Bitcoin mining corporations proceed struggling to outlive the continuing bear market. Desires of outperforming bitcoin as a public mining firm are lengthy gone. Bankruptcies and lawsuits make routine headlines. And even Wall Road analysts that have been as soon as bullish on bitcoin mining funding alternatives now say they’re “pulling the plug” till the market improves. However precisely how dangerous is the present bear market?

It’s at all times darkest earlier than daybreak, because the adage says. And in comparison with earlier bear markets, the mining trade appears to be like a lot nearer to the tip of a turbulent market part than the start of it. This text explores a bunch of knowledge units from the present and former bear markets to contextualize the state of the trade and the way the mining sector is faring. From {hardware} lifecycles and miner balances, to hash price development and hash value declines, all of those knowledge inform a novel story about one in all Bitcoin’s most vital financial sectors.

Mining Income Is Evaporating

When bitcoin’s value drops, it’s not stunning that dollar-denominated mining income additionally drops. However it has – lots. Roughly 900 BTC are nonetheless mined every single day and will likely be till the subsequent halving in 2024. However the fiat value for these bitcoin has plummeted this yr, which means miners have far fewer {dollars} for bills like electrical energy, upkeep and the servicing of loans.

Because the chart beneath demonstrates, in November, your entire bitcoin mining trade earned lower than $500 million from processing transactions and issuing new cash. The bar chart beneath exhibits this month-to-month income in comparison with the previous 5 years. November mining income marks a two-year low for month-to-month earnings.

Potential Hash Charge Uptrend Reversal

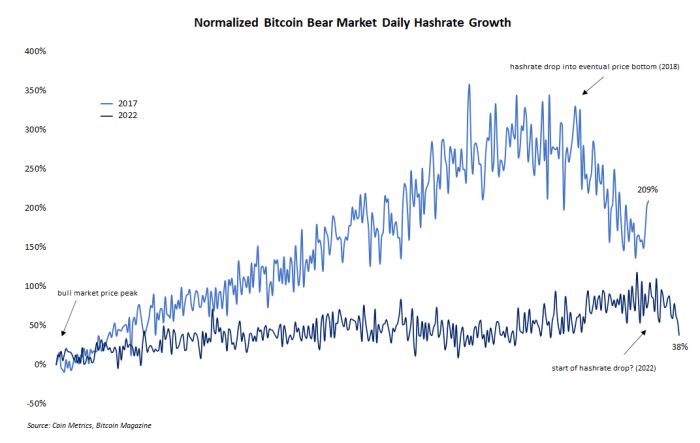

Evaluating the present bear market to the earlier one in 2018 gives some fascinating insights into how the mining trade has modified and the way it has remained the identical. One such comparability is hash price development throughout downward value tendencies. It’s not unusual to see hash price develop throughout bear markets. The annotated line chart beneath exhibits normalized hash price development in the course of the 2018 and 2022 bear markets from bitcoin’s value peak to the drawdowns’ historical past (or present) lows.

However one factor that’s clearly lacking from the above chart is a correction in hash price development in the course of the later interval of the bearish part. In 2018, for instance, the expansion pattern clearly modified course and dropped because the market ultimately discovered a low for bitcoin’s value. However within the present market, hash price has solely grown. Maybe a slight drop in hash price by way of late November indicators a pattern change, however the query remains to be open.

Collapse Of Public Mining Firms

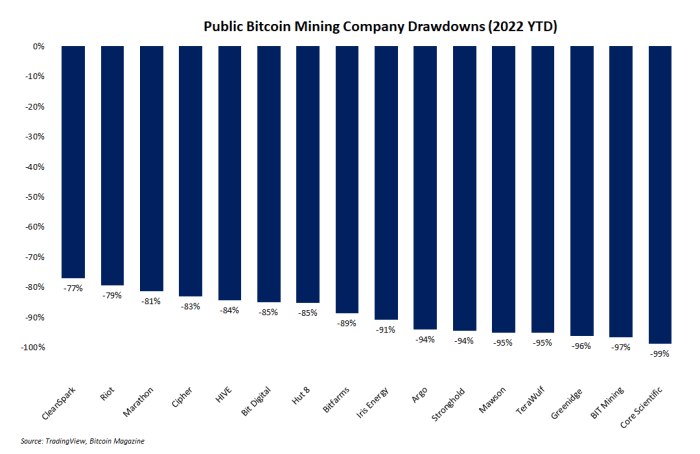

Maybe essentially the most brutal bitcoin mining chart of all exhibits the drawdowns of publicly-traded mining corporations this yr. It’s no secret that the previous yr has been brutal for bitcoin, different cryptocurrencies, and the worldwide economic system on the whole. However mining corporations specifically have been clobbered. Over half of those corporations have seen their share costs fall over 90% since January. Solely two — CleanSpark and Riot Blockchain — haven’t dropped greater than 80%.

Mining corporations on the whole are sometimes thought-about to be a high-beta funding in bitcoin, which means when bitcoin goes up, mining inventory costs go up extra. However this market dynamic cuts each methods, and when bitcoin falls, the draw back for mining shares is much more brutal. The bar chart beneath exhibits the bloodbath these shares have endured.

