. I significantly loved Erik Voorhees’ piece on the empowering nature of defi.

This isn’t to say that every one crypto initiatives have to be censorship resistant; certainly censorship resistance itself exists on a spectrum. But it’s important that some crypto initiatives stay robustly censorship resistant. At Bitcoin.com, we’re proud to supply instruments just like the Bitcoin.com Pockets, that anybody can use to self-custody their Bitcoin and different cryptocurrencies. As an {industry}, let’s take the occasions of the final yr to recollect how vital censorship resistance is. Let’s not sacrifice this industry-defining attribute for brief sighted positive factors.

Tags on this story

What are your ideas on this story? Tell us within the feedback part under.

Visitor Creator

That is an Op-ed article. The opinions expressed on this article are the writer’s personal. Bitcoin.com doesn’t endorse nor assist views, opinions or conclusions drawn on this submit. Bitcoin.com shouldn’t be liable for or chargeable for any content material, accuracy or high quality inside the Op-ed article. Readers ought to do their very own due diligence earlier than taking any actions associated to the content material. Bitcoin.com shouldn’t be accountable, straight or not directly, for any harm or loss induced or alleged to be brought on by or in reference to using or reliance on any info on this Op-ed article.

To contribute to our Op-ed part ship a suggestion to op-ed (at) bitcoin.com.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, straight or not directly, for any harm or loss induced or alleged to be brought on by or in reference to using or reliance on any content material, items or companies talked about on this article.