The Rise And Fall Of Bitcoin Mining’s ‘AK-47’

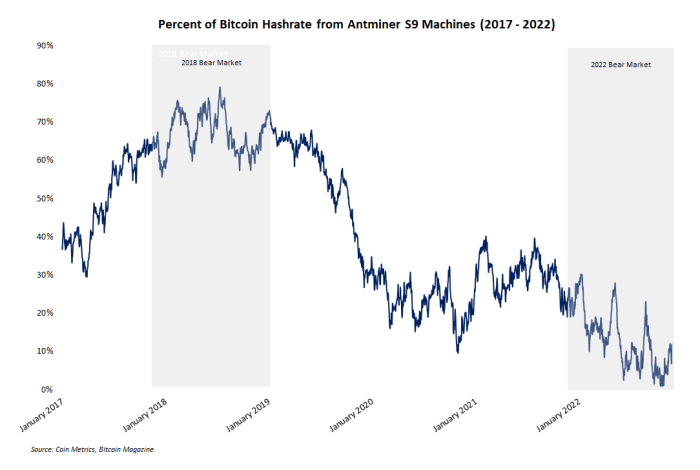

An underappreciated hallmark of the present bitcoin bear market is the precipitous decline in hash price contributed by Bitmain’s Antminer S9 machines. This mannequin of mining machine is sometimes known as the “AK-47” of mining due to its sturdiness and dependable efficiency. And at one level within the 2018 bear market, the S9 was king. Almost 80% of Bitcoin’s whole hash price got here from this Bitmain mannequin in the course of the depths of the earlier bear market.

However the present bear market tells a very totally different story. Because of new, extra environment friendly {hardware} and a vice-grip squeeze on mining revenue margins, the proportion of hash price from S9s dropped beneath 2% in early November. The annotated line chart beneath exhibits the rise and fall of this machine.

Miner Steadiness Retraces Its Promote Off

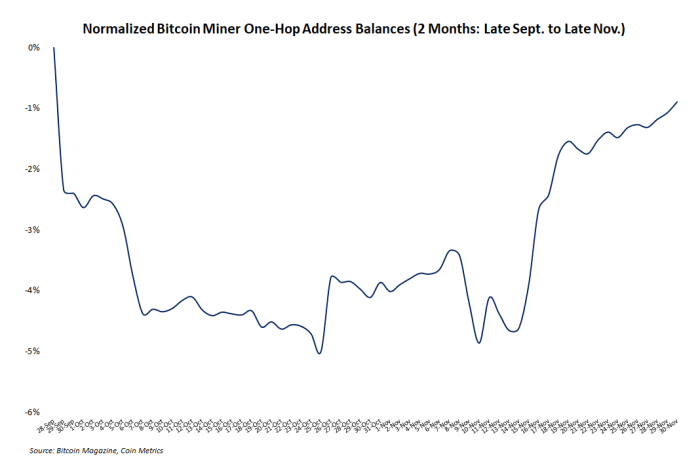

The previous few months have been disastrous for the “crypto” trade as alternate wars, bancrupt custodians and different types of monetary contagion swept the market. Many bitcoin traders prefer to assume their phase of the trade is usually insulated from the chaos of the remainder of “crypto,” however that is often false. Within the case of miners, who’re notoriously dangerous at timing the market, some panic was evident as deal with balances and miner outflows appeared to drop and spike, respectively.

However this exercise was quick lived. The road chart beneath exhibits that miner deal with balances have nearly totally retraced their drop from late September by way of October. In brief, miners seem like again in HODL mode, impervious to exogenous market occasions. Whether or not the bear market is over or not is unknown. However miners appear to be accumulating greater than promoting.

Hash Value Drop In the present day Vs. 2018

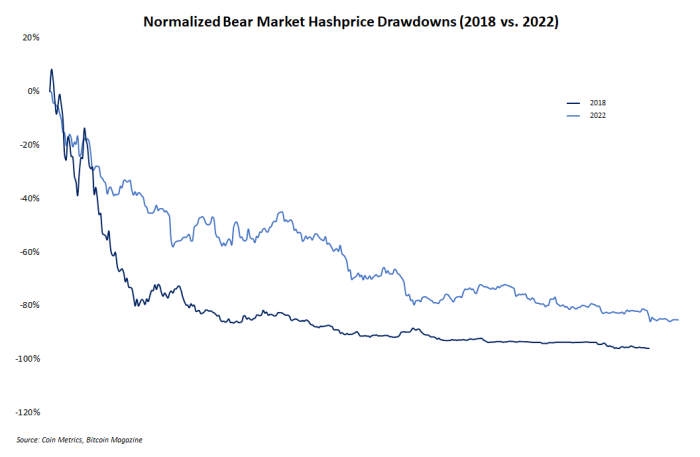

Hash value is likely one of the hottest financial metrics for miners to trace, although few individuals exterior of the mining sector perceive it. In brief, this metric represents the dollar-denominated income anticipated to be earned per marginal unit of hash price. And like all the pieces else within the bear market, hash value has fallen considerably. However its decline shouldn’t be uncommon, particularly when it is in comparison with the hash value decline in 2018.

Proven within the chart beneath are normalized hash value drawdowns from 2018 and 2022. Readers will discover the pretty related slope and measurement of the drawdowns. 2018 was barely steeper. 2022 thus far has been shallower however longer. However each have been and are brutal for fledgling mining operations.

The Subsequent Section Of Mining

Increase and bust cycles are a pure collection of occasions for any correctly functioning market. The bitcoin mining sector is not any exception. For the previous yr, mining has seen its weaker, unprepared operators weeded out because the excesses from the bull market are dropped at account. Now, within the depths of a bearish interval, the true builders can proceed to increase their operations and construct a strong basis for the subsequent part of euphoric bullishness.

It is a visitor submit by Zack Voell. Opinions expressed are totally their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.